IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

MCJ

Climate Change

Climate Change Energy

Energy Entrepreneurship and Job Creation

Entrepreneurship and Job CreationFirm Overview

MCJ is an early stage fund manager for industrial transformation and infrastructure resilience. We discover and invest in startups rewriting industries to be cleaner, more profitable and more resilient. We strengthen our investments through the MCJ Collective — a vetted member network that connects talented tech and industrial leaders with our portfolio and with one another. Our media platform including the Inevitable podcast spotlights key perspectives critical to our portfolio and the transition at large, reaching tens of thousands of professionals multiple times per week.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: Less than 25%

MCJ is a seed fund manager for industrial transformation and infrastructure resilience. We discover and invest in startups rewriting industries to be cleaner, more profitable and more resilient.

We successfully closed our second fund at MCJ, MCJ 2023, bringing in $80.6M in total capital commitments, and pushing our total assets under management to over $115M. As with our earlier funds, this capital is dedicated to backing startups driving the transition of energy and industry and solving the inevitable impacts of climate change. The need for greater climate resilience drives us to seek solutions that make our infrastructure stronger and our world safer. Conversely, humanity will unlikely embrace austerity in the face of climate change (our societal drive for ever greater computing needs are but one example of this) and so we are continuously seeking clean solutions to meet an increasing demand for power. These dual themes of energy transition and climate resilience have been driving much of our recent investment activity.

We strengthen our investments through the MCJ Collective — a vetted member network that connects talented tech and industrial leaders with our portfolio and with one another. Our media platform, including the Inevitable podcast and MCJ Newsletter spotlight key perspectives critical to our portfolio and the transition at large, reaching tens of thousands of professionals multiple times per week. And finally our corporate partnerships, which span industries and provide unique value to portfolio companies, sector expertise for due diligence, and capital for future funds.

Investment Example

Base Power provides reliable home energy solutions powered by distributed batteries, enhancing grid resilience and lowering costs. Co-founders Zach Dell (CEO) and Justin Lopas (CTO) bring expertise in venture-backed startups, energy systems, and distributed storage to build a smarter, more resilient grid. MCJ first connected with Base Power through an LP introduction. In April 2024, MCJ invested $400K in the company’s Series A, led by Valor Equity Partners. After its initial investment, MCJ immediately leveraged its network to strengthen Base Power's team, directly contributing to three key hires: Mechanical Engineer, GTM, and an intern. MCJ further elevated their industry profile by featuring Zach Dell in a live Startup Series podcast during Houston's inaugural Energy & Climate Startup Week. Base Power exemplifies MCJ’s approach—investing in early companies and providing the connections, expertise, and opportunities to accelerate impact.

Leadership and Team

|

Cody Simms – Managing Partner More Info

Cody resides in Los Angeles and, in addition to his work with MCJ, is also co-founder of Climate Changemakers, a climate-focused political action non-profit that got its start in the MCJ Member community. Cody is also co-author of the Amazon-bestselling book Levers: The Framework for Building Repeatability into Your Business. Cody previously served as Senior Vice President of Climate & Sustainability at Techstars and as an investing Partner in Techstars' institutional venture funds. |

|

Yin Lu – Partner More Info

Yin focuses on investing and post-investment founder support at MCJ. Yin previously worked at Sandberg Goldberg Bernthal Family Foundation and was GM of Khan Academy’s international business, where she and her team scaled content into 30 languages and launched offices in Mexico, Brazil, Peru and India. Yin also built up the first community, international and marketing teams at Coursera. She began her tech career at Google and Microsoft. |

|

Thai Nguyen – Partner More Info

Thai focuses on investing, portfolio support and corporate engagement at MCJ. He joined MCJ in 2020, helping drive content, community, and early climate investments. An operator across startups and large companies, Thai previously led business development at Luxe and worked on mobility tech for automakers like Volvo. Earlier in his career, he held product roles at Intuit. Thai holds a B.A. in Computer Science and Asian Studies from Williams College. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

The Firm exclusively invests in companies actively addressing one of these four key environmental challenges: (1) reducing existing greenhouse gas emissions, (2) mitigating future emissions, (3) enhancing climate resiliency, or (4) enabling capital or talent flow into these areas. We prioritize impactful investments without compromising financial returns, believing each opportunity should be a substantial value creator in its sector. Our core belief centers on the global economy transitioning towards a decarbonized future. This transformation not only mitigates climate change risks but also fuels accelerated economic growth, prosperity, and equity.

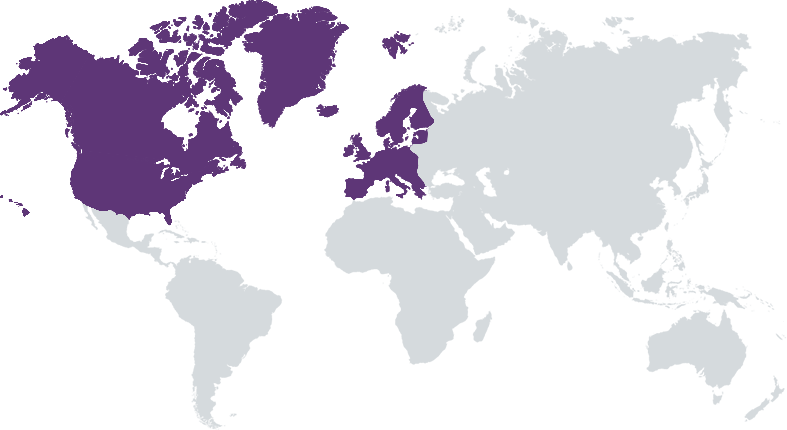

The Firm assesses potential investments according to these criteria and works with company management teams to track and support their continued progress in these areas: - Diversity of the founding team; - Diversity of the staff, inclusive of advisors; - Inclusive and equitable hiring practices; and - Geographic focus of business. The firm assesses potential investments according to these criteria and works with company management teams to track and support their continued progress in these areas: - Formalization of company’s mission into corporate structure - Continued adherence to company’s climate-related goals; and - Sustainability and emissions reporting practices including existence of a comprehensive business lifecycle analysis.

Impact Tracking and Monitoring

Learn More

867 Boylston St, 5th Floor #1407, Boston, MA 02116 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.