IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Meloy Fund

Entrepreneurship and Job Creation

Entrepreneurship and Job Creation Food Systems and Agriculture

Food Systems and Agriculture Natural Resources and Conservation

Natural Resources and ConservationFirm Overview

Deliberate Capital deploys impact capital and technical assistance to conscientiously and intentionally generate environmental and social impact. Deliberate Capital is the manager of the Meloy Fund for Sustainable Community Fisheries, the first fund to target investments in the coastal fishing and aquaculture sector. As the Meloy Fund reached the successful deployment of its fund, the team has partnered with Pegasus Capital Advisors to jointly manage the Global Fund for Coral Reefs investment fund, marrying large-scale private equity experience with on-the-ground knowledge and track record investing in the blue economy in the developing tropics.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: 50% – 99%

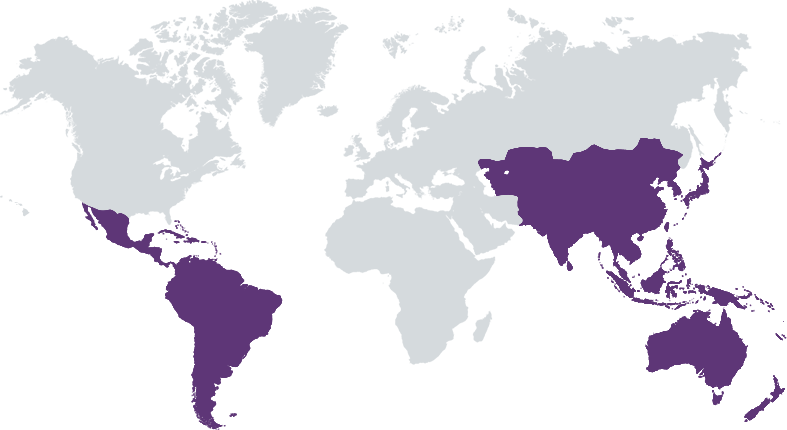

Deliberate Capital pursues a diversified, global portfolio of high-growth opportunities in the wild-caught fisheries, aquaculture, hospitality, and circular economy sectors, with the goal of generating competitive returns while creating positive benefits for undervalued coastal natural assets including coral reefs, related coastal ecosystems, and the climate-vulnerable communities that depend upon them.

Deliberate Capital invests in the following sectors to reduce the local drivers of degradation in coastal ecosystems that include the world's most climate-resilient reefs: Sustainable Ocean Production: Including sustainable wild-caught fisheries and enabling technologies, and sustainable aquaculture operations in the coastal environment. Sustainable Coastal Hospitality: Including eco-friendly hotels and related businesses, focused on those linked to the establishment and sustainable financing of marine protected areas and related sustainable coastal management. Circular Economy and Pollution Reduction: Including recycling and collections (with a strong focus on plastic and wastewater treatment); agricultural pollution management; offshore renewable energy Enabling Technologies: Those technologies that can be deployed in relevant supply chains, can catalyze adoption of sustainable business models, and/or have the potential to significantly transform the blue economy.

Deliberate Capital's main differentiator is the intentionality behind each of its investments. We look to have immediate impact that is measurable, and can be scaled over time with clear targets for the potential increases in environmental and social outcomes throughout the investment holding period. We also employ blended finance structures to de-risk, in particular, emerging markets exposure and to catalyze new entrants in investing into the blue economy. We also uniquely pursue neglected and undervalued natural capital assets, and combine investment dollars with non-dilutive grant funding partners to ensure connectivity between investments and benefits to people and nature at the local level. For example, the GFCR's blended finance structure brings together two complementary funds: a granting vehicle – offering grants, concessional loans, guarantees, and technical assistance – and our investment fund – with flexibility to put the right capital structure to work to achieve triple bottom line goals.

Investment Example

An illustrative investment is a vertically and horizontally-integrated, multi-product sustainable seafood platform created and financed by the Meloy Fund, called Ocean Union. The company is now a leader in sustainable seafood in Southeast Asia, as well as one of the largest firms by revenue in the region.

Leadership and Team

|

Dale Galvin – CEO of Deliberate Capital LLC More Info

Over his career, Dale Galvin has served in a variety of leadership roles in the international conservation, finance, investment, and technology sectors. His positions have included Founder and Fund Manager of the Meloy Fund I, LP, Chief Operating Officer of Rare, an international conservation organization, and Chief Financial Officer of PA Consulting Group North America. Galvin holds a B.A. in Economics from Cornell University and an M.B.A. from the MIT Sloan School of Management. Mr. Galvin is the CEO of Deliberate Capital LLC, a subadvisor to Pegasus Capital and the Managing Director of the GFCR Investment Fund SCSp. |

|

Peter Kennedy – Chief Investment Officer More Info

Global finance professional with over 30 years of experience in deal origination, investing, management, and governance of both private and public companies across Asia, US and Europe. Experienced Board Member serving on over 20 Boards, specializing in Tech and ESG with advanced degree from MIT in cybersecurity board governance. Thought leader in the impact/tech investing sector; established one of the early private equity impact funds and led more than 30 deals in this area since 2003. Strong sourcing and co-investment network with VC and private equity funds globally. |

|

Razak Radityo – Senior Investment Associate More Info

Currently work as an Impact Investing / Private Equity professional, connecting foreign capital to emerging market countries to help solve critical development challenges, especially in the blue economy sector. Have 10+ years of experience in buy-side & sell-side investments and management consulting. Earned MBA from Georgetown University, McDonough School of Business with full-merit scholarship. Occasionally providing mentorship and career coaching for MBA aspirants and MBA students. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Deliberate Capital targets investments that have the potential for an explicit social and environmental impact. Throughout diligence, ESG and impact strengths and weaknesses are assessed, and all investees are required to agree to an ESG and impact improvement plan, to correct gaps and maximize potential impact over time. This also includes a plan to access our non-dilutive technical assistance facilities, to which each portfolio company must contribute. Plans and projects are company and sector-specific, but could include, for example, adopting sustainable sourcing policies, labor policies, gender targets, participation in natural resource management plans (eg fishery improvement projects), etc.

Deliberate Capital ensures that all potential investees are reviewed against the following ESG standards in the due diligence process: 1) Fund’s Exclusion List; 2) Compliance with all applicable laws on environment, health, safety, social issues, and local company law, with a detailed focus on fisheries; 3) IFC's Environmental and Social Performance Standards; 4) The World Bank Group (WBG)/IFC Environmental Health and Safety (EHS) General Guidelines and relevant sectoral guidelines such as WBG/IFC EHS Guidelines for Aquaculture and for Fish Processing, as applicable; 5) Deliberate Capital's Sustainable Fishery Guidelines; 6) Corporate Governance practices; and 7) sector specific certifications and guidelines as applicable.

Impact Tracking and Monitoring

Learn More

2503D N. Harrison St, #1125, Arlington, VA 22207 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.