IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

responsAbility Investments AG

Climate Change

Climate Change Financial and Economic Inclusion

Financial and Economic Inclusion Food Systems and Agriculture

Food Systems and AgricultureFirm Overview

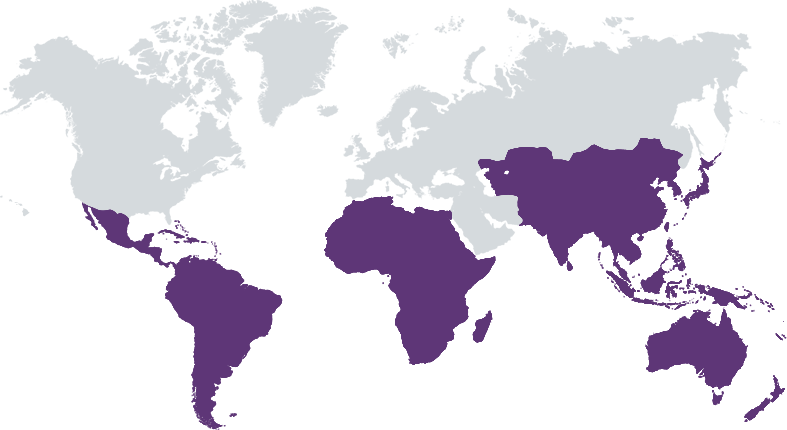

As a pioneer in impact investing since 2003, responsAbility stands at the forefront of managing private market investments focused on three pivotal themes: Financial Inclusion, Climate Finance, and Sustainable Food. Aligned with the United Nations Sustainable Development Goals (SDGs), these areas aim to finance the growth of Micro & SMEs, contribute to a net-zero pathway, and sustainably feed an ever-growing global population. To date, responsAbility has mobilized over USD 15.7 bn in impact investments and manages around USD 5.1 bn in assets across approximately 328 portfolio companies in around 70 countries. As part of M&G plc since 2022, responsAbility has contributed to enhancing capabilities in impact investing, thereby creating specific, measurable impacts alongside competitive market returns. Headquartered in Zurich, with a global presence in cities like Bangkok, Lima, Mumbai, Nairobi, Paris, Tbilisi, and Singapore, our team of over 274 dedicated employees collaborates across continents to drive sustainable change and development.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

responsAbility’s goal is to create development impact while also unlocking attractive new markets for private, institutional and public investors. Our investment solutions supply debt and equity financing to non-listed companies in emerging and developing economies, in the areas of financial inclusion, sustainable food and climate finance.

responsAbility’s investment focus is on development-related sectors of emerging economies, which comprise the areas of financial inclusion, sustainable food and climate finance. responsAbility makes investments – in the form of private debt or private equity – in companies with significant growth potential whose business models can overcome one or more of the following obstacles in an innovative manner: a lack of availability, affordability and/or a lack of suitability of core products and services. The companies must also be capable of efficiently expanding their activities in order to reach an increasing number of people (ability to scale). responsAbility considers responsible conduct towards clients as well as the environment, employees and other stakeholders to be an inherent part of a sustainable business approach that focuses on the achievement of long-term success.

At responsAbility, we stand as a partner for investors seeking long-term returns through access to significant growth markets and themes. We Are On Point: Our foundational expertise lies in making investments that alter the course of today's most pressing issues, from battling climate change to promoting financial inclusion and encouraging sustainable food production. This focus underscores our commitment and capability in driving meaningful, measurable change. Leading Sourcing Capacity: - Annually, we source and originate USD 1 – 1.5 bn investments around the globe. This substantial volume underscores our exceptional deal-sourcing capacity. Our extensive experience enables us to skilfully navigate challenges and constraints that may arise. - A robust local presence is vital to our strategy. We maintain sourcing teams in an unparalleled range of countries, ensuring deep market penetration and a thorough understanding of local dynamics. Furthermore, our in-house expertise spans various investment themes, providing a comprehensive approach to sustainable investment.

Investment Example

Kaebauk Investimentu No Finansas (KIF) is the largest microfinance institution in Timor-Leste, established in 2001 to support post-conflict recovery and economic growth. Aligned with the United Nations Sustainable Development Goals (SDGs), KIF focuses on empowering women and underserved rural communities. Over 58% of its clients are women, and 80% reside in remote areas. Originally created to support communities after political conflict, KIF now offers financial services across all 13 districts, emphasizing economic resilience and inclusive growth. A prominent success story is Mrs. Teresinha de Araujo, who rebuilt and expanded her business after receiving a small KIF loan in 2006, venturing into public transportation, truck rentals, and hospitality, all while securing education for her children. With a loan portfolio of over USD 28 million and around 18,464 clients, KIF plays a vital role in reducing poverty, fostering economic development, and creating sustainable growth opportunities throughout Timor-Leste.

Leadership and Team

|

Rochus Mommartz – Chief Executive Officer More Info

• CEO of responsAbility since 2016. • Over 30 years of experience in financial sector development, banking and emerging market private debt and equity investments. • Member of supervisory boards of financial institutions and funds for 15 years. • Established two private equity permanent capital structures for responsAbility. • Designed legal framework for the microfinance sector in 8 countries and worked as consultant to governments and regulators in over 40 emerging markets. • Studied Economics and Mathematics. |

|

Martin Heimes – Head of Private Debt, Member of EM More Info

• Since 2005 active in development investments (since 2009 at responsAbility), fund management and consulting on microfinance and small business lending. • Studied Economics and Social Anthropology at Freie Universität Berlin and London School of Economics. • Prior to responsAbility, Martin worked for the Frankfurt School of Finance and Management on consultancy projects related to SME lending and Microfinance Fund Management, as well as in Investment Management for the European Fund for Southeast Europe. |

|

Stephanie Bilo – Chief Client & Investment Solutions Officer More Info

•Chief Client & Investment Solutions Officer, Member of the Executive Management since 1 July 2019. • In charge of Sales, Product Development & Management and Marketing & Communications teams. • 20+ years of experience in banking and finance. • Ample experience in sales and distribution with institutional investors, family offices, and private clients. • In-depth know-how as to the structuring of investment solutions. • PhD in Finance from the University of St. Gallen, Switzerland. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

responsAbility sets impact objectives for each of its funds at inception (increase financial inclusion, improve access to electricity, reduce C02 emissions etc.) that determines the fund’s investment universe and eligibility criteria on the type of portfolio companies as well as the countries the fund can invest in. responsAbility reviews the overall eligibility of a company according to this predetermined list of eligibility criteria as early as possible during the investment process, an approach that is rather unique in the finance industry. This ensures that the investment universe is delimited in a way that leaves only portfolio companies eligible for investment that provide the impact responsAbility targets. Only if a portfolio company passed this initial step, our analysis focuses on risk/return parameters in order to determine a portfolio fit with regards to financial parameters. Eligibility criteria are reviewed periodically to ensure our investment universe fits the impact objectives of the fund.

responsAbility’s ESG principles and strategy are captured in its corporate ESG Policy, which is then translated by every investment team into a specific ESG process and a set of ESG tools that allows them to evaluate the relevant ESG risks of each potential investment. Prior to any investment, all potential portfolio companies are screened against the Fund’s ESG Exclusion List (i.e. no forced labour, weapons and munitions, corrupt practices, money laundering, etc.) and eligibility criteria are applied to all our investments, including multiple criteria relating to both ESG and impact. However, these criteria will vary according to the type of business model under consideration. Each proposed investment is categorized as ‘low’, ‘medium’ or ‘high’ to its ESG risks, in line with the IFC standards. ESG risks are then assessed through an ESG Due Diligence before investment. The results and mitigation actions are included in the investment documentation and closely monitored.

Impact Tracking and Monitoring

Learn More

Zollstrasse 17, 8005 Zurich, Switzerland

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.