IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Mercy Corps Ventures

Climate Change

Climate Change Financial and Economic Inclusion

Financial and Economic Inclusion Food Systems and Agriculture

Food Systems and AgricultureFirm Overview

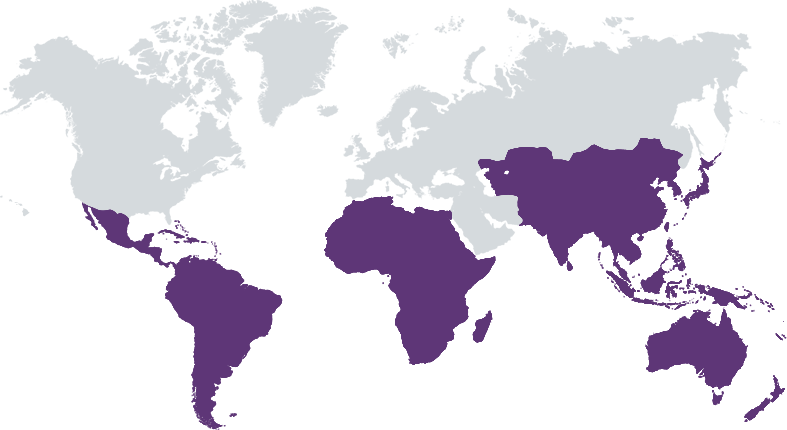

Mercy Corps Ventures (MCV) is the impact investing arm of Mercy Corps. Founded in 2015, MCV invests in pre-seed, seed and early-stage ventures focused on adaptive agriculture, inclusive fintech for climate resilience, and climate-smart technologies. MCV has supported its portfolio of 54 startups to scale to directly serve over 35 million users across more 90 countries and has catalyzed over $500 million in follow-on capital. MCV is a gender-smart investor with 44% of its portfolio founded by at least one female co-founder. MCV provides tailored support and strategic guidance to help startups scale their impact through its Venture Platform. By leveraging cutting-edge technologies and fostering partnerships, MCV aims to bridge the climate adaptation finance gap and empower communities to thrive amidst challenges. Through rigorous impact measurement and management, MCV ensures that its investments deliver meaningful social, environmental, and economic benefits, ultimately contributing to a more equitable and resilient future.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

Mercy Corps Ventures' Resilient Future backs early-stage, high-impact startups in agtech, inclusive climate fintech and climate smart technologies that enhance the climate resilience of vulnerable communities in Africa and Latin America.

Mercy Corps Ventures is a thesis-driven investor targeting pre-seed and seed stage tech-enabled startups across three themes: * Adaptive Agriculture & Food Systems * Inclusive Climate FinTech * Climate Smart Technologies These startups enable individuals and communities in emerging markets to withstand climate stresses and shocks and thrive in a rapidly evolving global economy. As one of the few fund managers with a long-term track record in emerging markets climate investing, the cornerstones of our approach are: * Through tailored post-investment support and Mercy Corps (our multinational INGO Sponsor), we help founders validate their business models, scale operations, secure sales relationships and ultimately contribute to closing the climate adaptation and SDG financing gaps. * We are a team of seasoned founders, operators and investors, deeply embedded in markets across Africa and LATAM. * We prioritize investments in diverse founding teams, recognizing that inclusive leadership fosters more innovative and effective solutions.

MCV’s pioneering and comprehensive focus on climate adaptation and resilience investing in frontier markets differentiates us from our peers. Track Record: 54 portfolio companies with >80% survival rate that have scaled to serve over 35M customers, 24% IRR, a 2.1x Multiple On Invested Capital (MOIC) and 5 exits. Our portfolio features 44% female-founded companies. Impact: We employ best-in-class IMM practices, and also enhance our portfolio companies' capacity to report impact data. Rigorous Selection & DD: Our thorough vetting process focuses on climate and gender-smart criteria, to identify those with the highest potential for both climate impact and commercial success. Tailored Support: We provide strategic support through our Venture Platform, helping companies achieve product-market fit, deepen their impact and attract follow-on investment. Global Network: MCV team members are embedded in emerging markets where we invest. We leverage Mercy Corps’ global networks to develop partnerships across 40 countries to catalyze portfolio growth.

Investment Example

In 2018, MCV invested $150,000 in Pula’s Seed round as one of its first investors. Pula is an agricultural insurance and technology company that designs and delivers innovative agricultural insurance and digital products to help smallholder farmers endure yield risks, improve their farming practices, and bolster their incomes over time. Immediately after our investment, we worked closely with Pula to establish valuable new partnerships with Safaricom Digifarm and Bayer. We secured a significant $750k grant from Bayer Foundation to support Pula’s expansion to serve more smallholder farmers. This was designed to test and de-risk market expansion, distribution, and go-to-market (GTM) approaches and expand the reach of its product suite. This has now blossomed into a $10 million+ partnership with Bayer to extend insurance to millions of additional farmers globally. Pula now reaches over 15.4 million farmers in 22 countries globally, and raised a $20 million Series B in April 2024.

Leadership and Team

|

Scott Onder – Co-Founder and Chief investment Officer More Info

Scott is Co-Founder and Investment Director of Mercy Corps Ventures (MCV). MCV has invested in 54 early-stage companies developing climate adaptation and resilience building solutions in Africa, Latin America, and Southeast Asia. MCV emphasizes innovations in Adaptive Agriculture, Inclusive Fintech, and Climate Smart Technologies, including sustainable supply chain solutions, Nature Based Solutions, carbon finance, weather forecasting models, and climate data analytics companies. Scott has grown MCV to also offer strategic support through its Venture Platform as well as partnerships and pilots through its Venture Lab to help ventures scale. |

|

Timothy Rann – Managing Partner More Info

I am the Managing Partner at Mercy Corps Ventures, a seed stage focused VC fund focused on startups building solutions for climate adaptation and financial resilience in emerging markets. My particular expertise is in AgriFoodTech, ClimateTech, Carbon Finance and Web3. Proud advisor to Forest Carbon (Indonesia), Generation Forest Invest, Goldfinch, MightyAlly, Renoster.co, Terraspect and Empowa.io. |

|

Natalie Vergara Giron – Head of Platform More Info

I am passionate about business solutions to solve social problems. I believe everyone has a role to play in building a better world for all. At Mercy Corps Ventures, our vision is a world where underserved people and communities can withstand disruption, build for a more equitable future, and thrive. We provide entrepreneurs with the early-stage capital and the support they need to grow. I have 16+ years of experience creating social and economic value in the private and development sector through project management, financial consulting and business development. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

MCV integrates impact measurement and management (IMM) throughout its deal sourcing and due diligence process. Our approach aligns to several globally-recognized industry frameworks, including the Sustainable Development Goals, the Impact Management Project’s 5 Dimensions of Impact, the Operating Principles of Impact Management, and the 2X Collaborative (of which MCV is a member). At each stage of diligence (e.g., 1-pager, Cover Letter, Founder Interviews, Investment Memos) the team assesses positive social and/or environmental impact alongside the identification and mitigation of ESG risks and negative impact based on: * Alignment with MCV's Investment Thesis and impact outcomes * Investee Theory of Change * ESG Risk Assessment * Investor Contribution Assessment * Five dimensions of impact (What, Who, How Much, Contribution, Risk) The Fund’s Investment Team leads the process, with support and collaboration from the Fund’s Impact Advisor. See MCV's Investment Process Manual for our full process and decision-making criteria: https://docsend.com/view/f2nfxd7xnrhdb48g

MCV integrates impact measurement and management (IMM) throughout its investment process. Our approach aligns to several globally-recognized industry frameworks, including the Sustainable Development Goals, the Impact Management Project’s 5 Dimensions of Impact, the Operating Principles of Impact Management, and the 2X Collaborative (of which MCV is a member). Our team assesses positive social and/or environmental impact alongside the identification and mitigation of ESG risks and negative impact based on: * Alignment with MCV's Investment Thesis and impact outcomes * Investee Theory of Change * ESG Risk Assessment * Investor Contribution Assessment * Five dimensions of impact The Fund’s Investment Team leads the process, with support and collaboration from the Fund’s Impact Advisor. MCV's full investment due diligence process and decision-making criteria are detailed in the Resilient Future Fund Investment Process Manual: https://docsend.com/view/f2nfxd7xnrhdb48g

Impact Tracking and Monitoring

Learn More

45 SW Ankeny St, Portland, OR 97204 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.