IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Supply Change Capital

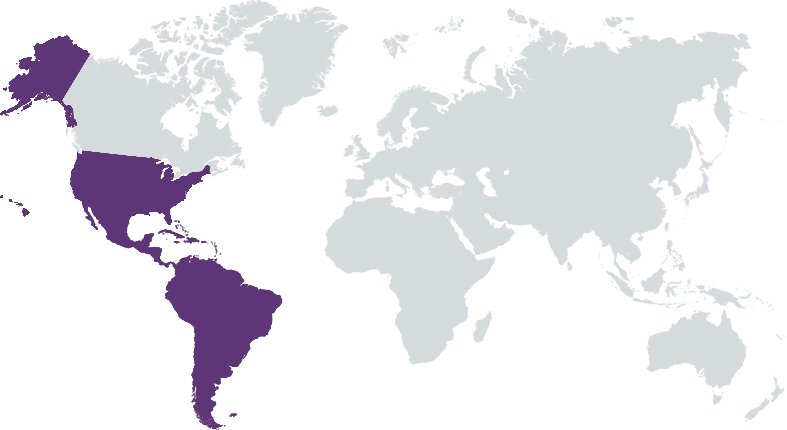

Climate Change

Climate Change Food Systems and Agriculture

Food Systems and Agriculture Health and Wellbeing

Health and WellbeingFirm Overview

Supply Change Capital is an early-stage venture capital firm investing in technology to transform the food system, with a focus on founders who are building healthier and regenerative businesses for people and the planet. The firm is led by two GPs who combine food domain expertise with tech and investment and impact experience. Noramay Cadena is an aerospace engineer turned investor. She’s been investing for the last 9 years, including as the GP of a micro VC firm that invested in over 20 manufacturing and supply chain companies. Shayna Harris' career spans two decades as an operator and visionary builder. As COO, she built venture-backed, healthy food company Farmer’s Fridge to tens of millions in revenue. As an intrapreneur, she pioneered the sustainable commodities program at Mars.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: 25% – 49%

We invest in early-stage, venture-scalable companies developing technology to modernize the food system. We focus on supporting innovative entrepreneurs who are accelerating the transition to a healthier, more diverse, and environmentally conscious future of food.

We invest at the intersection of food, culture, and technology, catalyzing early-stage sustainable businesses that are modernizing the food system across the following verticals: - Environment: Solutions for environmental adaptation and mitigation (waste, water, soil) - Health: Modern conveniences in service of healthy habits - Novel Ingredients: Novel ingredients that offer competitively advantaged IP and price parity at scale in service of health and environmental impacts - Value Chain: For a safer and more efficient supply chain

(1) As former operators, we help founders build an operational rhythm to establish and measure business KPIs. “Thanks to Supply Change’s constant support and championing, we have added a game-changing Independent Board Director to our Board. They have also provided countless introductions to key potential advisors and new hires, thanks to their extensive network and previous operating experience." Christian Ebersoll of 99 Counties. (2) Our deep and authentic Fortune 500 network. “Supply Change Capital has made more fruitful connections than the rest of our cap table combined. Every one of our five Fortune 500 customers have come from their network." Vince Tseng of Partnerslate. (3) SuperCharge III is a proprietary 6-month cohort program focusing on Leadership, Management, and Culture for fast-growing organizations. Denise Woodard of Partake shares her experience with her executive coach Lindsay Levin, matched through this program. Read more: https://www.inc.com/denise-woodard/4-tools-executive-leadership-coach-you-use-today-supercharge-success.html

Investment Example

Hyfé harnesses nutrients from food manufacturing wastewater to produce sustainable chemicals, materials, fuels, and foods. Biomanufacturing can solve some of the most pressing challenges facing humanity – but it’s too expensive. With the demand for glucose in the bioeconomy expected to surpass supply in the next 10-20 years, Hyfé aims to process food-grade wastewater from major companies like Cargill and ADM, offering a more cost-effective alternative to purified glucose for fermenters. As the fermentation industry shifts toward alternative feedstocks due to the high costs of purified glucose, Hyfé positions itself as a leader in this transition. Hyfé helps food manufacturers reduce their climate impact and GHG emissions, save on waste management costs, and better understand their waste streams.

Leadership and Team

|

Noramay Cadena – Managing Partner More Info

Noramay Cadena is an aerospace engineer turned investor. She’s been investing for the last 8 years, including as the GP of a micro VC firm that invested in over 20 manufacturing and supply chain companies. |

|

Shayna Harris – Managing Partner More Info

Shayna Harris' career spans two decades as a pioneering operator and visionary builder. As COO she built venture-backed Farmer’s Fridge to tens of millions in revenue. As an intrapreneur, she developed the sustainable commodities program at Mars. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Our sourcing strategy gives us access to a diverse range of founders. We monitor key diversity metrics in our deal pipeline (e.g., % founded by women) to maintain a wide pool of teams for evaluation. We also work to minimize bias by encouraging cold inquiries through our website and welcoming warm introductions. Additionally, we build strong, mission-aligned networks to expand our reach effectively. To date, we work with a highly diversely led portfolio: 75% of the portfolio is led by women, Black, or Latinx CEOs. Impact alignment and potential is evaluated early in our diligence process. Potential investments are screened through a 10-metric screener across health, diversity, and environmental dimensions. They are rated as high, medium, low, and absent, and they must achieve a predetermined total ‘impact score’ to pass.

We aim to fill a notable gap in the market: approaching food system change through a diversity lens. Our pre-screener tests for diversity on the founding team, full-time advisors, and board. Post-investment, we ask our portfolio companies to complete a customized questionnaire annually that allows companies to track their impacts across 30 IRIS+ aligned indicator metrics. These metrics include intrafirm practices such as employee diversity, health, and governance related to environmental metrics. Examples of metrics we test: Company has performed a compensation audit and completed any necessary adjustments to achieve equitable compensation across genders and racial identities or company has an employee meal program that offers discounted or free nutritious foods in all workplaces where they operate. Given the early stage context of our firms, we encourage focusing on manageable intrafirm policies that are key to their core growth and team priorities.

Impact Tracking and Monitoring

Learn More

8758 Aqueduct Ave, North Hills, CA 91343 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.