IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Enabling Qapital Ltd.

Diversity, Equity and Inclusion

Diversity, Equity and Inclusion Entrepreneurship and Job Creation

Entrepreneurship and Job Creation Gender Equality

Gender EqualityFirm Overview

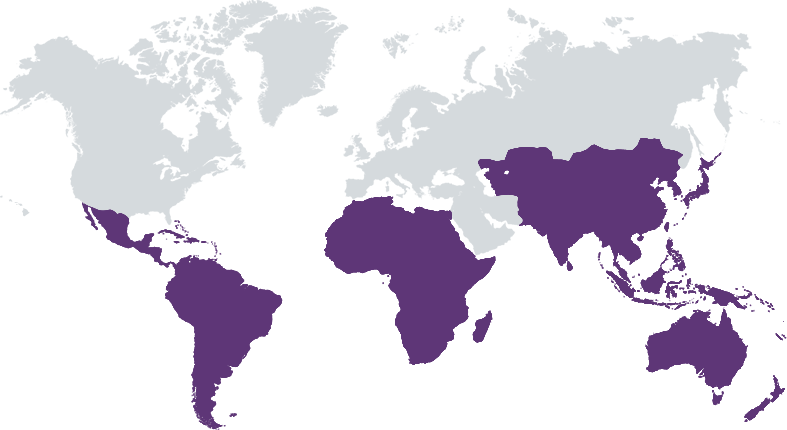

Enabling Qapital Ltd. (EQ) is a FINMA regulated leading Swiss Impact Asset Manager dedicated to a world where investments provide a financial and social return. Following the objective to have a positive economic, social, and environmental impact. EQ currently manages USD 700M in Assets within Microfinance (Private Debt) and Access to Energy / Clean Cooking. EQ has over 65 team members speaking more than 21 languages and representing 14 countries. Enabling Qapital is moving money to meaning.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: Less than 25%

Our investment thesis focuses on fostering financial inclusion and energy access in underserved communities. We seek opportunities that drive positive social and environmental impact while generating sustainable returns, aiming to empower individuals and businesses by bridging financial and energy gaps.

Our investment thesis centers on driving global change by addressing key challenges: financial inclusion and clean energy access. We're dedicated to supporting ventures that offer both financial returns and societal impact. In financial inclusion, we prioritize Microfinance Institutions and initiatives, aiming to empower underserved populations economically, reduce poverty, and enhance financial well-being. Simultaneously, we emphasize sustainable energy access, seeking opportunities in renewable energy projects, off-grid solutions, and clean tech startups. Our goal is reliable energy access for off-grid communities, reduced carbon emissions, and a more sustainable future. Our investment approach blends financial discipline with social and environmental responsibility. We assess investments for their potential positive societal impact, scalability, and financial viability. Through this thesis, we aim to create a world where financial inclusion and clean energy are accessible to all, fostering equity and sustainability.

The EMF Microfinance Fund primarily collaborates with smaller microfinance institutions that maintain a substantial commercial loan portfolio. We do not engage with large, general banks in emerging markets. Our fund strategically hedges 100% of its currency exposure. Furthermore, the EMF Microfinance Fund exclusively focuses on private debt investments and does not venture into equity or bond exposure. Enabling Qapital is independent and majority owned by the Management Team.

Investment Example

Enabling Qapital, through its EMF Microfinance Fund, extended a Senior Unsecured Loan to a female-led microfinance institution (MFI) in Kyrgyzstan. Despite its relatively small size and limited track record, this loan had a transformative impact. It significantly enhanced access to financial services for underserved populations within the region. Moreover, this financial infusion played a pivotal role in bolstering the MFI's credibility. As a result of this loan, the MFI successfully attracted more cost-effective local lending options. Additionally, it garnered interest from foreign lenders keen on collaborating with this institution. The loan not only empowered the MFI to expand its operations but also catalyzed broader financial inclusion efforts, ultimately fostering economic growth and stability in the region. This success story underscores the critical role of impact investing in advancing financial inclusion and empowerment in emerging markets like Kyrgyzstan.

Leadership and Team

|

Chuck Olson – Co-Founder and Managing Partner More Info

Over 29 years’ experience in the financial and impact sectors. Working experience in Africa, Latin America, Eastern Europe, and Asia. Former New York Federal Reserve Bank Examiner specializing in risk management and assessment of large complex financial institutions. Managed BlueOrchard’s investment operation with a 30+ team overseeing USD 1.5bn of Assets (USD 2.6bn disbursed). |

|

Christop Dreher – Co-Founder and Managing Partner More Info

Over 15 years of dedicated experience in finance, operations as well as the impact investing and ESG sector. Involved with the EMF Microfinance Fund since the beginning. Launched and managed a leading ESG reporting solution for institutional investors, before becoming Global Head of ESG with an investment fund data provider, responsible for defining the global strategy as well as execution plans for ESG offerings. Well-versed in managing complex regulatory scenarios and ensuring compliance with financial standards. |

|

Roger Müller – Co-Founder and Managing Partner More Info

Over 16 years of experience in the financial industry and with a focus on Impact Investing during the last 10 years. Business development background for Fund Houses as well as Asset Managers; in his last role at another impact manager, key responsibility to significantly grow the funds under management. Responsible for marketing, PR and investor related activities. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

The investment objective of the Fund is to contribute, directly or indirectly, to the financing of investees/issuers of various types involved in impact investment activities, across emerging and frontier markets globally. Said financial intermediaries may be involved in activities such as micro, small and medium enterprises (MSME) lending directly, or through downscaling programs targeting the productive sector, affordable housing, affordable education, health, agriculture, clean energy, and humanitarian relief activities. An Investee/Issuers may take several legal forms including, but not limited to: • Specialized microfinance banks • Non‐bank financial institutions (“NBFIs”) • Downscaling banks • Non‐governmental organizations (“NGOs”) • Leasing companies • Co‐operatives • Limited liability companies • Affordable education, health, renewable/energy efficiency, and housing providers; and Apex institutions and wholesalers that provide financial services for impact activities Pure consumer finance institutions fall outside of this definition.

EQ has created an Environmental, Social, and Governance (ESG) Rating system to methodically gauge how well each investee integrates and enacts ESG principles within their operations, ensuring alignment with the United Nations' Social Development Goals (SDGs). The EQ ESG Rating employs a three-pillar framework to assess an investee's ESG policies and practices within their products, services, and interactions with clients and stakeholders. It primarily concentrates on ESG performance, using metrics to evaluate principles, actions, outputs, elements, and some outcomes, including any corrective measures implemented by our investees. Our goal is to gauge our investees' performance and, to a limited extent, the impact on the end-client borrowers. This includes assessing the social performance of microfinance institutions (MFIs) regarding their program design, actions, and outcomes, as well as their impact on the livelihoods of end-beneficiaries.

Impact Tracking and Monitoring

Learn More

Mühlebachstrasse 164, 8008 Zurich Switzerland

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.