IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Ember Infrastructure

Climate Change

Climate Change Natural Resources and Conservation

Natural Resources and Conservation Water and Sanitation

Water and SanitationFirm Overview

Ember is an investment firm specializing in sustainable infrastructure. It focuses on reducing carbon emissions, increasing resource efficiency, and enhancing climate resilience. Ember invests across Energy Transition and Decarbonization, Climate Resilience and Adaptation, and Resource Efficiency and Management. The firm integrates impact and ESG considerations into its investment process, contributing to various UN Sustainable Development Goals: SDG 6: Clean Water and Sanitation SDG 7: Affordable and Clean Energy SDG 9: Industry, Innovation, and Infrastructure SDG 11: Sustainable Cities and Communities SDG 12: Responsible Consumption and Production SDG 14: Life Below Water Recognized as a 2023 Top 50 Emerging Impact Manager, Ember actively engages with industry partners to promote responsible investment. It tracks quantitative impact metrics like renewable energy generated and CO2 emissions avoided, ensuring transparency and accountability. Ember collaborates closely with portfolio companies to deliver scalable, sustainable solutions.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: 25% – 49%

Ember addresses a capital gap in scaling sustainable infrastructure companies in the low to mid-market space within energy transition, resource efficiency, and climate resilience sectors, targeting attractive market returns.

Ember sees a significant capital void in the low to mid-market space within energy transition and resource efficiency sectors. While a significant amount of capital has been channeled into utility scale renewables and VC-stage clean technologies, capital to support companies reaching commercial scalability remains limited. Beyond capital, many of the companies in this stage also lack support from investors with the right expertise to scale up infrastructure platforms. Ember is filling the capital and knowledge gap necessary to ensure that companies within the sustainable infrastructure space can capitalize on their growth opportunity and continue fulfilling their decarbonization mission in a meaningful way.

• Exposure to sectors beyond energy transition, including water, waste management and stormwater management. • Investment focus on climate solutions with proven technologies and commercially viable models. • Unique focus on climate resilience, where Ember has been a pioneer. • Targeting private equity returns with infrastructure characteristics. • Investment team has worked together for over 10 years, originating from GIP. • 100% of deals are privately sourced or bilaterally negotiated. • All team members have a stake in the fund, ensuring aligned incentives. • Addressing the capital gap in scaling sustainable infrastructure companies in the low to mid-market space

Investment Example

OnSyte develops and operates distributed wastewater treatment systems that reduce groundwater pollution and provide a simple, modular alternative to traditional septic tanks. Individual septic tanks are a major source of nutrient pollution, contributing to ecosystem damage such as algal blooms, deoxygenation, ecosystem imbalance, and water contamination. In Florida, where 2.7 million septic tanks exist, many systems are outdated and especially harmful to the environment due to the state's high-water table which makes Florida more vulnerable to groundwater contamination, especially in coastal areas. This higher water table can exacerbate problems with outdated septic systems, as poorly treated wastewater can more easily reach groundwater, leading to nutrient pollution. Nutrient pollution from nitrogen and phosphorus threatens U.S. water bodies, with the EPA reporting excess nutrients in 58% of rivers, 40% of lakes, and 23% of Great Lakes shorelines. OnSyte's remote monitoring technology offers a more effective solution, addressing nutrient pollution and protecting ecosystems.

Leadership and Team

|

Elena Savostianova – Founder & Managing Partner More Info

Elena Savostianova is the Founder & Managing Partner of Ember Infrastructure and is Chair of the Investment Committee. Elena has over 20 years of professional experience in the energy and infrastructure sectors. Prior to Ember, Elena served as a Principal with Global Infrastructure Partners CAPS team, focusing on renewable energy opportunities. Before GIP, Elena spent nearly a decade as part of Credit Suisse’s Power and Renewables group where she was responsible for coverage of energy corporates with a focus on renewable energy and infrastructure, as well as financial sponsors active in the energy and infrastructure space. |

|

Peter Milligan – Partner & General Counsel More Info

Peter Milligan is a Partner & General Counsel at Ember Infrastructure and is a member of the Investment Committee. Peter is also responsible for oversight of the firm’s ESG functions. Peter has over 13 years of experience in private equity deal execution. Prior to joining Ember, he was a Senior Associate in Weil, Gotshal & Manges LLP’s Private Equity group in New York where he represented private equity funds in connection with acquisitions, dispositions, minority investments, financings, joint ventures, and restructurings. Before practicing law, Peter worked for the private equity fund Catterton Partners. |

|

Maria Rengifo – Partner & Head of Capital Development More Info

Maria Rengifo is the Head of Capital Development at Ember Infrastructure. Maria leads capital formation across the firm’s fund and co-investment vehicles and is responsible for the firm’s client relationships. Maria Rengifo has over 20 years of experience in the financial sector. Prior to Ember, Maria was a director in the Latin America Investment Banking team at Credit Suisse where she was responsible for client coverage and leading the execution of a wide variety of M&A, IPO, strategic advisory and capital markets financings for corporate and financial sponsors. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

75% – 99%

|

Our investment themes focus on critical solutions necessary for the transition to a low-carbon, resource-efficient, and climate-resilient economy. We strategically target businesses involved in energy transition, distributed generation, energy efficiency, water and wastewater treatment, waste management, and stormwater mitigation, among other sectors.

ESG factors are integrated into the investment strategy and process for this strategy. Our ESG due diligence criteria align with international standards, including the Sustainability Accounting Standards Board (SASB) and IFC Performance Standards to ensure we are capturing material information, important for its implications for both firms’ financial value and firms’ impact on the world at large, particularly regarding climate change and other environmental impacts. Target investment management teams complete ESG questionnaires and participate in Q&A sessions with third-party ESG advisors who assist us in evaluating the ESG profile of each investment, including the company’s ability to comply with Ember’s sustainability and ESG reporting requirements. ESG findings are categorized according to their materiality (high materiality; low materiality; or non-material) and a preliminary action plan is developed for all materiality findings.

Impact Tracking and Monitoring

Learn More

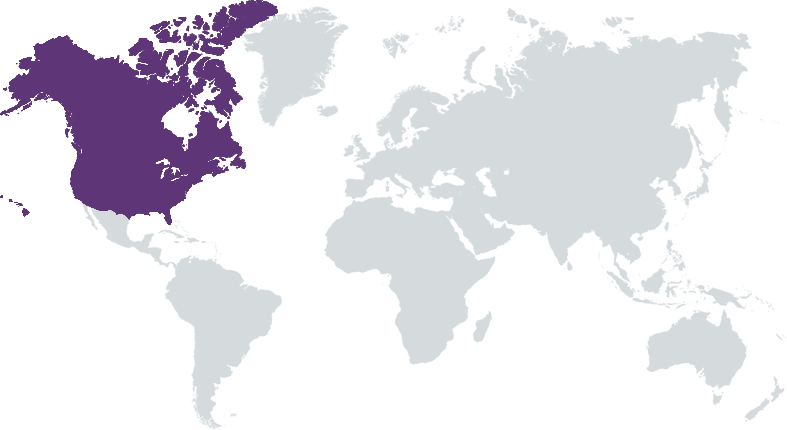

220 5th ave Fl 18, New York, NY 10001 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.