IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Cross-Border Impact Ventures

Climate Change

Climate Change Gender Equality

Gender Equality Health and Wellbeing

Health and WellbeingFirm Overview

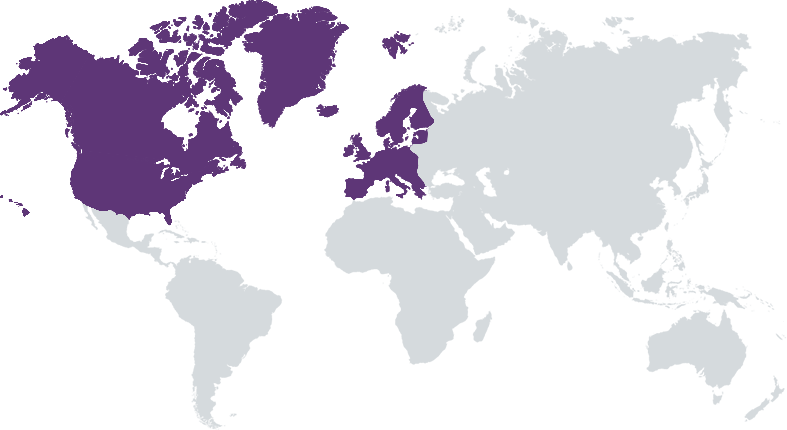

Cross-Border Impact Ventures is an impact venture capital firm on a mission to revolutionize venture investing in health technology. We invest in world class, early-growth stage health technology companies commercializing medical devices, diagnostics, therapeutics, and digital health innovations that benefit women, children and adolescents. We target venture returns for our investors and empower our portfolio companies to reach beyond their primary markets in the United States and Europe to reach more vulnerable populations in emerging markets. We work collaboratively with the CEOs of our portfolio companies and our networks to enable commercial success, promote gender equality and health equity, and deliver measurable impact with creative approaches tailored to local contexts. We are driven by our belief that good health should not be restricted by gender, age, race, wealth, or borders and seek to expand access to our portfolio’s world class technologies inclusively and globally.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: 25% – 49%

Cross Border Impact Ventures' Women's and Children's Health Technology Fund invests in transformative health technology companies with the potential of meeting the needs of women, children and adolescents across global markets.

The Fund invests in early growth stage health technology companies commercializing medical devices, diagnostics, therapeutics or software solutions that address women's, children's and adolescents' unmet needs to address health outcome inequalities related to gender, race, income level, and country of origin. Most prospective portfolio investments will be based in the U.S. and Europe, where strong investment performance can be achieved more predictably. All companies are vetted by our impact committee and also selected because of their potential to generate meaningful impact in emerging markets via partnerships with local teams. We work closely with our global network of aligned funders to secure the non-dilutive capital needed for the most impactful work of the portfolio.

The Fund's investment strategy is unique in the market, which positions us well for co-investment purposes. Our investees, CEOs of prospective companies and early-stage investors confirm that we bring a unique value proposition that they view as desirable to push the bar for global growth. Our focused approach and network often makes us the most knowledgeable voice at the board table and on the cap table. Investees see opportunity in our unique investment strategy and access to our broad network of experts in health and non-dilutive funders who can support these strategies. They value our decades of expertise in venture capital, private equity and lending, combined with the decades of operating and scientific experience of our 25+ advisors specialized in our areas of interest.

Investment Example

Sonio is an AI-enabled software company that aims to empower Fetal Ultrasound Practitioners with a suite of SaaS products. The company has created a SaaS product (CE Mark) that acts as a clinical decision support tool during ultrasound and uses AI to identify pregnancy complications, fetal anomalies and diagnose common and rare syndromes in real-time. The company has also developed a point-of-care hand-held ultrasound with AI technology that will guide the user to take better quality images and flag potential pregnancy complications and fetal birth defects in real-time. In emerging markets where maternal mortality rates are high, many sonographers are undertrained and information sharing within and across parts of the health system is sorely lacking. The company's technology has potential to improve access to quality ultrasounds and lead to early diagnosis and intervention. Sonio was recently acquired by Samsung, and CBIV continues to work with Sonio to achieve impact post-exit.

Leadership and Team

|

Annie Theriault, Ph.D., CFA, ICD.D – Managing Partner More Info

Annie Thériault, Managing Partner at CBIV, has been immersed in venture capital, impact investing, royalty financing, and managing capital markets strategies throughout her career. Annie is a thought leader in the field of inclusive health technology investing with a gender and impact lens. As a lead investor, Annie serves on the board of directors of several North American and European venture-backed companies. She is also often an advisor or speaker at health technology and global health conferences and, prior to the launch of CBIV, was Chief Investment Officer at Grand Challenges Canada following a successful career in traditional investment management. |

|

Donna Parr, MBA, MA, ICD.D – Managing Partner More Info

Donna Parr, Managing Partner at CBIV, has more than 30 years of experience managing venture capital, growth equity, and private debt portfolios of up to $1 billion. She has been a manager of two biotech-related funds (GrowthWorks Canadian Fund and Canadian Medical Discoveries Fund) and has held roles at several pension funds including OMERS and CPP. She is currently on the boards of Constellation Software and Topicus.com. Donna holds a Master’s degree in International Relations from the University of Toronto and earned her MBA from the Schulich School of Business. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

The Fund invests in an underserved investment sector. Women's health receives only 1% of venture capital investment, while children's health receives such low interest that it is not measured as a sector. Across most health conditions, there are inequalities in outcomes related to age, gender, race and income as well as between developed and emerging markets that are worsening with climate change. We evaluate the inequalities that exist relative to the condition targeted by the technology at the outset of the investment. We evaluate the technology's potential to impact these inequalities and produce an impact forecast. We also require tailored impact commitments with an implementation plan and penalties for missing the target. We perform a detailed gender evaluation that drives the improvements we recommend and support during the holding period.

Our firm uses best practices in evaluating all of our investees' ESG performance, including positive and negative impacts and potential ESG risks using the IFC Framework. In addition, our fund complies with SFDR Article 9 regulations in Europe as a regulated fund and reports on ESG metrics quarterly. The firm continues to comply with the UN's Principles of Responsible Investing and IFC's Operating Principles for Impact Management and participates in leading initiatives to drive the adoption of ESG and other impact-related principles for the VC industry.

Impact Tracking and Monitoring

Learn More

MaRS Centre, West Tower, 661 University Avenue, Suite 1720, Toronto, ON M5G 1M1

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.