IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Regeneration.VC

Climate Change

Climate Change Health and Wellbeing

Health and Wellbeing Media, Technology and Mobile

Media, Technology and MobileFirm Overview

Regeneration.VC is a venture capital firm investing in early-stage Consumer ClimateTech innovation. Our strategy targets companies demonstrating asymmetric return potential by embedding solutions into value chains of world-leading corporates. As founders and operators, the General Partners successfully scaled and exited six businesses. The GPs hold a combined track record of more than 28 early and growth-stage direct investments (top-decile performance). The management team works closely with an expert advisory board including Leonardo DiCaprio, William McDonough (seminal circular economy thought leader), Dr. Marta Pazos (fmr. Head of Formulation at P&G, Estéé Lauder, and Coca-Cola), Stephen Badger (fmr. Mars Chairman), and Tue Mantoni (fmr. Chairman Vaekstfonden and fmr. CEO Bang & Olufsen and Triumph Motorcycles).

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: Less than 25%

We invest through a circular lens (design, use, reuse) in early-stage climate technologies (hardware, software, hybrid) embedding proven B2B solutions across consumer industry value chains (Food, Apparel, Electronics, Home).

Humanity consumes nearly twice what Earth can annually replenish; over 1/4 of material consumption since 1900 occurred within the last five years; of the nine planetary boundaries outlining safe levels for Earth’s systems, six are transgressed. Consumer industries now face the unprecedented challenge of addressing the disproportionate environmental impact of their value chains (average 90% of their GHG footprint and over 90% of their biodiversity footprint). Regeneration.VC defines its strategy, ‘Insetting Consumer ClimateTech’, as technical interventions addressing GHG emissions, material resources, or biodiversity within the corporate value chain of consumer industry businesses. Our proprietary five-screen investment process harmonizes business and impact criteria, resulting in a differentiated portfolio with outsized opportunity through insetting. Progress and setbacks of each portfolio company are closely monitored, alongside our founder-facing value proposition coined ‘Supercharging’.

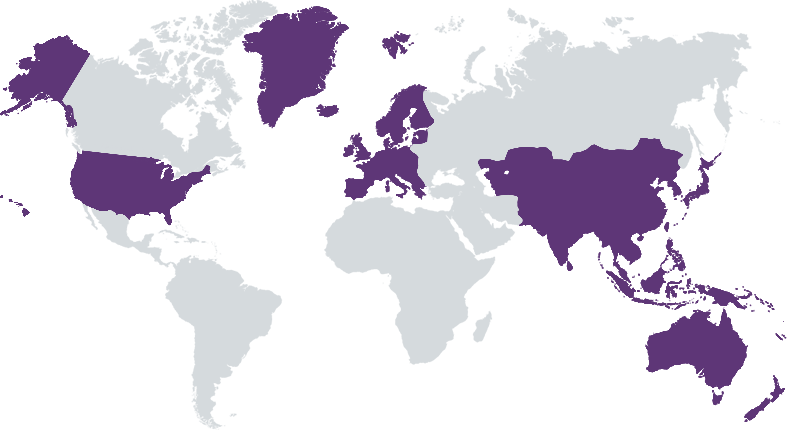

Our proprietary impact measurement & monitoring framework, value-add protocol ‘Supercharging’, and global team presence. Developed in-house, the Regenerative Evaluation Gauge (REG) harmonizes 150+ impact measurement & monitoring methodologies and 5,000+ metrics to evaluate circular and regenerative potential. This framework benchmarks six key pillars – resources, water, waste, toxics, emissions, and human – to the highest established global standards. The Supercharging protocol drives our ability to win competitive investment allocations, leverages backgrounds and skillsets of our management team and advisory board, and unlocks growth opportunities across key technical, commercial, and strategic objectives for portfolio companies. The Netherlands has established itself as one of the world’s leading circular innovation hubs, so we partnered with the Circle Economy Foundation to uncover leading Dutch Consumer ClimateTech businesses and scale them globally. We have now established similar ecosystems in Denmark, the United Kingdom, and New Zealand, allowing for proximity to our portfolio.

Investment Example

Cruz Foam upcycles shellfish waste streams into certified compostable, cost-competitive Styrofoam™ alternatives compatible with existing manufacturing infrastructure. Banned in over 50 countries and one quarter of U.S. states, polystyrene contains toxins, takes 500+ years to degrade, and comprises ~25% of global landfills. Cruz Foam empowers consumer product companies to inset a compostable solution with performance and near-cost parity as a drop-in replacement for upstream production. This non-toxic material replacement shows potential to mitigate 17,000 tons of CO2e annually for packaging producers and packaging consumers including Sony, Whirlpool, and Atlantic Packaging. At end-of-use, Cruz Foam products biodegrade within 60 days in home composts. Regeneration.VC invested in Cruz Foam’s Seed financing alongside strategic Sony Innovation Fund and the follow-on Series A financing (~3.4x initial investment mark-up). Our team facilitated vital contract manufacturing relationships, introduced new capital partners, and secured Leonardo DiCaprio and Ashton Kutcher as strategic investors & advisors.

Leadership and Team

|

Dan Fishman – General Partner More Info

Dan is a Co-Founder and General Partner of Regeneration.VC. Prior, Dan operated numerous companies within apparel, entertainment, and consumer products. He is an experienced investor in early-stage environmentally-conscious consumer businesses. In 2002, he co-founded Bulldog Entertainment Group, organizing brand deals for celebrities such as Quincy Jones, Shaquille O’Neal, Jennifer Hudson, and Prince before selling to Warner Music Group in 2006. |

|

Michael Smith – General Partner More Info

Michael Smith led marketing for Smith Broadcasting, a group of 20 network TV stations later acquired by Boston Ventures. Michael then followed a lifelong passion to become a touring DJ, alongside Rihanna and Diplo. He launched The Playlist Generation, serving music to 10,000 retail locations (sold in 2015). He co-founded Creative Space, an adaptive real estate firm with a portfolio of 80 repurposed LA and SF commercial properties. From their successful outcomes, he established Ponvalley, an environmental initiative with philanthropic, research, and impact investing practices. |

|

Katie Hoffman – Partner More Info

Katie Hoffman is a financial innovator, investor, and entrepreneur. Katie has over a decade of experience building and advising companies that drive measurable environmental impact in public and private markets. She has expertise in utilizing data-driven approaches to make climate-smart investments across multiple asset classes. Katie has shaped policy and practice around Environmental, Social and Governance standards for individual, family and institutional investors, including the California public funds and members of the $40.4T+ AUM Divest–Invest initiative, which she helped lead. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Our sourcing and due diligence processes verify that any new investment opportunity demonstrates potential for both outsized economic/financial and measurable environmental benefit. Through our proprietary impact gauge–methodically designed to service early-stage Consumer ClimateTech–we assess a venture's impact across six core themes: materials, water, toxics, CO2e, waste, human. Companies are evaluated based on the demonstrated potential for their core business model to generate significant measurable impact across any/all of relevant aforementioned impact themes.

Our sourcing and due diligence processes consider the intrafirm sustainability practices of each venture we consider. We aim to measure across the same six impact themes (as relevant) assessing internal company operations through focused investigation of key governance, operational, and management policies in place to preserve and prioritize company mission/impact. The internal review also considers DEI representation, with a focus on founding and leadership teams.

Impact Tracking and Monitoring

Learn More

1732 Aviation Blvd #154, Redondo Beach, CA 90278 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.