IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

CO Capital de Impacto

Social SAPI de CV

Climate Change

Climate Change Food Systems and Agriculture

Food Systems and Agriculture Natural Resources and Conservation

Natural Resources and ConservationFirm Overview

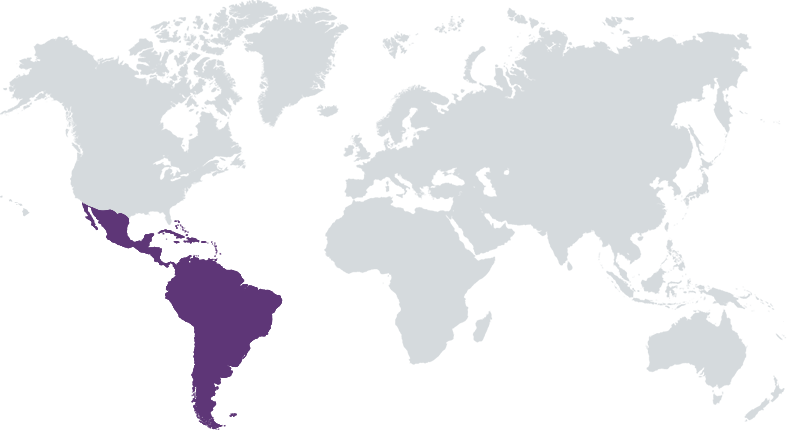

We are a Mexican impact-first fund focused on Latin America working to scale early stage social enterprises working primarily within the regenerative agrifood system at the intersection of poverty, biodiversity loss, climate change, and human health. We grew out of an ecosystem builder named CO_Plataforma, that has been operating since 2012. We are a B-certified corporation, co-founded/co-owned by a woman and co-led by women. We have raised our first fund of USD 13m committed mainly by local investors - part of our Theory of Change is to catalyze local capital for impact.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 25% – 49%

We are a Mexican impact-first fund focused on Latin America, providing equity or long-term flexible credit, working to scale early stage social enterprises working primarily within the regenerative agrifood system at the intersection of poverty, biodiversity loss, climate change, and human health.

Our fund is looking to catalyzes local capital (mainly UHNW women investors and families) and combine it with institutional investors. We then look to invest this capital into social and environmental enterprises within the regenerative agrifood system, across the whole supply chain, investing in productive activities, biological inputs, intermediaries, waste and food loss, agtech, financing, and healthy products for consumers. We primarily invest via long-term flexible funding with a primary focus on self-liquidating instruments (long-term loans or rev share) but have the capacity to do some equity investments. We have a very hands-on strategy and look to be value-adding partners.

1. Team: Multidisciplinary and diverse team with global experience fully aligned with our mission and values 2. Impact thesis: We are one of the few impact funds in the region and the only one that is working so closely with local investors. Our mission, beyond raising capital, is to educate local investors about new methods of deploying capital 3. Position: Given our history as an ecosystem developer, we have access to a broad pipeline, funders, and actors across the space 4. Flexible instruments: We look to deploy self-liquidating instruments that align with the companies needs, don't push them to exit, and don't further dilute management 5. Global access: Thanks to our networks we have access to global experts, co-investors, leaders, and insights positioning us an innovative leader in Latin America

Investment Example

We have done eleven investments to-date, a few examples: - Tienda Pago - provides inventory loans to mom and pop shops, supporting their growth, efficiency in cash management, and ultimately their resilience - Sistema.bio - a global biodigester manufacturer that sells to farmers so they can treat their animal manure converting it into energy - Salud Fácil - offers a medical equipment leasing product to small and medium-sized rural and peri-urban clinics - MINNA - works with artisans in LatAm creating home goods and transfering income to these communities - TAMOA - works with subsistence farmers preserving ancestral crops, such as corn, beans, and chile, and distributes them to restaurants and high end ingredients companies in the US and Europe - DEV.F - an edtech company focused on employability by developing programming skills for vulnerable youth - Carbonwave - a biotech company harvesting sargassum from the Caribbean to reduce methane emissions and converting it into byproducts for the agriculture and cosmetics industries

Leadership and Team

|

Alberto Gómez-Obregón – Managing Partner More Info

Alberto is a Managing Partner at CO_Capital. In his role, he leads the execution of the vision and strategy and manages the organization across all business, fundraising, investment, impact, and portfolio management activities. He has been a co-founder, investor, mentor, and Board member to different enterprises and funds. Prior to CO_Capital, Alberto was the Deputy CIO and Director of Portfolio for Acumen, where he managed Acumen’s global investment platform. While at Acumen he sat on several Investment Committees through which he worked closely with regional teams. |

|

Tania Rodriguez Riestra – CO-founder and Managing Partner More Info

Tania is the CEO and co_founder of CO_, driving the strategy and growth for the three verticals of the organization that together aim to mobilize non financial and financial capital toward reducing inequality and climate change in Latin America. |

|

Manuel Vega – Managing Partner More Info

|

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

We do not invest in organizations that are not looking to solve social or environmental issues through their business. Our impact assessment is fully embedded into our investment process - for us both go hand in hand. In our initial screening we meet the founders, understand their values and alignment to mission/model. If as a team, we want to advance, we connect with our Impact Director (also IC member with more than 20 years of experience in the social space). We work with her to clarify/confirm the Theory of Change and its linkage to the business. If the deal gets green light by the IC, we move into deep DD and work with her plus a hired sector-expert to go deeper, do site visits, and develop outcome-based metrics for the company. Finally, if the transaction is approved, we include provisions in legal docs designed to keep mission alignment.

Beyond the impact analysis outlined above, which primarily focuses on the organization's business model and objectives, we care also care about our companies' internal practices. Our GP is a certified B corp and we believe this methodology goes beyond simple ESG practices, therefore, in the final stages of our due diligence, we ask potential investees to answer the B Impact Assessment and obtain a grade. We do not force them to certify as B corps, but we have heard in several occasions that once having done the assessment, many of them would be interested in certifying, as in many cases it was already in their plans.

Impact Tracking and Monitoring

Learn More

Monte Pelvoux 110, Lomas de Chapultepec, 11000, Mexico

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.