IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Equator VC

Climate Change

Climate Change Energy

Energy Food Systems and Agriculture

Food Systems and AgricultureFirm Overview

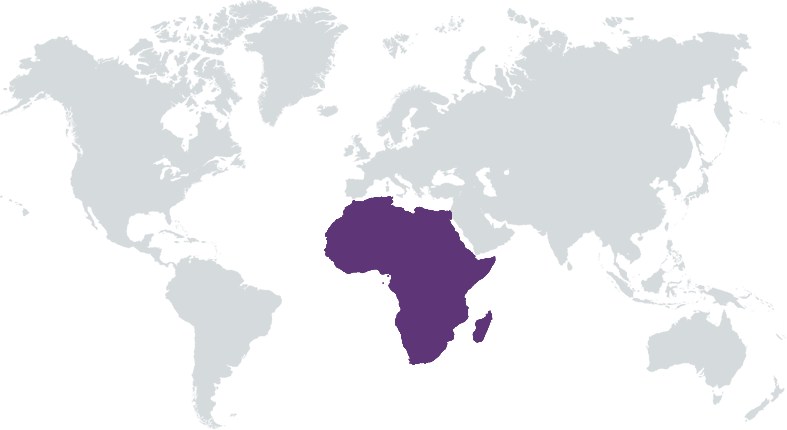

Equator is a venture capital firm with teams in Nairobi, Lagos, London, and Colorado that targets technology-enabled, early-stage ventures in energy, agriculture and mobility that are accelerating an equitable climate transition in Sub-Saharan Africa and supporting inclusive economic growth. Partnered with British International Investment (BII), the Global Energy Alliance for People and Planet (GEAPP), UK charity Shell Foundation and impact investor DOEN Participaties, Equator is backed by a team of technologists, operators, and investors with decades of experience investing in and scaling early-stage ventures in climate-positive sectors and across Sub-Saharan Africa.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: 50% – 99%

Equator invests in tech-enabled solutions across the energy, agriculture and mobility sectors in Sub-Saharan Africa.

Economic and Sustainable Development challenges in energy, agriculture, and mobility in SSA are both profound and highly interconnected. These spaces are often amenable to technology disruption and market-based solutions which, if done smartly, allow for increased human and economic development, GHG avoidance, and climate resiliency. Furthermore, Africa accounts for less than 3% of the world's energy-related carbon dioxide (CO2) emissions to date, but Africans will be among the world's most affected by the negative impacts of climate change. Equator was founded with the intention of accelerating an equitable climate transition in Sub-Saharan Africa by providing much-needed capital and active hands-on support to climate-tech ventures at a critical juncture in their start-up journey. The team seeks to invest in high-growth, ready-to-scale ventures that are driven by technology and business model innovation in their quest to address material economic and sustainability challenges in the region.

The climate-tech sector in Sub-Saharan Africa faces a “value-add gap”. There are limited players with the deep technical expertise and operational capacity to actively support companies post-investment. Equator has built a unique and diverse team of technologists, operators and investors that possesses the technical knowledge and market insight to fill this void by offering hands-on support and mentorship that extends beyond monetary investment. Many regional single-sector funds focus primarily on consumer product companies, like solar home systems or on traditional project models, like agri-developers. Equator focuses on enabling climate technologies and models that act as service providers to many of the ventures that our peers back. We support B2B ventures over B2C and try to play further upstream in the value chain. We also understand hardware solutions (which other funds often avoid.) With a heavy emphasis on global technology brokering, we seek scalable solutions with relevance across emerging markets.

Investment Example

SunCulture is a company headquartered in Kenya which offers affordable IoT enabled solar irrigation equipment, bundled with services & financing to smallholder farmers in Sub Saharan Africa, a region where only 4% of arable land is currently irrigated. SunCulture’s products, along with training and support, make it easier for farmers to grow high-value crops while increasing the productivity and profitability of their farms. The company operates at the intersection of agriculture and energy, addressing food insecurity, helping farmers adapt to climate change, and contributing to the reduction of greenhouse gas emissions. Equator invested $2m in SunCulture in 2022 as part of the company’s Series A, and subsequently invested $1m as part of a $4m bridge round to the Series B which Equator led in May 2023. Equator has provided fundraising support to SunCulture, assisted in CFO recruitment, connected the company with carbon market platforms and supported carbon financing initiatives.

Leadership and Team

|

Nijhad Jamal – Managing Partner More Info

Nijhad is the Managing Partner at Equator and brings over 16 years experience as an investor and entrepreneur, particularly in Sub-Saharan Africa. Previously, as the founder of Moja Capital and in his prior roles at BlackRock and Acumen Fund, he has invested in or operated businesses across the clean energy, agriculture, mobility, fintech, and retail sectors. He began his career at UBS Investment Bank and later left to help launch the boutique M&A advisory and growth equity firm Centerview Partners. Nijhad holds a BSc. from the Massachusetts Institute of Technology (MIT) and an MBA from Harvard Business School. |

|

Morgan DeFoort – Partner More Info

Morgan is a Partner at Equator and has a background in technology development and entrepreneurship with over two decades of experience working in emerging markets – predominantly Africa and India. Morgan is also the Founding Partner of Factor[e] Ventures and was a Co-Director of the Energy Institute at Colorado State University, supporting over 200 interdisciplinary faculty, teaching, and leading R&D programs in a wide range of technology areas including engine systems, biofuels, and cookstoves. Morgan has a PhD. and M.S. from Colorado State University and a BA from Hastings College. |

|

Lyndsay Handler – Operating Partner More Info

Lyndsay is an Operating Partner at Equator and brings over 18 years of leadership and operations experience building social ventures in the energy, agriculture, and fintech sectors in Africa. Lyndsay also runs the Venture Studio at Factor[e] Ventures and previously was the CEO of pan-African solar company Fenix International, where she built a team of over 1,100 employees to deliver clean, affordable power to over 3 million people in Uganda, Zambia, Benin, Nigeria, Cote d’Ivoire, and Mozambique before leading Fenix through an exit to ENGIE. Lyndsay holds a B.A. from Stanford University. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Equator’s deal sourcing and due diligence processes begins with an Impact Potential Screen (alignment with our impact theses, impact at scale, impact potential) and a Climate Finance Screen (finance methodology developed by the Joint Climate Finance Tracking Group of multilateral development banks (MDBs)and a group of representatives of the International Development Finance Club (IDFC) member banks.) A Climate and Impact scorecard is developed based on 6 key metrics: Job Creation, Carbon Reduced or Avoided, Climate Adaptation & Resiliency, Lives Impacted, Gender Equity and ESG. Finally, we also screen for Excluded Activities (in line with IFC Performance Standards) and conduct a Gender Baseline Survey for all potential investments. Beyond the Climate and Impact assessments, Equator endeavors to create value by promoting high standards for ESG and Business Integrity (BI) practices with our portfolio companies.

During Due Diligence, ESG and BI risk assessments are performed incorporating IFC Performance Standards, and a Gender Baseline Survey is completed by potential investees to evaluate commitment to gender equity and inclusion. Where ESG, BI and diversity risks and priorities are identified, Equator works with the prospective company to complete and adopt an ESG and BI Action Plan. The ESG and BI risk assessments, Action Plan, and an assessment of the target company’s internal ESG and BI capacity will be included in the investment memo and shared with the Equator investment committee as part of the investment review and approval process. Additionally, the Equator team will describe any ESG and BI related opportunities that the team can support the target company on with respect to operations, policies and procedures, and team for purposes of monitoring and reporting on long-term value add activities.

Impact Tracking and Monitoring

Learn More

2520 Nancy Gray Avenue, Fort Collins, CO 80525 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.