make your philanthropy go farther

I AM NATION, a community of professional athletes and an ImpactAssets client (see story below)

Built by impact investors, for impact investors, the ImpactAssets Donor Advised Fund is a way for donors to maximize their impact through both grants and investments. The ImpactAssets Investment Platform and client recommended investment service offer a wide range of investment opportunities spanning impact themes and investment vehicles, and are uniquely available to ImpactAssets Donor Advised Fund clients. Partner with us to:

- Create a granting and investing strategy that aligns with both your impact and financial goals.

- Select from thematic impact funds, model portfolios, and other private impact opportunities on our expertly vetted Impact Investing Platform.

- Recommend your own investment ideas in companies, funds and nonprofits you're passionate about, in addition to recommending grants.

No Deal Too Complex

We handle the complexity of impact investing and granting so you can focus on what matters most to you.

Unique Access to Impact

Access a wide selection of public and private investment options through the Impact Investment Platform.

Tax Advantages

Earn immediate tax deductions on donations and thoughtfully organize your giving over time to maximize your impact.

This does not constitute tax advice. Please note there are a number of factors to consider when assessing the tax implication of gifts to charity. Individuals should consult with a tax specialist before making any charitable donations.

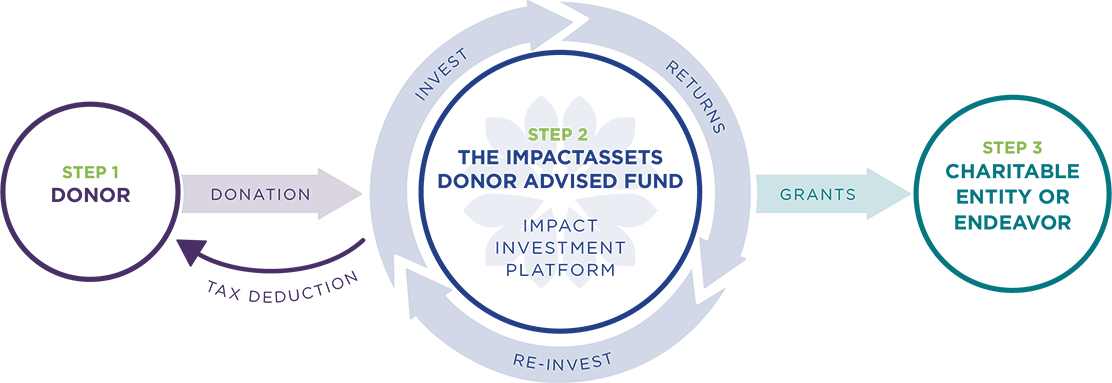

How The ImpactAssets Donor Advised Fund Works

STEP 1

Open an Account

Make an initial tax-deductible contribution and take the first step toward more personalized, impactful giving. We accept a wide range of assets, from cash and stocks to illiquid assets such as personal property, real estate and non-publicly traded securities.

STEP 2

Invest with Impact

Preserve and grow your giving dollars by selecting from a range of impact investing options that align with your philanthropic and financial goals. All investment returns go back into your ImpactAssets Donor Advised Fund account to be reinvested and granted for greater impact.

STEP 3

Make Grants to Causes

Recommend grants to charitable entities through an easy-to-use online platform.

Using a Donor Advised Fund to Invest in my Hometown

Former NFL player Derrick Morgan and his fellow pro-athletes at I AM Nation opened an ImpactAssets Donor Advised Fund to directly invest in businesses, infrastructure and other local community projects that support their hometowns.

"Our partnership with ImpactAssets enables us to unlock investment resources and create opportunities for the places that we come from and the people we care about."

— Derrick Morgan, Founder, I AM Nation