IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

UC Impower

Climate Change

Climate Change Energy

Energy Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

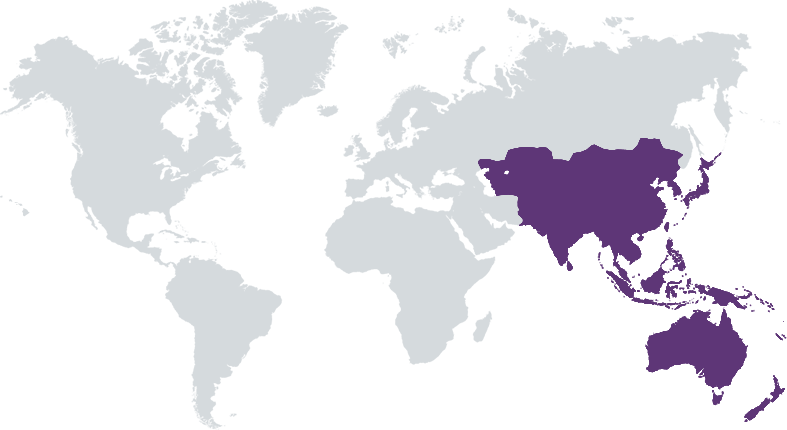

UC Impower has been formed by leveraging the learnings of Unitus Capital (pioneering impact investment bank), UC Inclusive Credit (Active Impact Lender), and the experience of its four partners. Leveraging a library of deep data sets and proprietary frameworks, UC Impower invests in entrepreneurs building innovative companies focusing on Accessibility, Affordability, Inclusivity for underserved communities, and Environmental Sustainability in India. UC Impower is focused on Financial Services and Climate Solutions (including agriculture) with a gender lens adopted as a horizontal across both sectors.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: 25% – 49%

The fund will invest in 8-12 companies operating in Financial Services and Climate Solutions (with a commitment to invest 30% of its capital in companies that meet the 2X Gender Lens criteria) typically Series A+/B which is a large white space by investing USD 2.5-3.5 Mn per company.

The fund has a strategy of investing in 8-12 companies in Financial Services and Climate Solutions (with a commitment to invest 30% of its capital in companies that meet the 2X Gender Lens criteria) and aims to provide meaningful early growth capital (typically Series A+/B which is a large white space) by investing USD 2.5-3.5 Mn per company. The fund will seek to back exemplary entrepreneurs while also taking an active role by securing special rights along with a board seat. UC Impower seeks to add value to its portfolio companies via five key areas of engagement: 1) Strategic direction, governance and sounding board 2) Leveraging networks for partnerships and talent acquisition 3) Capital structuring and raising 4) Strategic advice on data analytics, technology, finance & legal and 5) Impact measurement and management.

The early-stage VC space in India is very active with many funds actively deploying capital across sectors. Hence, while there is Seed/ Pre-Series A capital available for companies that come under the definition of impact, there is limited impact capital for companies beyond Series A. The lack of capital is driven by 1) limited visibility of work done by such companies 2) need for in-depth and often technical due diligence and 3) need for strong networks who can help globalize these solutions. UC Impower aims to address this gap by using its experience, knowledge and network to back them at their Series A+/ B stage where they are in need of early growth capital to scale. The Fund adds value by helping these companies price their rounds; leading / co-leading them; capital structuring and raising subsequent rounds; strategic advice on data analytics, technology, finance & legal; and strengthening governance standards.

Investment Example

The Fund has closed its first investment in September 2024. The company is a North India-focused MSME lender providing business loans, agri and allied loans (including for the purchase of livestock and LAP (Loan Against Property). It is focused on underserved creditworthy customers primarily in rural and semi-urban regions in Tier 2 - 4 towns with an average monthly household income of Rs 30k (~$375) and provides loans linked to the livelihoods of their borrowers. The company is present in four states in the northern part of India including Haryana, Uttar Pradesh, Rajasthan, and Uttarakhand through its network of 28 branches targeting rural borrowers in remote districts.

Leadership and Team

|

Mona Kachhwaha – Partner More Info

Mona Kachhwaha - Partner, has over 29 years of experience in banking and impact investing. She managed a $89 Mn impact equity fund at Caspian and was part of the team that managed funds aggregating ~$200 Mn. |

|

Eric Savage – Partner More Info

Eric Savage - Partner, has over 30 years of investment banking and entrepreneurship experience. He serves as Senior Advisor at Copenhagen Investment Management and Board Member at Nexus Hybrid Fund. |

|

Narayan Ramachandran – Partner More Info

Narayan Ramachandran - Partner, has over 35 years of experience in asset management and investing and is a pioneer in building inclusive institutions in India. He was the Vice Chairman of L Catterton, Chairman of RBL Bank and continues to be on the board many prominent companies in India. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

The fund has an internally developed impact policy that outlines the processes of measuring impact across the deal lifecycle. When a deal is originated, an initial review is done to understand the company’s impact thesis and whether there is an overlap with one or more of the Fund’s impact areas. The Fund has a varied pipeline of companies that reflect this conscious process, with companies such as: a) Full-stack telematics platform provider for smart mobility and energy efficiency helping accelerate the adoption of greener grids and electric vehicles b) EV leasing company that utilizes deep asset expertise, engineering capabilities, and tech-first thinking to lead the electric vehicle transition in India c) Electric energy storage systems provider that enables efficient storage of clean energy by utilizing Battery Energy Storage Systems (BESS) with a hardware and software approach

At the time of diligence, a review of impact metrics (and other qualitative assessments) being tracked by the company is done. Additionally, the fund looks at the company's policies such as employee related policies on diversity and inclusion, management of waste generated internally, efficient consumption of non renewable resources also water, among other practices.

Impact Tracking and Monitoring

Learn More

No. 9/3, Kaiser-E-Hind, Richmond Road, Bangalore, Karnataka 560025 India

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.