IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Global Innovation Fund

Climate Change

Climate Change Food Systems and Agriculture

Food Systems and AgricultureFirm Overview

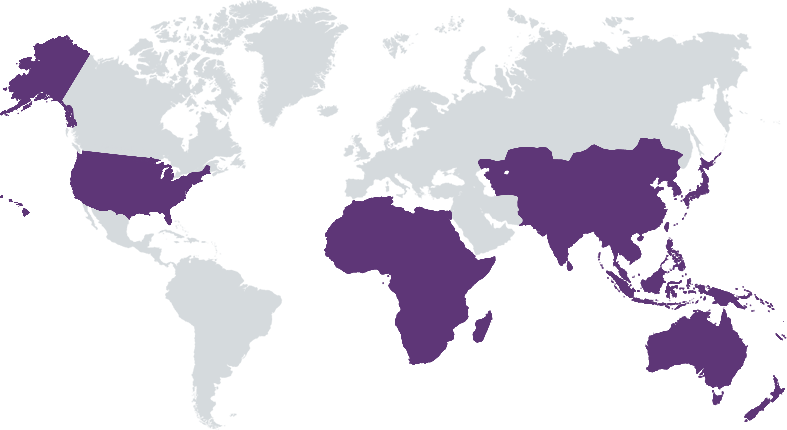

The Global Innovation Fund (GIF) is a non-profit, impact-first investment fund headquartered in London with offices in Washington, D.C., Nairobi and Singapore. We invest in the promising innovations targeted at improving the lives of the world's poorest people across Sub-Saharan Africa and Asia. GIF and it's subsidiary GIF Growth, which is a newly launched blended finance debt vehicle, together provide patient capital to seed to early growth stage organizations helping them on the path to delivering impact at scale. Innovations in our portfolio are expected to benefit 156m people by 2033, and our research and analysis show that just six of our earliest investments have generated more than $2.8bn in social benefits to date.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 50% – 99%

The Global Innovation Fund finds and funds innovations which can deliver sustainable, equitable and climate resilient economic development and wellbeing for the global poor.

The Global Innovation Fund (GIF) is sector agnostic, lead by the core development objective of poverty alleviation and sustainable development with a specific thematic focus on improving the agency of women and girls and driving climate adaptation and resilience. Supported by a multidisciplinary team of impact experts, economists and ESG specialists, GIF applies it's rigorous practical impact framework and a gender and climate lens to all of its investments. GIF is also one of the first private sector 2x challenge participant fund. Our theory of change seeks to find innovative solutions - new products and technology or business models, to address market frictions, to improve economic productivity and enhance delivery of essential services. Our work focuses on improving productivity in agricultural supply chains, increasing access to markets and financing for SMEs and supporting innovations which help delivery of public utilities and infrastructure.

GIF is unique as a multilateral investment vehicle with funding from the UK, US, Swedish, Australian and Canadian governments as well as private investors. With its new fund, GIF Growth, we have further created a unique public-private blended capital structure to help mobilize impact first capital and help deliver impact at scale. GIFs multidisciplinary team of ESG and Analytics experts drives our impact analysis frameworks, which have created market leading tools such as Practical Impacts, Gender and Climate markers, to help measure and model developmental impact, gender impact including enhanced agency of women and girls and measuring resilience to climate adaptation. Lastly, our ability to deploy multi-stage capital through a variety of instruments (debt, equity, mezzanine and grants) across a range of sectors, also positions us uniquely to take on high impact innovations.

Investment Example

In February 2023, GIF invested $1.8 million in S4S Technologies; inventors of a low cost solar-powered food dehydrator and innovative village level procurement and processing model. S4S reduces food waste whilst increasing farmer resilience to climate shocks adversely affecting crop quantity and quality. Importantly, S4S creates climate-resilient employment and agency for rural women, who lack alternative employment outside of drudgerous informal farm labour. Female agents purchase “unsellable” crops from smallholder farmers, which are dehydrated by village-based female entrepreneurs and sent to a central facility for final processing before reaching S4S’s customers. GIF’s investment enabled S4S to refine its model, strengthen its team, increase its product range and scale procurement, processing and impact. S4S has tripled its network of female processors since GIF’s initial investment and paid over $12m to farmers over a period of extreme drought and plummeting yields in India. In November 2023, S4S won the prestigious Earthshot Prize.

Leadership and Team

|

Joseph Ssentongo – Chief Executive Officer More Info

Joseph Ssentongo holds the overarching responsibility for GIF’s mission: identifying and funding innovations capable of transforming the lives of people living on less than $5 a day. Prior to being appointed CEO he served in various executive capacities, including as GIF’s Chief Operating Officer, where he oversaw strategic alignment across all organisational teams and functions. He also held the position of Senior Vice President for Impact, managing the work of the Grants, Analytics, and Environmental, Social Responsibility, and Governance (ESG) teams. |

|

Avinash Mishra – Chief Investment Officer More Info

Avinash leads GIF's risk capital investment team and heads GIF Growth, GIF's new returnable capital investment vehicle. He shares oversight of the GIF's finance function with our CEO, ensuring close alignment between investments and financing. Avinash has over 12 years of experience spanning impact investing, social entrepreneurship, international banking and technology. He previously worked as a consultant advising institutional and individual investors on early stage investing in India - most notably helping prepare strategy and structure for a $100m family office. |

|

Cillian Moynihan – General Counsel More Info

Cillian Moynihan oversees the legal and ESG teams and functions at GIF. He is responsible for structuring and negotiating all GIF’s investments around the globe, managing all existing investments, fundraisings and exits, and advising the GIF Board, investment team and Executive Team on all legal and ESG issues. Cillian oversees the group compliance function, including managing regulatory interactions and investor engagement. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

GIF is an impact first investor which is enshrined in our articles and byelaws. We invest in innovations throughout the developing world which we believe will have an outsized impact to improve the lives of the world's poorest people. One of GIF's focal areas has been its work with women and girls and helping to improve the lives of women. This has included through its innovating for gender equality fund, where, since 2018, we have invested in 13 innovations across 19 countries, impacting over 24.5m women, forecasted to rise to 44m in 2033. A recent external evaluation of GIF's gender portfolio found that “GIF excels in all evaluation dimensions, surpassing expectations in identifying and funding innovative solutions that advance gender equality at scale.” An example from GIF’s portfolio, in Africa, includes No Means No Worldwide which expanded its dual-gender sexual violence prevention intervention across Africa via a social franchise model.

Yes, The Global Innovation Fund focuses on two such areas: gender and climate. Gender: GIF uses gender analysis tools to ensure we consider each of our investments through a 'gender lens'. Our toolkit allows us to analyse gender issues for innovations focused specifically on gender impact, but also to consider gender issues for innovations primarily focused on non-gender impact outcomes. Climate: GIF is committed to investing in innovation for climate resilience and adaptation. We use a dedicated climate diagnostic and marker to ensure we consider climate issues for each of our investments – both for those that are climate-related, as well as for those primarily focused on non-climate outcomes.

Impact Tracking and Monitoring

Learn More

8 Devonshire Square, London, EC2M 4PL United Kingdom

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.