IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

RSF Social Finance

Climate Change

Climate Change Education

Education Food Systems and Agriculture

Food Systems and AgricultureFirm Overview

RSF Social Finance's mission is to change finance and finance change. By offering investment notes, donor advised funds, and flexible, customized loan capital, RSF mobilizes money toward positive impact. Since 1984, RSF has innovated finance tools and invested in healthier food systems, thriving arts communities, whole-child education, cleaner climates, racial justice, and more.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

We partner with impact minded investors and provide values aligned capital for mission-first organizations that make the world a more just, regenerative, healthy, and compassionate place.

We provide senior secured debt to social enterprises in diverse sectors in which we have expertise, including climate, gender and racial equity, food and agriculture. We focus on supporting organizations and entrepreneurs of underserved communities that sometimes have limited access to affordable capital. We bring a highly relational, bespoke, consultative lending approach that mitigates risk while helping borrowers succeed. We do this through the coordinated use of different forms of financial capital and non-financial resources to support an enterprise that's working to solve complex social and environmental problems. Our Catalytic Impact Pool empowers RSF to provide credit enhancements to borrowers and make loans that otherwise wouldn't be possible. By maintaining strong relationships with borrowers through economic uncertainty, leveraging technology to improve the borrower experience, and building new diverse strategic relationships and industry expertise, we are able to expand our portfolio and grow impact through various industries.

On the lending side, our focus on supporting organizations and entrepreneurs of underserved communities that often have limited access to the affordable and patient capital that we provide, differentiates us. RSF's highly relational, bespoke, consultative approach that both mitigates risk and helps borrowers succeed is another key differentiator. On the investor side, our relational, high-touch approach differentiates RSF from our peer group. Whether through community pricing gatherings that bring investors and borrowers together for transparent pricing discussions, or engaging our investors in deeper conversations about money and meaning in their lives, our individualized, human-centered approach, makes RSF entirely unique.

Investment Example

Example: Mad Capital Mission: Provide financing for farmers looking to transition from traditional to organic & regenerative agriculture. RSF contribution: $12M in credit facilities to support Mad Capital’s financing for farmers. Why we invested: The affordable and accessible financing that Mad Capital supplies helps farmers invest in sustainable and regenerative agriculture that’s more profitable and better for the planet.

Leadership and Team

|

Michael Jones – Vice President of Lending Business Development More Info

As RSF’s Vice President of Lending Business Development, Michael Jones manages RSF’s business development, oversees the relationship management team, and works with strategic lending partners. He is a graduate of Morehouse College in Atlanta and attended graduate school at NYU. Michael began his banking career in New York with Wells Fargo in a real estate structured finance group and later with the corporate banking group. He then shifted to Wells Fargo’s middle market banking group in Oakland. After Wells Fargo, Michael worked at Mechanic’s Bank where he was able to support local organizations and non-profits. |

|

Jasper van Brakel – Chief Executive Officer More Info

As president and CEO of RSF Social Finance, Jasper van Brakel sees firsthand the energy that mission-aligned, catalytic capital sparks. He guides RSF in revolutionizing how people relate to and work with money, leading a talented team that develops innovative giving, investing, and lending programs to address the significant social, environmental, and economic challenges of our time. Prior to joining RSF in March 2018, van Brakel was a partner at Newpark Capital, a private equity firm for impact-driven companies. |

|

Kathleen Paylor – Vice President of Impact Investing & Philanthropy More Info

As Vice President of Investor Relations, Kathleen plays a pivotal role in enhancing the visibility of the Social Investment Fund and expanding the catalytic impact of the RSF community. Kathleen’s prior experience includes founding and leading the philanthropic advising firm Rise Philanthropy; growing philanthropic investments in FoodCorps; serving as chief strategy officer for COMMON, a creative accelerator and community for entrepreneurs building socially responsible brands and companies; building a major gift and impact investing program for Root Capital; and founding and leading Conscious Capital. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

75% – 99%

|

We consider and track MANY social/environmental practices of companies, included but not limited to: Who benefits from firm's work How employees benefit from firm's financial success Purchasing, procurement, and/or supply chain practices Social, ecological, and/or economic values that guide firm's decision-making How power is distributed or shared How firm defines equity and how is it incorporated both internally and externally into work How firm measures your impact If firm serves BIPOC individuals and if so, number. If firm serves low-income individuals and if so, number. Salary ratio (as a percentage of highest to lowest salary) Number of BIPOC people on board, staff, and leadership team Number of people from low-income communities on board, staff, and leadership team Number of women, transgender, or non-binary people people on board, staff, and leadership team

See above

Impact Tracking and Monitoring

Learn More

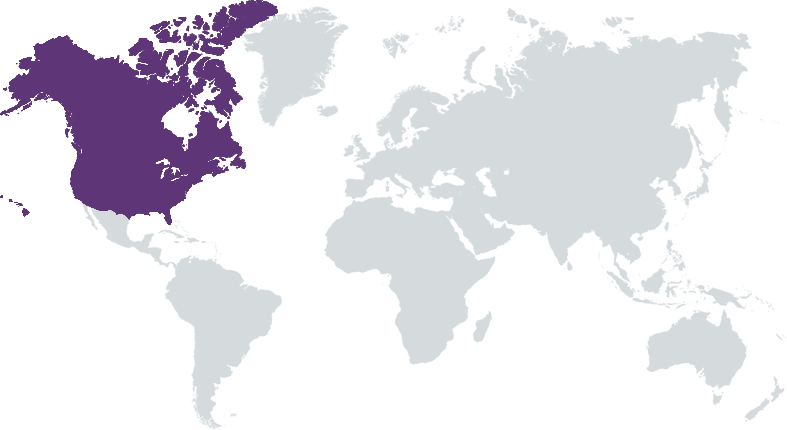

PO Box 2007, San Francisco, CA 94126 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.