IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Regenerate Asset Management

Climate Change

Climate Change Food Systems and Agriculture

Food Systems and Agriculture Natural Resources and Conservation

Natural Resources and ConservationFirm Overview

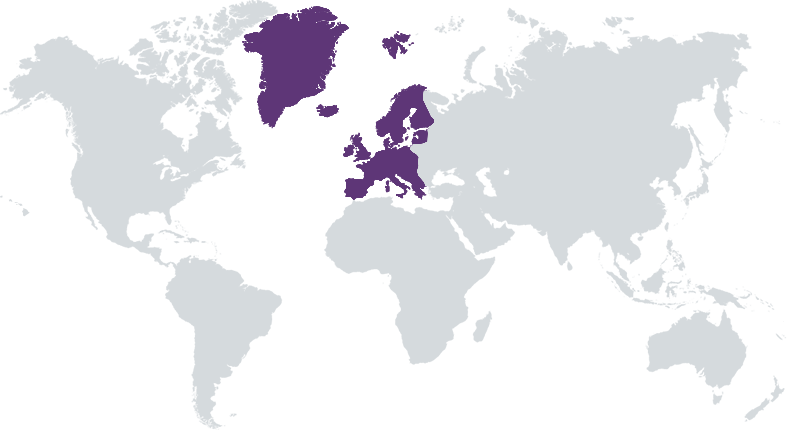

Regenerate Asset Management is pioneering a ground-breaking innovative investment strategy in European agriculture, blending patient private capital with Regenerate's extensive agricultural expertise and networks. This unique approach aims to create both economic and regenerative value in assets. The strategy is expected to benefit from downside protection delivered by the stability of underlying land asset values which serve as a safeguard against inflation, and sustainable long term cash flows delivered through asset consolidation. Regenerate European Sustainable Agriculture fund (“RESA”) is focused on regenerative agriculture and food production. RESA executes an asset backed, value add investment strategy, delivering private equity returns (15-21% net IRR target) with strong downside protection. The team will apply specialist regenerative techniques to agricultural enterprises (owner/ operator model) and transition the business models to sustainable practices, generating operating cashflow improvement and capital value appreciation and a hedge to inflation with measurable positive Impact in an Article 9 structure.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: 100%

Regenerate is a purpose led impact asset manager with a singular mission to pioneer and catalyse environmental change to create a more sustainable world. Regenerate aims to achieve this goal by leading the way in activating international private capital to support the global climate transition, through market leading investment strategies.

Regenerate’s focus on agriculture is fundamentally underpinned by the visible potential for agriculture to continue to grow into an even more significant and highly impactful investment asset class, in which European agriculture can offers the dual benefits of strong risk adjusted returns aligned to improving the world’s most depleted soils.

Regenerate Asset Management differentiates itself from other agricultural asset managers through its unique focus on value creation through regenerative agriculture. The key differentiators are listed below: Returns led value added strategy- RESA targets a net IRR of 15-21% and a money multiple of 2.0-2.5x, through a transitional value creation strategy. Traditional agriculture investment funds target 3-5%. Specialist team– Regenerate’s team are experts in private equity Impact, infrastructure and Regenerative Agriculture, with over 50 years of experience in low-carbon infrastructure and sustainability. Integration of Impact - Regenerate are deeply committed to impact investing, aligning its investment strategies with environmental and social goals. This mission-aligns financial returns and positive impacts on the environment. Regional focus – RESA balances regional opportunities with scaling and diversification requirements, ensuring investments are diversified across multiple hubs to achieve stability and resilience. This strategic regional diversification enhances the robustness of the investment portfolio.

Investment Example

Regenerate’s first investment is Regen Blue, two blueberry farms in Portugal. The strategy is to build a regenerative model around a core blueberry crop in Portugal. This asset presents a unique opportunity to reduce off-farm inputs, increase margins, augment the resilience of the natural assets and the business whilst creating an environmentally beneficial way of farming with outperformance prospects when scaled to generate price premium and environmental outcomes. The farms have started their regenerative journey and have the potential to create low input, climate positive blueberries while substantially scaling up the business across production, processing and packing. The opportunity comes at a time, when localization of food is particularly relevant in Europe. Through developing the business to produce regenerative blueberries, it carves a niche as a “better” supplier of European blueberries. The platform has excellent return prospects with an 18.8% return and 3.0x return multiple on exit in 7 years

Leadership and Team

|

Ben Stafford – CEO More Info

Ben has focused on sustainable private equity and venture capital investments across Europe and the UK over the past fourteen years. He has a successful and proven track record investing, managing and exiting European renewable energy businesses. He has a long history of successfully selecting and establishing new markets, while managing teams to deliver value through development and growth. Ben is responsible for fundraising, origination, investment and business development. Ben is an advocate for the natural environment and financing projects which drive change as well as excellent returns. |

|

Ryan Cameron – CIO More Info

Ryan is a founder and the CIO of Regenerate Asset Management. Ryan’s experience has centred on real asset based private equity investments across Europe and the UK over the past twenty years. He has a successful and proven track record investing in and exiting European renewable energy businesses, with a focus on extracting value from land management and asset centred companies. Ryan is responsible for fundraising, origination, investment and risk management. |

|

Nicholas Burlington – Head of Investor Relations (Director) More Info

Passionate private market specialist with 15 years’ experience in private markets fundraising, investor relations, and product design tailored specifically for institutional investors. Over the course of my career, I’ve been involved in raising more than €4 billion across multiple asset classes, working alongside leading European asset managers to attract capital from global institutional investors, family offices, and high-net-worth individuals. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Yes, Regenerate has established its sourcing and due diligence using an impact assessment framework based on seven United Nations Sustainable Development Goals (Stated below) that closely align with the key focus areas for delivering impact within the investment strategy. 2. Zero Hunger 3. Good Health and well being 6. Clean water and sanitation 8. Decent work and economic growth 12. Responsible consumption and production 13. Climate action 15. Life on land Every investment considered by the Fund is assessed against these seven UNSDGs to ensure alignment with the Fund impact objectives. This initial mapping serves as the first stage of the investment screening process. Beyond this initial assessment, the investment team has developed a bespoke Regenerate impact framework aligned to each UN SDG. This framework identifies specific technical and non-technical metrics which are of critical in delivering a positive regenerative transition. These include carbon, soil health, biodiversity, and social factors.

Yes, all investment opportunities are rigorously evaluated using Regenerate’s impact framework to ensure that investments meet the Fund’s impact criteria and provide consistency with the relevant UNSDGs. At which point, an investment will only advance if it meets the required criteria across all metrics, ensuring that the Regenerate investment team is confident the investment aligns and can execute on the following areas: • Regeneration Plan: assesses the current environmental state of the asset, detailing how the Fund can add value through biodiversity enhancements and improvements in soil health. • Key Risk Analysis and Sensitivities: Highlight potential risks to the Fund's return profile, including sensitivities related to crop types, water resources, environmental factors, land acquisitions, and market access strategies. • Operational Management Plan: Outline the current governance and employment structure of the company, identifying opportunities for the Fund to implement new hires, strengthen management teams, and provide staff training to support the regeneration plan.

Impact Tracking and Monitoring

Learn More

Regenerate Asset Management, Leeds, Yorkshire LS11 9YJ United Kingdom

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.