IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Unconventional Ventures Fund II

Climate Change

Climate Change Diversity, Equity and Inclusion

Diversity, Equity and Inclusion Health and Wellbeing

Health and WellbeingFirm Overview

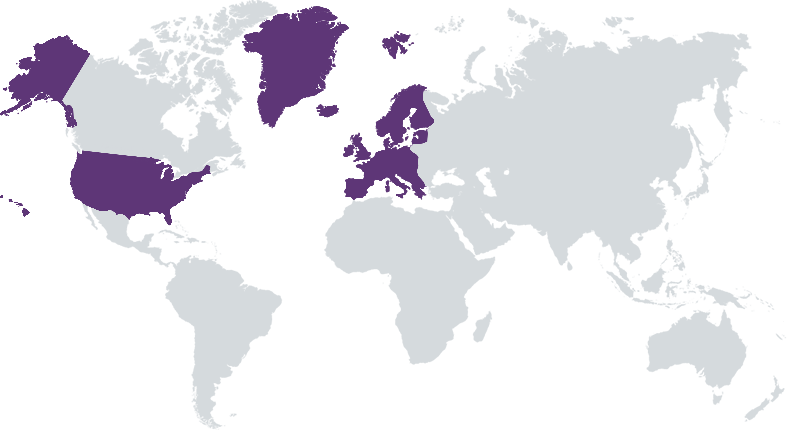

Unconventional Ventures was founded in 2019 by Thea Messel and Nora Bavey backs pre-seed and seed-stage startups across Europe led by diverse founders, including women, people of colour, and LGBTQ+ individuals. The fund targets scalable, impactful companies focused on Climate, Health, Education, and Equitable Tech. As a premier early-stage investment firm, Unconventional Ventures is uniquely positioned to capitalize on the powerful intersection of impact and diversity. UV Fund II continues the pioneering legacy of UV Fund I, driving change and exceptional financial returns.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: 50% – 99%

Unconventional Ventures’ backs pre-seed and seed-stage startups across Europe led by diverse founders, including women, people of color, and LGBTQ+ individuals, building scalable, impactful companies focused on Climate, Health, Education, and Equitable Tech.

Unconventional Ventures Fund II seizes a rare arbitrage opportunity within an undercapitalized market: backing high-performing female fund managers and diverse founders who are systematically underfunded despite proven outperformance. Female fund managers currently manage only 9% of available assets, yet data shows women-led funds outperform male-led ones by 9.3 percentage points, highlighting the alpha potential of investing in this segment. Similarly, diverse founders, particularly women and minorities, receive a fraction of venture capital funding—Nordic all-women teams, for example, received only 0.9% in 2022—despite data indicating that diverse-led companies are 39% more likely to outperform financially. Fund II focuses on early-stage impact ventures in Climate, Health, Education, and Equitable Tech, harnessing the intersection of diversity and impact to drive scalable, high-growth solutions to global challenges, all while positioning investors for superior financial returns.

At Unconventional, our value-add lies in acting as early believers in ambitious pre-seed and seed founders. Our investment strategy combines impact expertise with a strong commitment to diversity, equity, inclusion, and belonging (DEIB). We provide close, hands-on support through the UV team and our expansive network, alongside an international follow-on network for sustained portfolio growth. These factors enhance our ability to secure competitive deals and drive meaningful impact.

Investment Example

Climate X is a climate risk data analytics platform for financial institutions. It focuses on increasing climate risk insights and mitigation adoption. The company was founded in London, UK, and operates in the Climate Fintech industry. Unconventional VC invested in Climate X at the Seed stage in 2022. The company's solution, Spectra, calculates the probability and severity of weather events at an asset level, enabling organizations to assess physical risk, estimate financial losses, and analyze various scenarios. Since Unconventional VC's investment, Climate X has seen significant growth, raising a Series A round in 2024 with notable investors like Google Ventures and Pale Blue Dot. The company's ARR has grown to £1.5m in Q2 2024, and the gross multiple of the initial investment is 1.59x with an unrealized IRR of 24.99%.

Leadership and Team

|

Thea Messel – Managing Partner and General Partner More Info

Before moving into the VC industry, Thea has a decade of experience in banking. She has co-founded and developed digital platforms supporting tech and impact startups, and worked with developing and launching concepts for supporting diverse founders in the Nordics as well as driving research on diversity in investments. Thea has furthermore developed concepts for sustainable finance, impact investments and impact measurement and is a former member of UNEP-FI working group for Sustainable Banking. |

|

Nora Bavey – General Partner More Info

Nora has been an active key figure in the tech industry the last 13 years. Responsible for many of the successful strategies implemented by big tech companies as well as startups in the Nordic region. Before moving into the VC industry, she was an EdTech founder that built and launched concepts for supporting underrepresented founders in the Nordics as well as supporting boards and management teams with insights and learnings on DEI and how to implement best practices. |

|

Alexis-Horowitz-Burdick – General Partner More Info

Experienced operator and investor with a demonstrated history of working at the intersection of technology and consumer products. – Venture Capital – Startups & Scaleups – Commercialisation & Marketing – Team leadership & growth – Global expansion – Profitability |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Before we invest, we assess the potential positive impact at investment the investeee needs to sign a side letter laying out the reporting and compliance requirements (SFDR requirements, Global Compact, Minimum safeguard) we have, in addition confirming reporting on the ESG general and the Impact specifically to them.

Impact Tracking and Monitoring

Learn More

Luganovej 20, København, 2300 Denmark

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.