IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Avesta Fund

Climate Change

Climate Change Decarbonization and Carbon Drawdown

Decarbonization and Carbon Drawdown Financial and Economic Inclusion

Financial and Economic InclusionFirm Overview

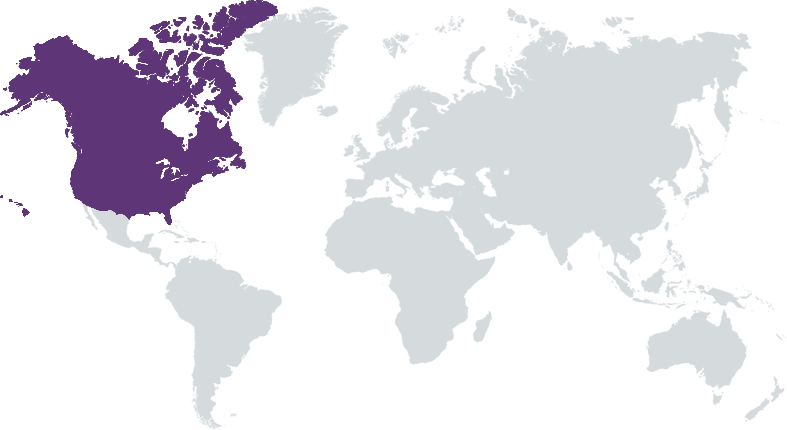

Avesta Fund is a seed-stage fund that invests in companies driving decarbonization and economic inclusion for a more sustainable and prosperous future. We invest in tech-enabled companies in North America whose positive impact is aligned with their business and prioritize diverse founding teams. We help our startups bridge the tech, venture and impact investing worlds - to attract like-minded investors, colleagues and customers as they drive toward impact and commercial success.

Years of Operation: 3 – 4 years

% of Capital from Top 3 Investors: 25% – 49%

Avesta Fund invests in tech-enabled startups driving decarbonization or economic opportunity, while prioritizing diverse founders; Avesta’s unique seed-at-scale impact investing model is poised to deliver top venture returns and measurable impact.

Avesta Fund aims to harness technology and capitalism to build a more just and sustainable world. Avesta invests in pre-seed and seed stage companies that boost economic opportunity and/or climate action. Areas of focus include: 1) Climate: Energy Efficiency, Clean Energy, Circular Economy, Green Buildings, Digital Solutions, Climate Adaptation & Resilience, Sustainable Agriculture 2) Opportunity: Education, Financial Inclusion, Future of Work,Housing, Entrepreneurship Development The founders who best understand the problems in these industries are often those who come from underserved backgrounds because inequality and climate change disproportionately impact their communities the most. As such, Avesta prioritizes diverse entrepreneurs who deeply care about the impact their solutions will have.

Avesta differentiates ourselves from other seed stage funds in the following ways: 1) What we invest in. We only invest in startups whose products have the potential to enable climate action and/or economic opportunity in a scalable way. 2) Who we invest in. We only invest in purpose-driven founders who seek both commercial and impact success. We prioritize diverse founders whose lived experience enables unique market insights. 3) How we invest. We engage with startups early to help them align their impact with their business model and bake an impact-driven culture into their DNA from day one – so their impact alignment drives superior returns. We help them attract like-minded Series A capital to help maintain investor support for delivering measurable impact. Additionally, we bridge them to Corporate VCs to explore pilot opportunities, JDAs, and strategic investments.

Investment Example

BoxPower (Avesta-Funded Company) BoxPower provides a seamless end-to-end solution for rural microgrid projects that can be installed in a day. Over one billion people still lack access to electricity, in the US, 1 in 7 Native American households lack access to electricity; Puerto Rico’s electricity was not fully restored until 11 months after Hurricane Maria; and large parts of rural California still don’t have reliable electricity after the recent wildfires. Projections show that by 2030, roughly 674 million people will remain without energy access. Moreover, climate change magnifies the need to create resilient electric grids to prepare for and respond to natural disasters that will continue growing, with outsized negative impacts on vulnerable and underserved communities. BoxPower offers a unique containerized, solar-based microgrid which provides clean, reliable and affordable energy to rural areas as a low-cost alternative to polluting diesel generators.

Leadership and Team

|

Srikant Vasan – Managing Partner and Investment Committee Member More Info

Srikant’s background straddles entrepreneurship, venture capital, philanthropy, social enterprise, and corporate investing. Prior to launching Avesta Fund, Srikant was a Partner on Techstars’ investment team, where he was responsible for impact investments across the global Techstars network of 45 accelerators. Srikant has co-founded, led, and sold two VC-backed technology companies in highly competitive markets: KBkids/eToys (acquired by Big Lots) and StorePerform (acquired by RedPrairie, now JDA). |

|

Stuart Davidson – Venture Partner and Investment Committee Member More Info

Stuart Davidson is founding partner and investment committee member at Avesta Fund, where he helps invest in companies that have the potential for both measurable impact and strong investment returns. Earlier, Stuart was a managing partner of Labrador Ventures, an early stage technology-focused venture capital fund, which he joined in 1995. He has been a partner in four Labrador funds and invested in over a hundred early stage companies and served on numerous boards. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Avesta Fund only invests in companies where impact is directly tied to the business model. We screen each company for positive social and/or environmental impact. If a company does not meet this criteria they do not advance in the screening process. During due diligence we rate each company for impact via a set of questions influenced by the Five Dimensions of Impact framework.

During the due diligence process we score each company on their leadership team and employee diversity.

Impact Tracking and Monitoring

Learn More

Denver, CO

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.