your partner in purpose

$B+

Assets under Management

Active Private Portfolio Companies and Funds

Collective years of impact

investing experience

2023

$3 Billion in Assets Under Management

2023

Thematic Impact Funds

Launched three thematic impact funds.

2022

Launched ImpactAssets Capital Partners

Partnering with institutional investors to create positive change for the world through impact investing.

2022

$1 Billion in Grants Since Inception

2021

1000 Client Recommended Impact Investments

2021

$1.6 Billion in

Assets Under

Management

Assets Under

Management

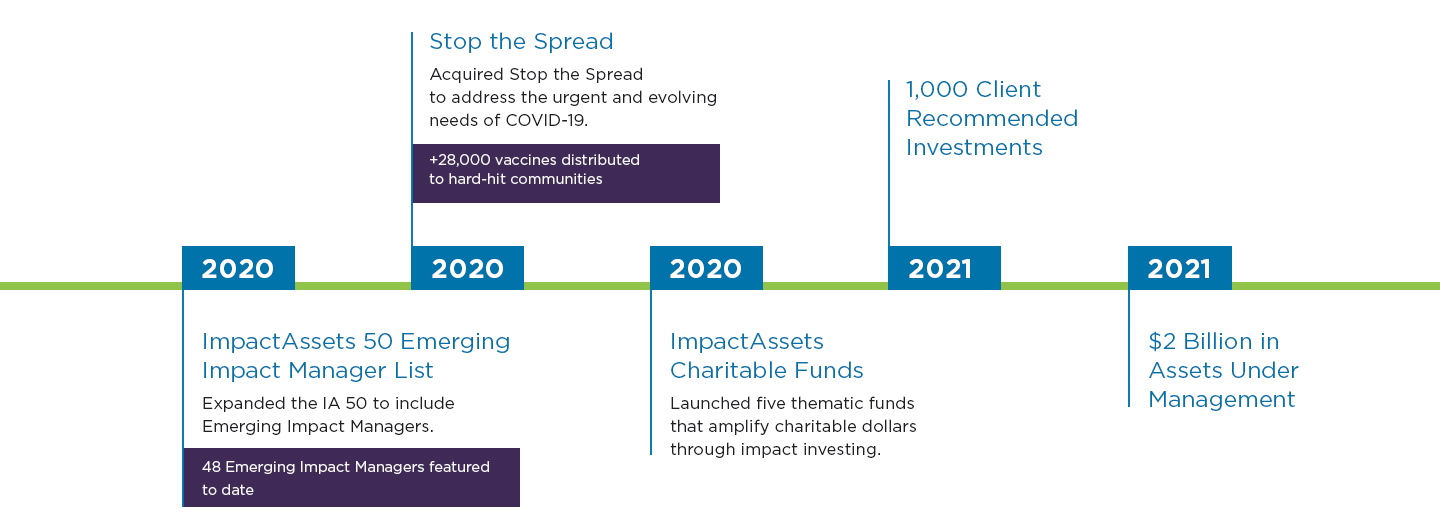

2020

ImpactAssets

Charitable Funds

Charitable Funds

Launched five thematic funds

that amplify charitable dollars

through impact investing.

that amplify charitable dollars

through impact investing.

2020

Stop the Spread

Acquired Stop the Spread

to address the urgent and

evolving needs of COVID-19.

to address the urgent and

evolving needs of COVID-19.

+28,000 vaccines distributed

to hard-hit communities

to hard-hit communities

2020

ImpactAssets 50 Emerging

Impact Manager List

Impact Manager List

Expanded the IA 50 to include

Emerging Impact Managers.

Emerging Impact Managers.

48 Emerging Impact Managers

featured to date

featured to date

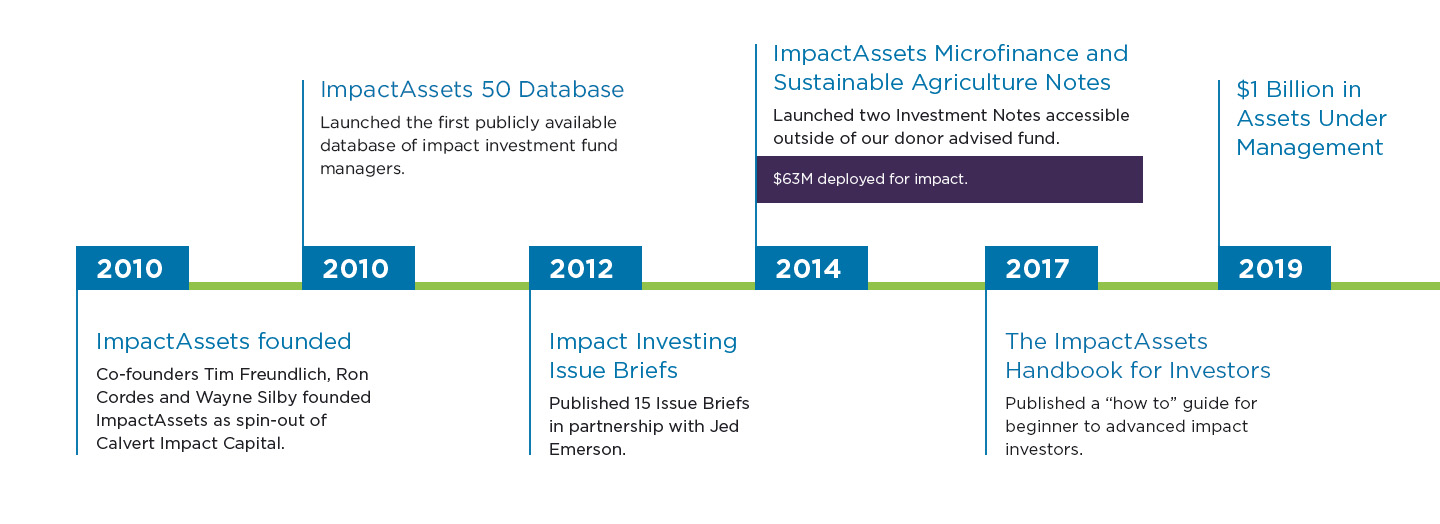

2019

$1 Billion in

Assets Under

Management

Assets Under

Management

2017

The ImpactAssets

Handbook for Investors

Handbook for Investors

Published a “how to” guide for

beginner to advanced impact

investors.

beginner to advanced impact

investors.

2014

ImpactAssets Microfinance and Sustainable Agriculture Notes

Launched two Investment Notes accessible outside of our donor advised fund.

$63M deployed for impact.

2012

Impact Investing

Issue Briefs

Issue Briefs

Published 15 Issue Briefs

in partnership with Jed

Emerson.

in partnership with Jed

Emerson.

2010

ImpactAssets 50 Database

Launched the first publicly available

database of impact investment fund

managers.

database of impact investment fund

managers.

2010

ImpactAssets founded

Co-founders Tim Freundlich, Ron

Cordes and Wayne Silby founded

ImpactAssets as spin-out of

Calvert Impact Capital.

Cordes and Wayne Silby founded

ImpactAssets as spin-out of

Calvert Impact Capital.

Our Commitment to Our People and Culture

We celebrate differences and embrace unique perspectives—we are rooted in the belief that respecting and supporting people from every background is critical to our mission.

Our Values

Our Funders & Partners