IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Next Billion Capital Partners

Entrepreneurship and Job Creation

Entrepreneurship and Job Creation Financial and Economic Inclusion

Financial and Economic Inclusion Gender Equality

Gender EqualityFirm Overview

Next Billion Capital Partners was founded on the partners’ strong belief that innovation-led private sector growth will positively impact lives at scale in emerging markets (i.e. to serve the ‘next billion’ households and SMEs), coupled with the recognition that capital to scale high-growth local companies is still scarce. As such, the firm’s mission is to contribute to the United Nations’ Sustainable Development Goals by supporting economic development through investments in innovative technology companies that improve access to key goods and services for households, women, and small businesses in emerging markets.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 25% – 49%

The Next Billion people in emerging markets are now accessing essential services through their smartphones. This presents a generational opportunity for private equity to deliver financial and positive social returns.

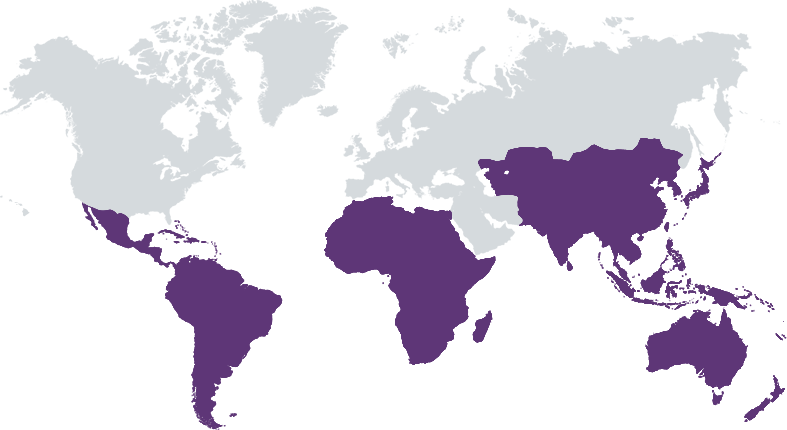

The wave of digitalization across the world has created a significant and overlooked opportunity in emerging markets, where a third of the global internet users reside; the investment opportunity arises from the gap between this large and growing population of new internet users and the lack of digital solutions that are available to them. We invest in technology business models that promote access to essential goods and services (including and especially financial services, commerce, and health) in emerging markets for households, women and MSMEs. We invest at the growth stage, where capital remains scarce today, and where business model and technology risks are minimal. We target a subset of markets in Southeast Asia, Middle East & Africa, and Latin America where the size of the population and the rapid growth of the digital economy signal the accelerating emergence of successful Digital Commerce, Fintech, and Healthtech companies in the next decade.

Business model focus: We screen the entire investable universe to find proven digital business models across high-impact sectors, that have local adaptations in our markets, and then pick the best companies executing these models. This strategy of cross-border pattern recognition sets us apart from most of our competitors. Impact focus: We focus specifically on women, both as end beneficiaries and at portfolio companies, and we create a detailed gender action plan for each of our investee companies. Geography: We specialize in the next set of growth markets after China and India, especially those countries that still feature a large lack of capital but have a large and growing digital user base. Stage of investing: We invest at the growth stage, where there is a “missing middle” for global capital, while most of our peers focus either on early-stage venture or on large, profitable companies at the later stage.

Investment Example

We invested in Qoala, the leading digital insurance platform in Southeast Asia. The company equips insurance agents with digital tools to distribute essential insurance products to underserved customers, and it designs and underwrites new insurance products that are more affordable and targeted to Indonesian emerging consumers and businesses. It services an enormous market need in the region, which today still features a <2.0% insurance penetration, among the lowest in the world. The company has already insured 3M+ households, bringing them a step closer to financial resilience. In order to reach and educate first-time insurance customers, Qoala works with 70K agents, 40% of whom are female. Once onboarded by Qoala, agents increase their productivity by 4 times in less than two years, thus being able to increase their livelihood and offer a better service to customers.

Leadership and Team

|

Ruzgar Barisik – Managing Partner More Info

Investment manager with over 20 years of private equity & venture capital investing and firm-building experience across US and international markets. Track record of delivering financial and developmental returns from direct and LP investments in multiple industries and geographies (US, EMEA, LatAM and Asia). Co-founder Next Billion Capital Partners, a technology investment firm focused on early to growth stage companies in emerging markets. Previously led IFC / World Bank’s Venture Capital business in EMENA and co-Lead for Global Consumer Internet. |

|

Kentaro Toyoda – Managing Partner More Info

Ken sets the direction for the Next Billion Growth Fund’s thematic investments across priority subsectors and business models. His experience and networks in Latin America and Southeast Asia enable him to source top deals across regions. Ken serves on the Fund’s Investment Committee and is based between Mexico City and Washington, DC. Before founding Next Billion, Ken was an Investment Professional at the IFC and at Fortress. Ken holds a BA from Harvard University and an MBA from The Wharton School. |

|

Falgu Shah – Partner More Info

10+ years in payments, fintech and finance. Operating, advising, investing in real time payment infrastructure, payment processors, and alternative lending models. Investing at the intersection of technology, processes, and people in high-growth markets. Expanding digital payments acceptance in Africa. Lived on 3 continents and done business on 5. Believer in building technology for good to empower the next generation of digital economies. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Impact is integrated in the following way into the investment process: - Business model prioritization: We target models that solve large and essential problems in emerging markets. To establish whether a model is satisfactory from an impact standpoint, the team developed a methodology called Model Impact Rating. - Company prioritization: Once the team has prioritized a business model, the team chooses the best company executing that model in our markets. Besides commercial evaluation, the company must also satisfy a strict impact evaluation. To establish whether a company is satisfactory from an impact standpoint, the team developed a methodology called Company Impact Rating. - Value-add: We always implement comprehensive impact programs, E&S Action Plans and Gender Action Plans. We only invest in companies and founders that are receptive about impact and ESG, and need our help in formulating strategies and policies in this regard. - KPI design and monitoring.

The Fund aims to achieve attractive risk-adjusted returns while generating positive developmental and environmental impacts. To accomplish this, the Investment team created an Environmental, Social and Governance Management System (ESMS) that details the Fund's ESG Policy, risk assessment processes, and ESG risk management strategies. This policy defines standards to benchmark investments and ensures compliance with the IFC Exclusion List, eliminating investments in harmful activities. The Investment team carries out ESG assessments, categorizing investments based on their risk level and management capability, including ratings from ‘unsatisfactory’ to ‘excellent’. The assessment process encompasses pre-assessment, due diligence, and ongoing monitoring, ensuring compliance with regulations and commitment to continuous improvement. Each investment has a tailored ESG and gender action plan to enhance performance and mitigate risks. Ultimately, ESG considerations are integral to investment decisions, influencing contract terms that commit companies to improve their ESG practices throughout the investment period.

Impact Tracking and Monitoring

Learn More

3500 South Dupont Highway, Dover, DE 19901 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.