IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Local Initiatives

Support Corporation

Community Development

Community Development Place-based Impact

Place-based Impact Racial Equity and Justice

Racial Equity and JusticeFirm Overview

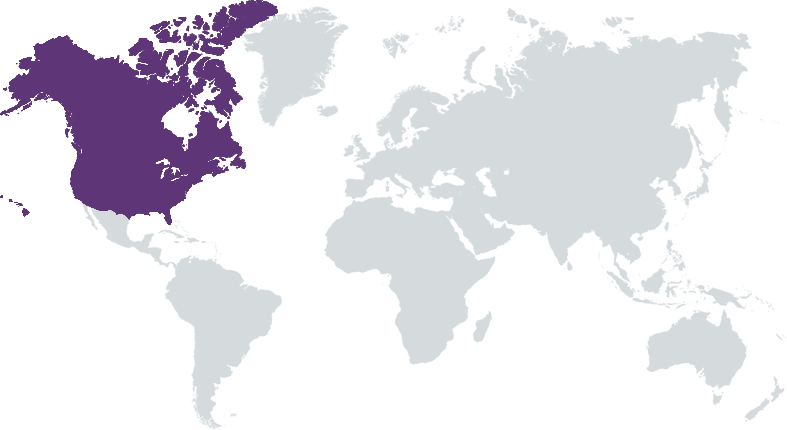

Local Initiatives Support Corporation (LISC) is an S&P ‘AA-’ rated (as of December 2023) not-for-profit and a certified Community Development Financial Institution (CDFI). Since 1979, LISC and affiliates have invested $32 billion to redevelop urban neighborhoods and rural communities through investments in affordable housing, health, education, public safety and employment. With residents and partners, LISC forges resilient and inclusive communities of opportunity across America – great places to live, work, visit, do business and raise families. LISC operates through local offices in 37 cities and through a national rural program in 2,400+ counties across 49 states. LISC affiliate LISC Fund Management, LLC is a registered investment advisor and manages private equity and real estate funds. At FYE 2023, LISC’s total assets exceeded $1.39 billion with net worth increasing 44% over the past 5 years. LISC is governed by a 21-member Board of Directors and has over 600 staff members.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

As an intermediary and convener of public- and private-sector resources, LISC catalyzes opportunity by financing organizations that foster improvement of economic conditions, development of housing and other physical facilities, provision of amenities and services, and other activities to revitalize disinvested communities or serve low- to moderate-wage individuals.

LISC mobilizes corporate, philanthropic and public capital from local and national sources to fund a diverse toolkit of support -- including loans, tax credit equity (through affiliates), grants, training, technical assistance and public policy support -- to improve the quality of life for low-wage people and places. LISC takes a double bottom line approach, promoting social impact while also requiring strong financial performance of its investments. LISC’s community investment model aims to improve conditions in some of America's disinvested communities while seeking to minimize displacement in places where gentrification has taken hold. In 2024, LISC and its coalition partners were awarded $2 billion in EPA funds to expand their investment in green housing and jobs supporting climate resilience. LISC embraces activities supporting comprehensive community development, using a place-based model to equip communities to become great places to live, work, visit, do business, and raise families.

Supported by its CDFI status, LISC mobilizes public- and private-sector resources within its communities by providing grant funding and technical assistance to its vast network of local partners. Outside of lending and investment activity, LISC has provided training, education and financial support to organizations leading revitalization efforts in their communities. Partnerships include: providing funding to 1,384 community development corporations through U.S. HUD’s Section 4 program; partnering with the U.S. Department of Justice to support over 100 community-law enforcement partnerships; helping build or renovate more than 600 recreation facilities through partnerships with the National Football League Foundation, ESPN and Under Armour; and leading a network of 130 financial opportunity centers to assist over 22,600 people to improve their credit since 2013. Through its affiliate LFM, a registered investment advisor, LISC creates and manages private mission-driven investment funds, both direct investment funds and conduit loan funds in partnership with other CDFIs.

Investment Example

Addressing the climate crisis requires a holistic approach to investing, ensuring our most at-risk neighborhoods and communities are not left behind in the green transition. LISC has been supporting green development in our target neighborhoods for years, from financing large affordable housing projects that meet the highest green building standards to helping small businesses and nonprofits install solar panels on their existing properties. In 2023, LISC provided a $1.8MM construction loan to Housing Initiative Partnership, Inc. in Prince George’s County, Maryland to support Fairmount Heights Zero Energy Homes. Located on the site of a former municipal storage facility, the development will include six single-family homes restricted to families making no more than 80% AMI and will meet multiple green certifications, including Energy Star, Indoor Air Plus and Water Sense, in addition to being equipped with rooftop solar panels.

Leadership and Team

|

Michael Pugh – CEO More Info

Michael T. Pugh became CEO of LISC in October 2023. Michael has more than 30 years of experience in banking, with a particular focus on expanding access to capital for underserved families, businesses, and communities. He spent more than a decade at the Harlem-based Carver, leading the nation’s largest publicly traded African American-operated bank, with more than $720 million in assets. Earlier in his career, Michael was a senior vice president at Capital One, N.A., where he oversaw 75 banking centers and $3 billion in deposits in Maryland, Washington, D.C., and Delaware. |

|

Christina Travers – Executive Vice President and Chief Financial Officer More Info

Prior to joining LISC, Christina was the CFO of Working Solutions CDFI, a San Francisco Bay Area microlender. During her time at Working Solutions, she focused on the migration to a single treasury management platform, financial management report creation, debt consolidation, financial forecasting and the implementation of a risk assessment based asset management function. Christina also spent over two years at the Low Income Investment Fund (LIIF) as Vice President for Finance & Capital Strategies. In this role, she served as a liaison and resource for LIIF’s banking and other lending relationships. |

|

Shawn Luther – Senior Vice President and Chief Credit Officer More Info

Shawn Luther is Senior Vice President and Chief Credit Officer at Local Initiatives Support Corporation, responsible for establishing the credit policies and overseeing credit approval and risk management functions for LISC’s loan fund, as well as managing a team of credit, closing and construction management personnel. Mr. Luther previously served as Senior Director and Credit Officer at Capital Impact Partners, Vice President and Chief Credit Officer at Nonprofit Finance Fund, and Director of Asset Management and Associate General Counsel at LISC. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

LISC’s loan underwriting and management policies reflect the needs of communities, LISC’s charitable mission and purpose, and LISC’s responsibilities to lenders and investors. LISC has broad experience with loans made to nonprofit organizations, mission-aligned for-profit developers and small businesses engaged in community and economic development projects and has fostered an underwriting approach tailored to a wide diversity of loan requests. LISC considers how financing businesses, housing and other community infrastructure will catalyze economic, health, safety and educational mobility for individuals and communities. Factors include whether the project will be located in a low- to moderate-wage community, provide goods and services that benefit an underinvested community, provide quality job opportunities to underserved populations, develop partnerships with other community-based organizations and develop needed infrastructure.

LISC’s investment sourcing, due diligence and underwriting processes evaluate and prioritize organizations that incorporate environmental, social and governance considerations into their management processes. Each loan additionally undergoes a formal impact assessment that results in a quantitative score of impact across six dimensions that incorporate social and environmental sustainability factors. These include equal opportunity hiring practices, offering living wages, training programs and advancement opportunities for their employees, and using best management practices to minimize environmental impacts.

Impact Tracking and Monitoring

Learn More

28 Liberty Street, 34th Floor, New York, NY 10005 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.