IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

EcoEnterprises Fund

Diversity, Equity and Inclusion

Diversity, Equity and Inclusion Financial and Economic Inclusion

Financial and Economic Inclusion Natural Resources and Conservation

Natural Resources and ConservationFirm Overview

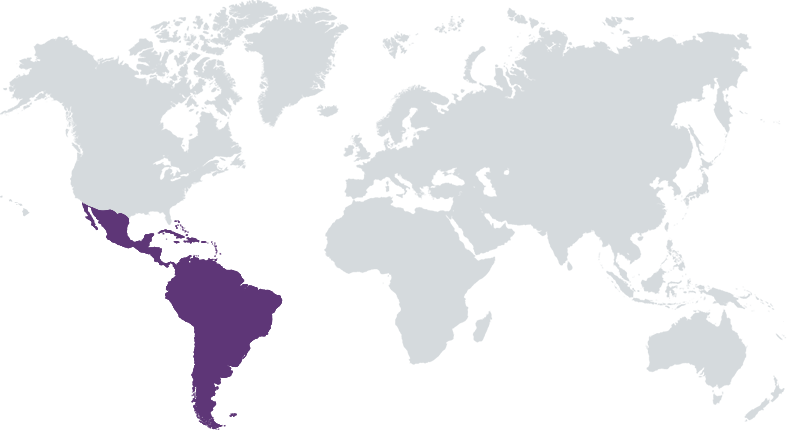

EcoEnterprises Fund is a pioneer in the impact investing space that has nurtured innovative nature-positive, gender-smart businesses across Latin America for over two decades. We have a unique investment strategy: investing catalytic, long-term capital concurrent with engaged value-added services to help scale community-based businesses that contribute to biodiversity conservation, climate solutions, and social equity through partnership with underrepresented peoples, including women and Indigenous communities. To date, EcoEnterprises Fund has invested in 50 ventures in 11 countries in the region. The women-owned and managed Fund launched EcoEnterprises Partners III, LP in 2018, now with 13 companies in the portfolio ranging from upcycled and carbon-neutral snacks, on-farm biodigester circular systems, natural food colorants derived from local flora, organic lime reforestation on degraded cattle lands, to alternative proteins. EcoEnterprises Partners IV, LP is anticipated to be launched in 2024.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

EcoEnterprises Fund builds “portfolios for the planet” and fills a void in the capital markets by making tailored growth capital available for innovative nature-positive companies in Latin America that achieve solid financial returns alongside transformative environmental and social impacts.

In Latin America, a region which holds nearly 40% of the planet’s remaining biodiversity and five of its ten most biodiverse countries, there is a significant burden on critical ecosystems due to unsustainable agricultural methods, deforestation, and harmful business practices. EcoEnterprises Fund has found that nature-based solutions which create value from biodiversity while concurrently collaborating with rural communities are crucial to building economic resilience, tackling the global climate crisis and ensuring planetary health. By providing tailored growth capital and advisory services to innovative small businesses in regenerative agriculture, agroforestry, sustainable aquaculture, ecosystem services, ag-tech, climate-tech and more, the Fund’s portfolio leads by example. Portfolio companies are at the forefront of transforming the region’s systems to create a sustainable future. Impact and returns are maximized by leveraging the Fund’s broad network of partners, as well as comprehensive impact and investment risk mitigation strategies developed and tested over 25 years.

Given our expertise and track record, with one of the longest tenures working in Latin America, we have a truly distinctive and engaged investment approach in a focused niche: nature-positive, inclusive businesses. We build deep partnerships with portfolio companies to catalyze growth. We have high-touch working relationships that adapt to a company’s trajectory, bringing in resources and talent to ensure solid execution in line with financial, environmental, and social KPIs. We are a women-owned and managed firm working as a team and with our stakeholders for decades. This consistency together with evolving systems and tools to support the investment and impact processes is a significant asset. Our diverse international investors, many of whom have participated in all three funds, seek us out for our results-oriented strategies and to be involved as co-financiers and/or on our Investment and Impact Committees. Investor participation transforms “thinking and doing” in our investment space.

Investment Example

Sambazon is a first mover in organic and Fair Trade sustainably harvested açaí-based products from Brazil. EcoEnterprises Fund has served as a long-term partner to Sambazon, providing start-up capital and then growth capital to scale performance. From protecting the biodiversity of more than 2.5 million acres of critical Amazonian rainforest, to creating thousands of jobs for growers, cooperative members, and employees, Sambazon serves as an activist to truly drive environmental conservation and community economic gains, objectives that are even more critical today. Through its biodiversity research, the company is furthering scientific knowledge and demonstrating the benefits of organic açaí production on biodiversity in the Amazon. The company is also pursuing science-based GHG emission reduction targets as part of its net-zero strategy. Aligning with the Fund’s investment thesis of creating successful, regenerative businesses that represent models for replication, Sambazon is a much-needed example of impactful performance with financial results.

Leadership and Team

|

Tammy E. Newmark – Managing Partner & CEO More Info

A leader in impact investing, Tammy Newmark has over thirty years of experience in the field. Newmark launched EcoEnterprises Partners II, LP in 2012 under EcoEnterprises Capital Management, LLC in which she is a partner. She served as President of Fondo EcoEmpresas, S.A., EcoEnterprises Fund’s first fund under management, for The Nature Conservancy from 1998 to 2010. Newmark directed Technoserve, Inc.’s environmental business advisory services in Latin America and Africa. |

|

Michele Pena – Managing Partner & COO More Info

Michele Pena has been part of the EcoEnterprises Fund’s senior team since 2001, managing all operational, business development and monitoring and evaluation functions. She now serves as Chief Operating Officer. Pena launched EcoEnterprises Partners II, LP in 2012 under EcoEnterprises Capital Management, LLC in which she is a partner. Pena brought organizational and marketing expertise to EcoEnterprises Fund from her position as Program Director at the Climate Institute, a nonprofit organization focused on global climate change issues. |

|

Oksana Aguilar – Managing Director, Compliance and Operations More Info

With over seventeen years’ experience, Oksana Aguilar has served in various financial management functions. For five years, she served as Investment Monitoring Officer for Fondo EcoEmpresas, S.A., EcoEnterprises Fund’s first fund under management and rejoined the team in 2012 to serve as Financial Controller for EcoEnterprises Partners II, LP. Prior to this present position, she was Finance and Administration Director for World Wildlife Fund’s Central America Program Office in Costa Rica. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Developed over two decades, our sophisticated Environmental & Social Management System (ESMS) guides our investment process. We systematically screen for companies that actively promote sustainable natural resource use and protection of the biodiversity they source from, including community organizations and Indigenous peoples as stakeholders. Our portfolio companies partner with rural communities and adhere to ethical sourcing and Fair Trade principles, which we enhance via our partnership with the Union for Ethical Biotrade, creating much-needed long-term jobs and fair income opportunities. Gender equality is promoted through the Fund’s commitment to the 2X Challenge and a gender-lens approach integrated throughout the ESMS. A rigorous environmental analysis is undertaken for every investment including the application of our tested impact metrics and risk assessment tools in cooperation with external specialists. A highly qualified Impact Committee supports the team and portfolio companies on items that are identified, monitored, and improved over time.

Employing best practices in social and environmental sustainability is a critical requirement to be included in the Fund's portfolio. We work with each portfolio company to develop an Environmental & Social Action Plan to enhance results. Metrics pertaining to best practices in governance, diversity, community engagement, waste, energy and water usage, and more are included in the Fund’s Impact Metric Guidelines used during due diligence and subsequent monitoring. Most of the companies targeted pursue certifications such as B-Corp, Fair Trade, Rainforest Alliance, Forest Stewardship Council, Global G.A.P, and organic labels. Several of the Fund's portfolio companies also help local suppliers to receive certification, establish ethical sourcing regimes or have fair-sharing of benefits, thereby expanding their impact. The Fund continuously supports its companies in these efforts on an advisory level, through targeted technical assistance, such as the implementation of ESMS at the company-level, or through participation on the board of directors.

Impact Tracking and Monitoring

Learn More

5614 Connecticut Avenue, NW #135, Washington, D.C. 20015 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.