When ImpactAssets Donor Advised Fund (DAF) client Sallie Calhoun discovered ImpactAssets nearly 15 years ago, she was searching for a partner to help funnel her charitable dollars into private impact investments — and wondering if she’d ever find it.

What evolved in her partnership with ImpactAssets would achieve that goal and far surpass it. Today, her DAF invests in nearly three dozen impactful organizations spanning Sallie’s impact priorities: environmental sustainability, community resilience and regenerative agriculture.

After 25 years in tech and the sale of her software company, Sallie left that career in 2000 and became a full-time rancher in Central California, surprising even herself. Her study of holistic ranch management blossomed into passions for soil health, carbon sequestration, biodiversity, and thriving communities. She began exploring how to leverage her financial resources toward these same ends.

For Sallie, the answers have been a diverse mix of financial approaches and tools.

Diversification Across Domains

As Sallie searched for the right tools and partner, ImpactAssets’ ability to offer DAF clients private impact investments was critical. She knew this would magnify her impact in the areas she cared about most.

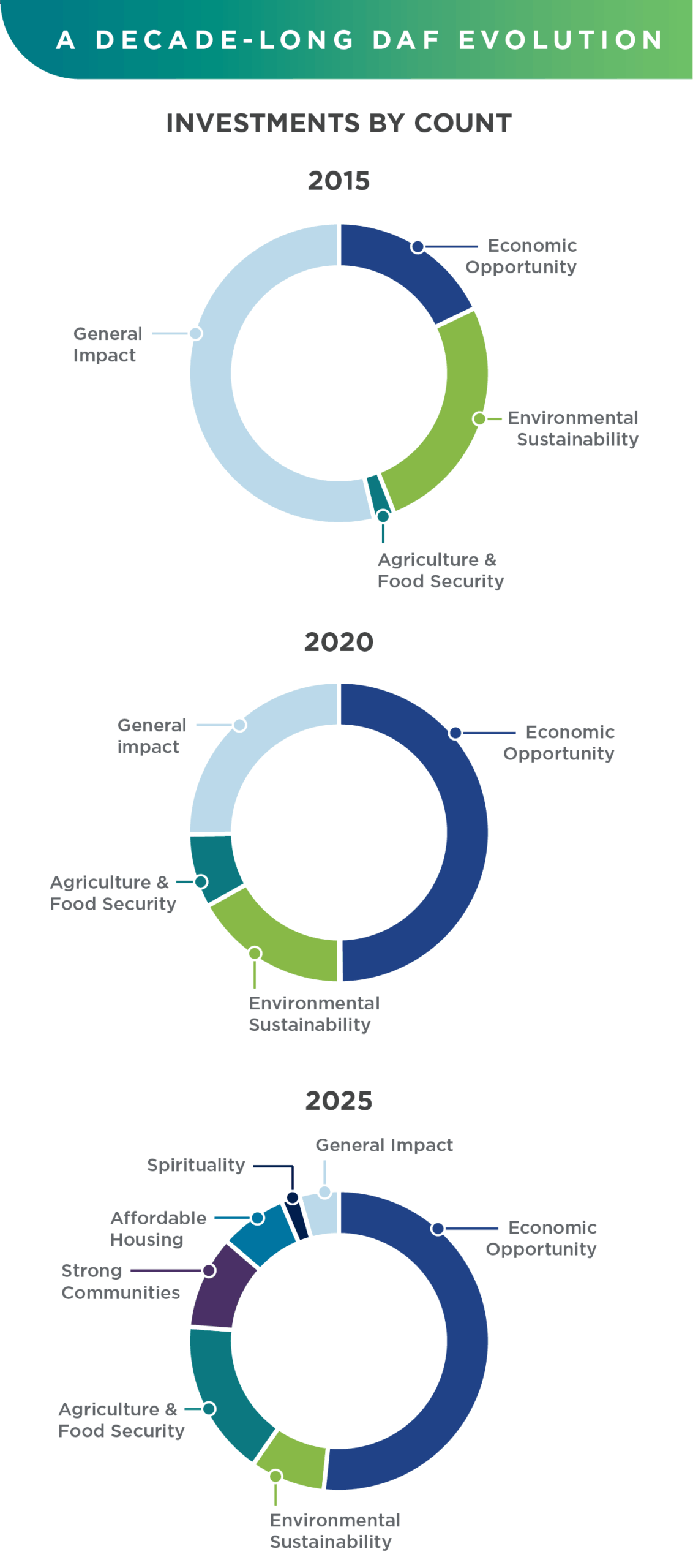

While regenerative agriculture and soil health were Sallie’s priorities from the beginning, her well-diversified investment portfolio didn’t happen overnight. She has worked with ImpactAssets to diversify investments and themes over time.

Back in 2015, her DAF held seven investees. It had a broad impact focus with some environmental and economic opportunity investments through our model portfolios. By 2020, after five years to further refine her focus, Sallie added investments in nine more companies and funds, further diversifying her portfolio and deepening her impact. By 2025, her investee count had more than doubled — weighted heavily toward agriculture and food security, as well as adjacent themes like strong communities, affordable housing and economic opportunity.

Continuing to Partner, With Purpose

Discovering a partner willing to go the extra mile was critical for Sallie. “It was so important to my journey to find ImpactAssets,” she says.

Esther Park, Sallie’s advisor and CEO of Cienega Capital — an investment firm also founded by Sallie that focuses on regenerative agriculture — agrees. “In terms of the way we wanted to structure our investments and how we wanted the loans to show up for our borrowers, ImpactAssets made it really easy for us,” Esther adds. “Even when we wanted to have really specialized loan agreements, the team really worked with us to help bridge the legal side with the idealistic side that we wanted to put forward.”

Sallie’s advice to high-net-worth individuals and family offices looking to make a greater impact: Find mission-aligned people to work with, both internally and externally.

LEGAL AND PROGRAM DISCLAIMER: This is not a solicitation to buy or sell securities, nor a private placement offering pursuant to any private placement memorandum that must be issued to qualified investors. It is an informational description of charitably oriented, social purpose investment options that have been approved by ImpactAssets only for use in its donor advised fund asset base. It is only for use by its donors. This does not constitute tax advice. Please note there are a number of factors to consider when assessing the tax implication of gifts to charity. Individuals should consult with a tax specialist before making any charitable donations.

This spotlight features a current client of ImpactAssets, Inc. No cash or non-cash compensation was provided to the client.