IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Sweef Capital

Food Systems and Agriculture

Food Systems and Agriculture Gender Equality

Gender Equality Health and Wellbeing

Health and WellbeingFirm Overview

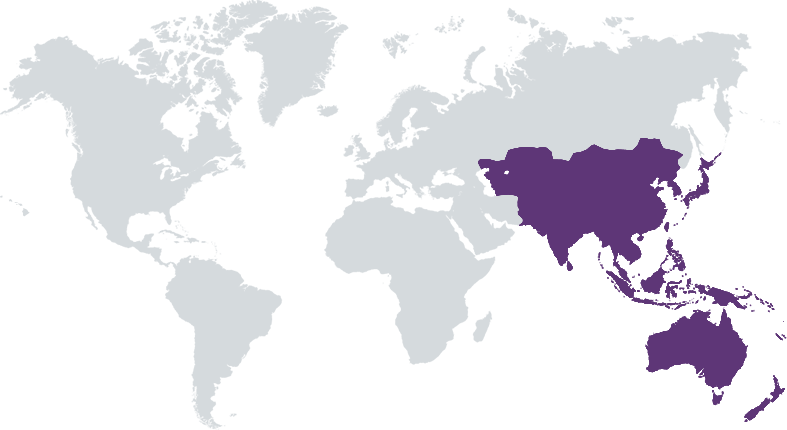

Established in 2021, Sweef Capital is a women-led impact investment firm dedicated to harnessing the transformative potential of women and fostering sustainable growth in Southeast Asia. Through its Southeast Asian Women’s Economic Empowerment Fund (SWEEF). Sweef Capital stands as a pioneering force, blending private equity rigour with robust impact measurement and management (IMM) practices. Sweef Capital is more than just an investment firm; they are catalysts for positive change. Sweef’s IMM framework has built through strategic partnerships that amplify impact and extend reach. Through projects like Sweef’s inaugural Annual Impact Report and Gender-Responsive Climate Report, Sweef seeks to educate the broader global ecosystem on its leading gender methodologies and the vast potential to drive meaningful impact in Southeast Asia through comprehensive case studies. Furthermore, by leveraging Sweef’s Gender ROITM database, the firm continues to build an evidence base for gender lens investing, ensuring a more inclusive, resilient and sustainable future.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: 50% – 99%

Sweef Capital aims to unlock women's potential in growth-driven private equity, creating a demonstration effect for future gender-focused fund managers by pursuing investments where impact scales alongside business growth, generating social, economic and financial returns.

Sweef Capital’s investment thesis centres around building relationships and fostering value creation. The firm targets sectors experiencing strong demand, including education, healthcare, food systems, and climate resilience. It seeks investment opportunities in companies that align with core values, particularly women-led or women-owned businesses, those promoting gender equality within their operations, and companies addressing the unmet needs of women and girls in society. By prioritising gender diversity and women’s economic empowerment, Sweef drives financial returns while catalysing social impact. The firm firmly believes that investing in the potential of women is not only a matter of social responsibility but also a strategic imperative for sustainable growth and positive change. The thesis is straightforward: by empowering women economically and promoting gender equality in investments, new opportunities can be unlocked, driving innovation and transformative impact across communities and industries.

Sweef Capital distinguishes itself as the only regional fund investing in companies where diversity and gender equality are central to leadership, operations and value chains. By setting industry standards, Sweef has carved out a unique position, blending the stability of mainstream private equity with the agility of venture capital. This approach ensures the firm has a transformative executive capability, creating a platform that bridges sectors and drives meaningful impact. A key strength is Sweef’s diverse and global network of clients which includes pension funds, insurance companies, governments, foundations, and family offices. This broad client base reflects a shared commitment to addressing gender issues within investment strategies. Additionally, Sweef developed the proprietary GenderROITM tool, which builds the evidence base for gender lens investing. This tool identifies opportunities, measures impact, and drives systemic change across four dimensions: Leadership, Workforce, Value Chains, and Society, ensuring measurable social impact alongside financial returns.

Investment Example

An illustrative example of Sweef’s investment philosophy can be seen in its recent investment in Vilo Gelato, a leading ice cream brand that stands out not just for its delectable products but also its commitment to gender-smart supply chains. Founded in 2017, Vilo’s vision extends beyond being a leading ice cream brand; it aspires to be a catalyst for positive change by focusing on sustainability, social responsibility and inclusive business practices. Vilo creates a lasting impact on the communities it serves. Since Sweef’s investment, Vilo has experienced significant growth, expanding 34 outlets across 15 cities in Indonesia. Sweef’s support has enabled Vilo to further extend its market reach while deepening its social impact through increased production and partnership with local, women-owned supplies. This investment showcases Sweef’s ability to align business expansion with community empowerment, job creation and gender equality.

Leadership and Team

|

Jennifer Buckley – Managing Director More Info

Jennifer Buckley, MD, led Sweef’s spin-out to an independent firm in 2021 with a vision to be the leading women-centred private equity firm in Southeast Asia. She has a storied career in private equity markets in Europe and Asia-Pacific having led GE Capital’s European private equity team and been CIO of its Asia team. Having spent most of her career in private equity, Jennifer is aware of how private capital can help entrepreneurs develop their businesses, but also that gender biases affect investment decisions leading to less capital going to women-owned enterprises. Jennifer saw an opportunity to integrate the private equity model with impact frameworks and tools to develop and investment product that will encourage mainstream capital providers to move into gender lens investing. |

|

Rowena Reyes – Director More Info

As a Director of our firm and senior member of the investment team, I am actively involved in building Sweef Capital’s investment approach and deal pipeline and proud to lead our coverage in my home country of Philippines. I have been actively involved in developing our impact frameworks and diversity and inclusion tools. Our focus on enabling women to realise their potential as leaders and agents of change in their communities draws on my experience in corporate development, M&A, capital markets and divestment across Asia-Pacific and as an entrepreneur and founder of Crossborder Ventures, a corporate and hospitality sector-focused import & export business, developing and managing global distribution networks. |

|

Brianna Losoya-Evora – Head of Impact Measurement and Management More Info

I am a monitoring and evaluation specialist with over ten years of experience using data to promote evidence-based decision-making in development programming. As Head of Impact Measurement and Management for Sweef Capital, I measure the firm’s impact and foster a learning culture that relies on impact data to iterate and maximize positive social and environmental impact. I also aim to share Sweef’s evidence-based approach by fostering partnerships and facilitating knowledge exchange to promote learning at the global and ecosystem levels. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Sweef Capital systematically targets companies where impact is integral to the business model, particularly in addressing social and environmental issues. In assessing potential portfolio companies, Sweef focuses on enterprises committed to creating meaningful change, such as its investments in Teky, an education technology company providing STEM-based learning solutions, and USM Healthcare, a medical device manufacturer. Among these, the investment in Vilo highlights Sweef’s commitment to positive impact. Vilo aims to train women for success in the food sector, integrate local women suppliers into its supply chains, and reduce non-recyclable production materials and food waste. The company fosters equitable promotion tracks and develops technical skills for all employees, including part-time staff, thereby enhancing gender equality and inclusive economic opportunities. Additionally, this investment supports sustainable practices that contribute to environmental preservation and a circular economy.

At Sweef, investment processes systematically incorporate intrafirm social and environmental sustainability practices, particularly through a strong focus on gender equality, diversity, and climate resilience. Proprietary tools like the Sweef Capital Gender ROI™ are used to assess and drive improvements in gender equality across leadership, workforce policies, and business practices. In due diligence, climate-specific assessments are conducted in collaboration with expert partners (e.g. leading New York-based climate consultant OnePointFive) to evaluate and mitigate environmental risks. For instance, in the investment in Vilo, rigorous environmental and social assessments were applied, identifying opportunities for improving emissions tracking, resource use, and responsible waste management. This approach goes beyond compliance, embedding sustainability into the core of investments. Sweef Capital ensures alignment with international standards, such as the SDG Impact Standards, to generate both financial returns and positive social and environmental outcomes. This process reflects the belief that sustainability practices are critical to long-term value creation.

Impact Tracking and Monitoring

Learn More

9 Raffles Place, No.19-21, Republic Plaza, Singapore 048619

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.