IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Integra Partners

Climate Change

Climate Change Financial and Economic Inclusion

Financial and Economic Inclusion Health and Wellbeing

Health and WellbeingFirm Overview

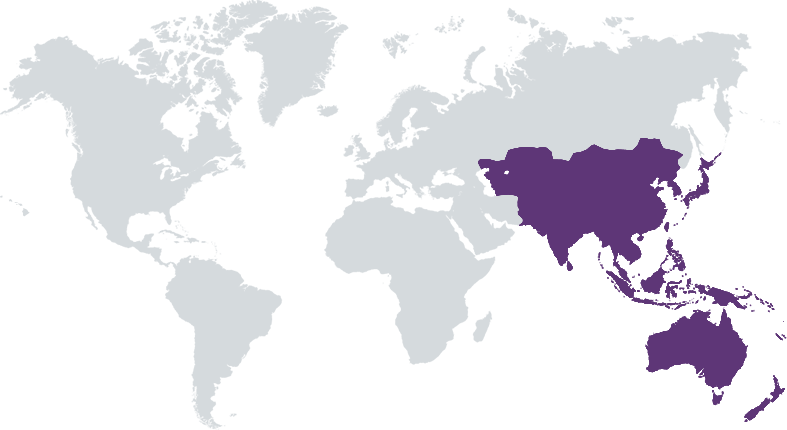

Integra Partners is an early stage venture capital firm based in Singapore that invests from Series Pre-A to B across large themes in Southeast Asia, with a focus on companies working in SME enablement, digital financial inclusion, healthcare access, climate and environment, and agri and food. We look for companies that leverage technology and financial services to unlock greater monetization, creating more profitable and sustainable business models.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: 25% – 49%

Integra Partners invests in early stage companies working in SME enablement, digital financial inclusion, healthcare access, climate and environment, and agri and food, with a focus on companies that leverage technology and financial services to unlock greater monetization, creating more profitable and sustainable business models.

Leveraging the power of technology to embed financial services across a wide range of businesses has been key to both (1) the consumer and SME-level financial inclusion gains that Southeast Asia has seen in the last decade, and (2) the ability for large technology platforms to unlock greater monetization and achieve sustainable unit economics. At the same time, technology still has the power to address problems inherent in the great themes in Southeast Asia, including supporting the SMEs that comprise more than 60% of the region's employment, fostering financial inclusion, improving healthcare access, addressing climate change, and driving more sustainable and more efficient agriculture and food production. Integra is investing in early stage companies working in these five great regional themes, with a focus on companies that leverage technology and financial services to unlock greater monetization, creating more profitable and sustainable business models.

We are active board members or observers, providing advice on strategy, governance, recruitment and connectivity to help the business achieve venture-style scale. We leverage our thematic expertise (particularly in fintech) to help companies identify potential threats and opportunities, react to market shifts, and access our entire ecosystem. We also tend to look for companies that are under-invested because they require domain expertise to understand, spend a significant amount of time with promising companies that may not resonate with the VC market at first glance to validate their potential, and help coach founders in simplifying and articulating their value propositions to attract a wider pool of generalist investors to lower their cost of capital. Our technology partner, Keval, also monitors our companies to ensure that they are setting realistic but ambitious goals for product iteration, helps with tech talent recruitment, and advises them on large projects.

Investment Example

Sprout Solutions is the leading B2B SaaS platform in the Philippines, starting with HR and payroll management. Integra invested $1m in their Series A in 2019 and facilitated their partnership with our earned wage access (EWA) company, Advance.ph, to help bring EWA to the employees on Sprout's platform. Soon after we invested, the Philippines went into lockdown, and Sprout had to find a way to survive as clients downsized their workforces. Since then, Sprout has quadrupled revenues, adapted its product to serve businesses from small businesses to large enterprises, and founded SaaSCon, the biggest B2B SaaS conference in the Philippines to support the country’s growing ecosystem of B2B software startups. With our help, they are now exploring bringing earned wage access and other financial wellness products directly to the employees managed on its platform, fielded buyout offers, and begun regional expansion through strategic M&A.

Leadership and Team

|

Jinesh Patel – Co-Managing Partner More Info

Jinesh is Co-Managing Partner at Integra Partners. He is an investment professional with over 20 years of experience in the Asia Pacific. Prior to becoming the founding partner of Integra Partners, Jinesh managed US$200 million in public equities, structured US$60 million in early-stage private equity deals and contributed to the issuance of more than US$10 billion in public debt and equity transactions. He has also built an extensive network of connections with government agencies, senior executives at some of the largest regional TMT companies as well as various early-stage companies across Asia Pacific and Europe. |

|

Christiaan Kaptein – Co-Managing Partner More Info

I have been fortunate to have been part of the region’s development throughout the last 20 years. After Taipei, Shanghai, and Hong Kong, we have now been in Singapore for the last 9 years, building Integra Partners. |

|

Jennifer Ho – Partner More Info

I grew up between Singapore and the U.S. Two things make me look forward to getting into the office in the morning: meeting founders who are working on audacious solutions to big problems, and learning about new technologies that might one day become part of the fabric of everyday life. In my spare time you'll usually find me on a climbing wall. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

50% – 74%

|

Our Net Impact Framework is fully integrated into our investment process. At the initial stages, the deal team ensures that the company 's mission is aligned with our fund's mandate and that it falls outside our list of investment restrictions. During due diligence, we evaluate and score the company on its ESG risks and impact relevance and additionality using our Net Impact Toolkit, and work with the founder to come up with a concrete net impact action plan to address any shortcomings that the toolkit identifies. Our investment is subject to the founder signing an ESG commitment statement. We also work with the founder to create a reporting dashboard that includes relevant impact metrics that we monitor quarterly. We also re-evaluate our portfolio companies annually using the Net Impact Toolkit and monitor progress against the net impact action plan. Our findings are published once a year in our Impact Report.

As part of due diligence, we review the companies’ existing policies around labour standards, human resources policies, E&S policy and procedures, including policies around non-discrimination and equal opportunities in recruitment, talent development and retrenchment, anti-discrimination and anti-harassment, internal data privacy, human rights, and grievance mechanisms. We also use policy templates to help our portfolio companies upgrade their social and environmental sustainability practices. These policy templates are available publicly on our website.

Impact Tracking and Monitoring

Learn More

15 Beach Road, #02-01, Beach Centre, Singapore 189677

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.