IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Patamar Capital, LLC

Financial and Economic Inclusion

Financial and Economic Inclusion Health and Wellbeing

Health and Wellbeing Media, Technology and Mobile

Media, Technology and MobileFirm Overview

With over a decade of experience, Patamar Capital is one of the first impact venture capital funds in Asia with a primary focus on venture capital and debt products across its key investment themes. Patamar has since built teams across its key markets and driven its thesis of impact investing across multiple funds. The company has launched three equity funds, two gender lens funds, and a venture debt fund, investing in over 50 companies and impacting over 15 million lives to date. As an early investor, Patamar seeks to help these companies scale their operations and impact, achieve commercial success, and generate long-term capital appreciation for investors. Patamar’s commitment lies in providing top-tier financial returns to its investors and fostering equality through positive social impact to the emerging middle class while aligning with environmental and climate considerations, creating a sustainable and just future for generations to come.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

Patamar Capital makes venture capital investments in early stage tech companies, serving the emerging middle class in our targeted geographies.

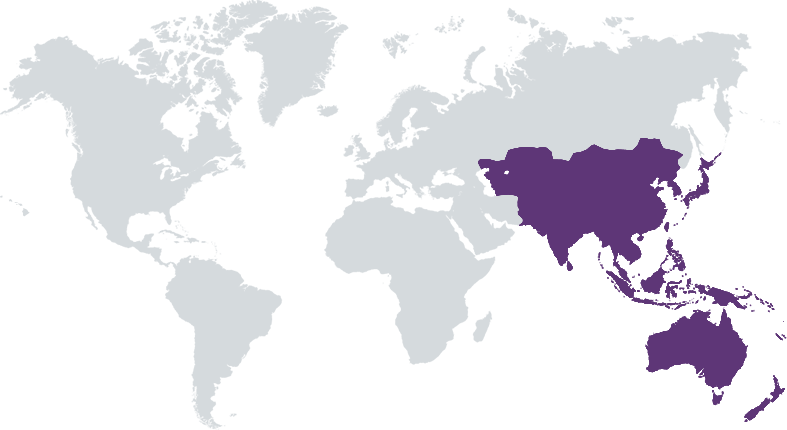

Patamar is focused on investing in early-stage tech companies in our target geographies (predominantly in Asia) across the firm’s investment themes of financial inclusion, SME digitization, agriculture, education, healthcare, climate action, and employment. The firm's investment objective is to achieve the twin goals of top-tier financial returns for its investors and measurable net positive social impact for the emerging middle class. The funds focus on two beneficiaries (a) early-stage businesses serving the mass market consumers, and (b) small and medium enterprises (SMEs) that drive the majority of economic activity in their specific markets. Whilst focusing on driving inclusive growth to reduce inequality, the firm is continuously refining its investment process to incorporate climate considerations. Patamar aims to build a more inclusive, sustainable, and prosperous future for the emerging middle class in Asia and beyond.

The management team believes that its unique investment thesis and expertise will not only allow the funds to land proprietary investment opportunities but also prove uniquely attractive to companies as they weigh investments from competing investors. Over a decade of investing in Asia’s low-income populations provides the fund with a “market intelligence” premium. Companies misperceived as too risky for mainstream investors achieved successful exits following Patamar Capital’s investment and support through the Series A and Series B rounds of financing. As regional and global industry leaders continue to invest in or acquire companies focused on low-income customers and producers, the funds' investment experience and expertise become more valuable to investors and portfolio companies alike. Further, the investment team is located across five countries, embedding itself in the start-up and venture ecosystems in the region, building relationships with local investors, accelerators, incubators, and members of the broader business community.

Investment Example

A Patamar Fund II investment (2021) Vigo, a B2B FMCG distribution platform designed to democratize brand access to mom-and-pop shops across Tier 2 and 3 cities in Vietnam and India. Southeast Asia spends USD 200 billion on groceries every year, two-thirds of which is spent at mom-and-pop shops. In India, mom-and-pop shops account for 75-78% of the consumer goods market. However, these informal retailers do not have predictable access to high-quality FMCG products and lack bargaining power when negotiating pricing with brands and their distributors. Vigo was created to help small retailers gain better access to a wider range of FMCG products at competitive prices by aggregating their purchasing power and connecting them with low-income brand agents who work as distributors, and wholesalers. Thus, consequently impacting the livelihood of approximately 50,000 mom-and-pop shop owners and its network of over 1,000 agents. The latter, whose monthly income has increased by 20-30%.

Leadership and Team

|

Geoffrey "Chester" Woolley – Founding Partner More Info

Geoff has been active in venture capital investing for over 30 years, managing more than $2 billion in investment capital as the founder of successful venture funds in the United States, Europe, and Asia. As Founding Partner of Dominion Ventures and European Venture Partners (now called Kreos Capital), Geoff pioneered the concept of venture debt. Over his career, Geoff has invested debt and equity in over 400 companies, including Ciena, Coinstar, Hotmail, and Human Genome Science. |

|

Lee FitzGerald – Founding Partner More Info

Lee is a Co-Founder and Partner of Patamar Capital. Lee brings to the venture capital community three decades of leadership and operational experience in various commercial sectors. His professional career began as a practicing attorney assisting institutional investors in private placement finance transactions. Later Lee joined San Francisco-based Venture Out Holdings as President and CEO where he focused its private investment portfolio on operating companies in the recreation vehicle, hospitality, reprographics and real estate development sectors. |

|

Shuyin Tang – Partner More Info

Based in Vietnam, Shuyin focuses on investment opportunities in Southeast Asia. Prior to joining Patamar Capital, Shuyin was an Investment Manager for Southeast Asia at LGT Venture Philanthropy (LGT VP), a global impact investor which invests in strongly growing organizations with effective solutions to social and/or environmental challenges. She led LGT VP’s investment activities in the Mekong region and was also Head of LGT VP’s Accelerator Program across Asia, a program which offers hands on business consulting and customized financial support to outstanding, early-stage social ventures. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Patamar Capital is focused on investing in financial inclusion, supply chain & distribution, agriculture, healthcare, education, and other companies that contain real, measurable social impact as a main driver of the companies’ overall success and scalability. The low-income earners, i.e. the emerging middle class is adopting technology at an unprecedented pace due to decreasing cost in smartphones and mobile internet access. Therefore, we intentionally target impact driven tech entrepreneurs harnessing the economic powers of the emerging middle class, consumers, suppliers and SMEs who are committed to driving productivity and inclusive economic growth to the hundreds of millions of lives across the region.

Patamar Capital’s due diligence process systematically assesses how well social/environmental sustainability practices are embedded in our investees’ business models. At pre-investment, the deal team fills in an Investment Memorandum (IM). There is a section dedicated to detailing out how the deal aligns to Patamar’s impact goals as a part of the IM. A sub part of this section requires the deal team to identify any form of negative outcome (social or environmental) that currently exists or could arise in the future based on the information they have in hand. Simultaneously to the deal team filling in the IM, the Impact Assessment Committee (IAC) also evaluates the impact of the company independently and provides their recommendation to the Investment Committee. The IAC takes all impact risks into account when making their recommendation and the plan proposed (if given) by the company on how the risk can be mitigated going forward.

Impact Tracking and Monitoring

Learn More

21 Merchant Road, Floor 02, Unit 01, Singapore 058267, Republic of Singapore

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.