IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

VoLo Earth Ventures

Climate Change

Climate Change Energy

Energy Entrepreneurship and Job Creation

Entrepreneurship and Job CreationFirm Overview

VoLo Earth continues to emerge as a story of outperformance and leadership in the energy transition. Currently performing in the top decile(10%) of fund managers across sectors for our Fund I vintage (2021), VoLo Earth is a team of energy experts identifying, investing in, and collaborating with innovative leaders and technologies towards a net zero future. We employ a quantitative, data driven process complimented by multiple decades of subject matter expertise in energy to optimize financial outcomes while delivering significant climate impact.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: 25% – 49%

The current combination of policy, capital, and entrepreneurial talent is accelerating the new energy economy, providing the opportunity for qualified climate tech VC firms to deliver superior investment returns and quantified carbon impact.

This decade, the new energy economy may see a $35T+ market opportunity* that’s on par with the largest sectors of our global economy. Existing corporates are turning to startups to deliver on their climate commitments, creating market share and opportunity for impressive exit multiples for early-stage companies. Those companies that provide compelling economic value propositions while delivering quantifiable carbon benefit have the opportunity to generate superior investment returns. Finding and supporting the best opportunities demands a purpose-built team with outstanding techno-economic, market, and policy expertise, coupled with world-class networks and partners.

We are sector specialists in the key verticals of the energy transition: Energy, Mobility, Buildings and Industry. Our purpose built team of 5 founding partners possess a deep empathy for decision makers in the sectors in which we invest. We work hand in hand with our founders to help navigate the fastest routes to market adoption. Our quantitative, data driven process has led to the construction of our proprietary RVM, Relative Value Matrix. We now leverage this unique database of over 12,000 Startups and over 1,000,000 data points in our diligence of deals from more than 150 different deal sourcing channels.

Investment Example

Blue Frontier is an HVAC and cooling-as-a-service technology company producing ultra-efficient cooling with integrated energy storage, in many cases using 80% less energy. Our team experience as builders and buyers of HVAC technology allowed us to underwrite 1) Blue Frontier’s load shifting technology, 2) scalability of 3 party financing, and 3) the challenge of HVAC sales without 1 & 2. Most recently, Blue Frontier has entered commercial revenue with Florida Power and Light and Waffle House as key customers and is a leading company in Fund I.

Leadership and Team

|

Joseph Goodman – Co-Founder, Managing Partner More Info

Before co-founding VoLo Earth, Joseph invested 20 years in the energy transition. He started his career at GE Energy developing the decarbonization and carbon capture roadmap for the GE. This formative work informed the trajectory of Joe’s career through Wind, Solid State Fuel Cells, Solar, Buildings, EV and industrial decarbonization. Joe is an professional alum of RMI and served as thought partner for RMI Founder and Chief Scientist Amory Lovins (also a VoLo Earth Advisor). Joe has led private and public market investments into climate solutions since 2010 working with venture capital and public equity firms as a subject matter expert and successful angel investor. |

|

Kareem Dabbagh – Co-Founder, Managing Partner More Info

Kareem is a Managing Partner for VoLo Earth Ventures and co-leads the investment team. Prior to co-founding the Firm, Kareem served in various roles integral to the success of multiple high-profile startups in the solar sector, including SolarCity (Tesla), Sunrun, and Aurora Solar. He has also held managerial and consultancy positions with the Rocky Mountain Institute, and a mentor position with the CleanTech Open, Denver Chapter. Kareem is passionate about protecting our planet and its resources for generations to come. He boasts years of startup investing and advisory experience and is a subject matter expert in renewable energy, storage, electrical grids, and electricity markets. |

|

Chris Tullar – Co-Founder, Operating Partner More Info

Chris is a Managing Partner and the Head of Partnerships for VoLo Earth Ventures. Before co-founding the Firm, he served as Principal and Managing Director at JonesTrading Institutional Services, a third market institutional broker. Chris has spent 20 years in sales and trading in public equity markets, overseeing FINRA and SEC trading compliance and working closely with some of the largest asset managers in the world, strategizing to achieve best execution in domestic and foreign markets. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

At the highest level, companies must meet our 3 pillars required for investment consideration. Companies must be able to demonstrate significant and quantifiable carbon impact, economic merit, and must be able to benefit strategically through our expertise, hands on partnership, and networks. At VoLo Earth we believe the economic growth rate of a carbon free economy is both the biggest opportunity and most glaring necessity of our generation. This belief informs our strategy as a returns-forward climate tech fund. To effectively report against our strategy, we report customer value, 10 yr / fund life carbon impact forecast and annual actuals for carbon impact. Carbon impact includes scope 1, 2 and 3 emissions that are relevant to the respective investment/company.

We regularly screen for ESG factors during our diligence process and work with our early stage companies to employ and track ESG metrics post investment as our companies grow. We help portfolio companies develop DEI initiatives post investment as well.

Impact Tracking and Monitoring

Learn More

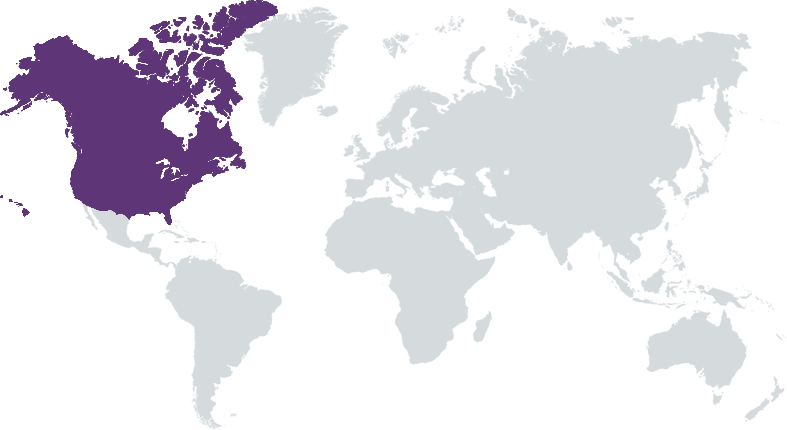

55 Elbert Lane, Smowmass Village, CO 81615 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.