IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Root Capital

Climate Change

Climate Change Gender Equality

Gender Equality Natural Resources and Conservation

Natural Resources and ConservationFirm Overview

Root Capital is a nonprofit with a mission to serve agricultural businesses that connect smallholder farmers to world markets. Our approach includes lending capital, delivering financial and other client relevant trainings, and strengthening market connections for small and growing agricultural businesses. Over the past two decades, Root Capital has cumulatively loaned more than $2 billion to over 843 businesses reaching more than 2.3 million farms and employees and provided training to over 2,000 businesses. In addition, almost 90% of our lending would not have been made by commercial lenders.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

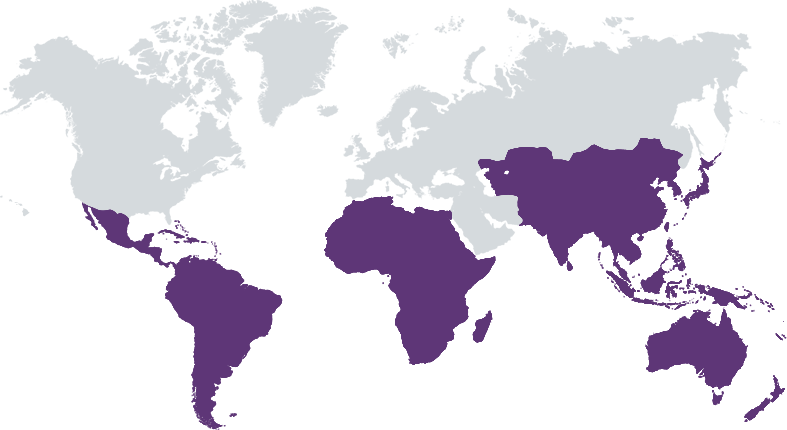

Root Capital invests in the growth of agricultural enterprises in rural, environmentally vulnerable places in Africa, Latin America and Indonesia, so that the businesses become engines of impact that transform their communities by increasing incomes, creating jobs, preserving ecosystems, empowering women and giving young people the opportunity to lead.

Root Capital invests in the growth of agricultural enterprises so that they can transform rural communities. These businesses purchase crops such as coffee, cocoa or grains from smallholder farmers. With growth, they become engines of impact that can raise incomes, create jobs,, empower women and young people, sustain peace and preserve vulnerable ecosystems. We provide loans, deliver training and strengthen market connections for small and growing agricultural businesses. We place capital where it's needed most: in the businesses that have the hardest time accessing the resources they need to grow, but have the greatest potential for impact. We've learned to lend wisely, without losing focus on where we can have the greatest effect. We blend philanthropic and borrowed capital in order to supply these businesses with critical resources: access to credit, trade and technical partners and essential training in business skills and conservation practices.

At the highest level, Root Capital seeks to lead in shaping the market for smallholder finance such that it fully integrates social and environmental impact alongside financial risk and return. This builds upon our field building and sector leadership in recent years: namely we co-founded the recognized leader of the Council on Smallholder Agricultural Finance, an alliance of 12+ financial institutions that lend to agricultural businesses in emerging markets. As a direct service provider, we have one of the longest track records in this peer group with over 25 years. We seek to reach high-impact agricultural businesses that are the hardest to serve. We also provide them with what they need to grow which is the combination of financing augmented with advisory services that strengthen and support those businesses to a point of resilience.

Investment Example

Cooperativa de Servicios Múltiples Flor de Café R.L. (Flor de Café) is a coffee cooperative in Nicaragua. Flor de Café is committed to producing sustainable, high-quality coffee as well as supporting its more than 900 members with technical coffee production assistance and training. Our partnership began in 2013 with a $455,000 loan. Since then, we have loaned nearly $7.6 million and provided them with agronomic, climate resilience, digital business, and business management advisory services. Due to the tropical climate in Nicaragua, the post-harvest period has brought challenges particularly when drying their coffee under wet conditions. Root Capital’s suggested covered solar dryers. We provided a grant to cover the initial funds to purchase and construct six covered coffee dryers. The dryers have helped ensure a better coffee process for the farmers, with the end result being cleaner, better-quality coffee, greater coffee yields, and higher incomes for the cooperative and its members.

Leadership and Team

|

Willy Foote – CEO More Info

Willy Foote is founder and CEO of Root Capital, a nonprofit impact investor that offers farmers around the world a path to prosperity by investing in the agricultural businesses that serve as engines of impact in their communities. Root Capital provides these businesses with the capital, training, and access to markets they need in order to grow, thrive, and create opportunities for thousands of farmers at a time. Since its founding in 1999, Root Capital has provided more than $1 billion in loans to 630 agricultural businesses in Africa, Asia, and Latin America. Together, these businesses have generated more than $6 billion in revenue, 80 percent of which has been paid directly to the 1.2 million smallholder farmers whose crops they collect and market. |

|

Alexandra Tuinstra – Chief Strategy Officer More Info

Alexandra Tuinstra first joined Root Capital in 2014 and currently serves as Chief Strategy Officer. Throughout her tenure, Alexandra has served in numerous roles, including as the Manager of Advisory Services for Mesoamerica, Vice President for Advisory Services & Impact, and Chief Programs Officer. Since becoming Chief Strategy Officer in January of 2023, she has led the dynamic Strategy Department, which ensures that Root Capital’s strategic priorities are designed to effect systemic change. This team shepherds organizational strategy across all stages of its lifecycle, leads the design of innovative services, and builds the evidence base that enables our leadership as field-builders and systems entrepreneurs. |

|

Bryan Woliner – Chief Financial Officer More Info

Bryan has worked at Root Capital since 2010 and currently serves as Chief Financial Officer, where he oversees Root Capital’s finance functions, including accounting, financial planning & analysis, treasury, and investor relations. He also leads Root Capital’s global information technology operations, ensuring Root Capital’s global staff have the right systems and tools to efficiently and effectively execute on Root Capital’s mission. Bryan came to Root Capital with a decade of experience in finance and IT roles across multiple sectors, including managing a team of analysts at the global governance advisory firm Glass Lewis. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

We asses the businesses we lend to on their financial viability as well as social environmental impact. We target early-stage businesses who often are unable to secure financing from other commercial lenders due to their small size, lack of collateral, limited managerial experience and perceived risk. Our clients generally operate in areas in which individuals live below $4 per day or even $2.50 in Africa. We seek to serve businesses that will improve livelihoods of individuals in the following ways: - Paying higher prices relative to the local market, - Giving farmers access to agronomic assistance and inputs and credit to invest in their farms - Supporting community initiatives in education, health and infrastructure -supporting Women led/owned businesses through our Women in Agriculture Initiative (WAI)- supporting businesses as they navigate through the impact of climate through our Climate Resilience Initiative.

We seek to invest in small and growing agricultural businesses that value environmental stewardship and build sustainable livelihoods in local communities. As part of the credit evaluation process for each business, Root Capital's loan officers use our proprietary social and environmental scorecards in order to evaluate the business's social and environmental practices and impact. These tools include metrics developed by the Impact Reporting and Investment Standards (IRIS), a subset of which we report in our Quarterly Performance Reports and online Performance Dashboard. As part of our underwriting process, we are conducting an in-depth analysis of the context in which the business is operating from poverty levels to climate change hotspots as well as the social and environmental practices that the business conducts.

Impact Tracking and Monitoring

Learn More

245 Main Street, 2nd Floor, Cambridge, MA 02142 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.