IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Quona Capital

Entrepreneurship and Job Creation

Entrepreneurship and Job Creation Financial and Economic Inclusion

Financial and Economic Inclusion Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

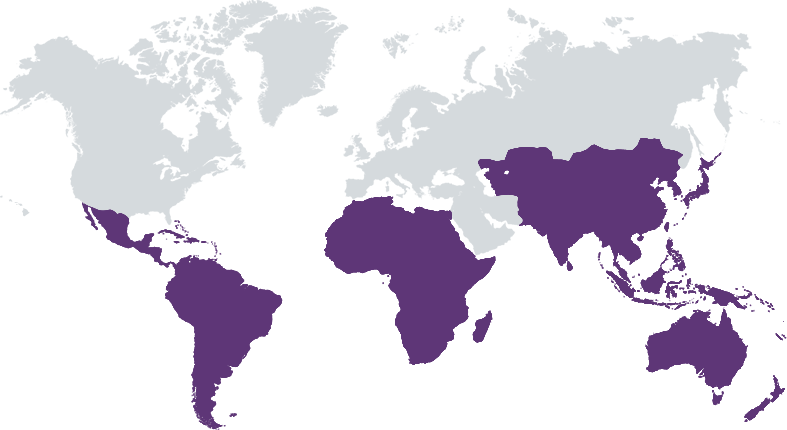

Since its early days as a pioneer of impact investing in emerging markets, Quona has blended purpose with progress, capital with community, and innovation with execution to help founders build a more financially inclusive world. While the firm is primarily focused on venture investments in Latin America, India and Southeast Asia, Africa and the Middle East, Quona’s influence is in no way restricted by geographical borders. Just as payments and other transactions move increasingly globally, Quona aims to fuel global fintech that can advance financial inclusion for all. With over 70 cumulative investments and current assets under management (AUM) of over USD 750 million, Quona is powered by a diverse team with significant investment and operational experience, domain expertise in technology and financial services, extensive global networks, and a commitment to social impact and strong financial returns.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: Less than 25%

Quona invests in inclusive, innovative fintech companies leveraging technology to enhance the accessibility, efficiency, reach, and scope of financial products and services for underserved consumers in emerging markets.

At Quona, we believe that we can help build great companies with outstanding shareholder value, while affecting positive change through the expansion of access to quality financial services. Moreover, we believe that social and financial drivers and rewards are mutually reinforcing. We thus invest in scale-up stage companies with demonstrated revenue traction that provide solutions to underserved consumers and small businesses in Latin America, India and Southeast Asia, Africa and the Middle East. We typically invest $2 to 6 million in equity investments and take a board seat to enable active portfolio management. In addition to building value as a board member, Quona leverages our strategic partners and the financial and technical resources of its marquee investor base, which includes Accion, GP for the Accion Frontier Inclusion Fund (AFIF) and Accion Quona Inclusion Fund (AQF), to support portfolio companies and accelerate growth.

First-mover advantage: As pioneers in emerging markets fintech investing, Quona has carved out a niche of unparalleled sector expertise, yielding unique insights into the drivers of tech-driven financial services innovation. Over the years, Quona has also cultivated an expansive network that helps shape its investment strategy and adds value to its portfolio. Global-local footprint: With team members anchored in over 10 countries including the U.S.. Brazil, Mexico, India, South Africa, and Singapore, Quona brings a diverse and deeply global perspective combined with local insights. This geographic footprint allows the firm to seamlessly weave connections across markets, share best practices and forge strategic alliances between potential partners, investors, and acquirers. Fintech and emerging markets experience: Quona’s partners have extensive histories of founding and scaling fintech ventures in the firm’s target markets. Collectively, their experience encompasses venture capital, private equity, investment banking, and microfinance, further solidifying Quona's credentials in the fintech domain.

Investment Example

Creditas is a lending platform in Latin America that is democratizing access to secured consumer loans across home, auto, payroll and more, allowing lower-income segments to leverage their assets to access significantly lower interest rates vs. unsecured lending alternatives. Quona’s participation in Creditas’ 2015 Series A marked Fund 1’s inaugural investment. At the time, there was skepticism in the broader market about consumer finance, largely due to concerns around responsible lending and over-indebtedness. Quona, however, had strong conviction in the potential of asset-based and use-case consumer lending to drive financial inclusion, and recognized unique potential in Creditas to achieve these outcomes. Creditas, which has become one of the strongest performers in Quona’s portfolio, evolved into a centralized digital ecosystem, expanding its credit and fintech platform to more synergistically serve customers. With 10 million registered users, the company has made a significant impact while also prioritizing building a diverse workforce.

Leadership and Team

|

Monica Brand Engel – Co-Founding Partner, Africa & Cross-Border Investments More Info

Monica Brand Engel focuses on Quona’s global investments. Monica is an investor and entrepreneur, having launched a number of investment vehicles and products aimed at broadening financial inclusion. Before co-founding Quona, Monica was the founder and Managing Director of Accion Frontier Investments Group, a growth stage fintech portfolio. She also launched and managed Accion’s Marketing and Product Development Unit, where she oversaw the creation of new financial services to move the industry beyond microcredit, and worked in Mexico with Compartamos Bank, the largest microfinance institution in Latin America which IPO’d in 2007. |

|

Jonathan Whittle – Co-Founding Partner, Latin America Investments More Info

Jonathan Whittle is a founding partner of Quona Capital, where he focuses on Quona’s Latin American investments. Jonathan is a seasoned investor and entrepreneur with over 25 years of experience in Latin America. Before co-founding Quona, he was co-founder and CEO of Acesso, a leading prepaid financial service provider for the unbanked population in Brazil. Prior to launching Acesso, Jonathan managed Darby Technology Ventures, a pioneering technology venture capital fund for Latin America. He joined Darby after a decade of experience as part of the founding team of leading venture capital-backed telecommunications and data services companies in Latin America, including Diveo (acquired by UOL), and Optiglobe (now Tivit). |

|

Ganesh Rengaswamy – Co-Founding Partner, Asia Investments More Info

Ganesh Rengaswamy, a seasoned entrepreneur and venture investor, leads Quona’s investments in India and Southeast Asia. Before co-founding Quona, Ganesh led Accion Frontier Investments’ work in India. Prior to his time with Accion, Ganesh was a General Partner of Lok Capital, a venture growth fund that invests in financial inclusion and social enterprises. Ganesh previously served as the Asia Director for Unitus Inc., a global organization investing in sustainable solutions in financial inclusion. During these stints, Ganesh invested and advised leading financial institutions and banks including SKS/Bharat Financial Inclusion Ltd, Ujjivan, Equitas, IFMR/NorthenArc, Vistaar, TechProcess and Bandhan. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Quona's first stage of screening is for financial inclusion. Quona only invests in companies with business models that increase financial inclusion in emerging markets along the three pillars of Quona's impact framework: Access, Quality and Markets. An analysis of the depth and breadth of impact in financial inclusion is included in each piece of investment documentation that the investment team prepares for investment committee approvals. As of 2022, this process includes an impact scorecard – intended to document and quantify + categorize ex ante impact – for all new and follow-on investments. Quona assesses impact at every stage of an investment's life - from pre-screen to exit.

Quona is committed to responsible ESG management. Each of Quona’s funds have their own ESG policy, similar but with slight differences driven by requirements by certain core LPs. Quona’s ESG policies are aligned to industry standards, including the IFC’s Corporate Governance Methodology. Risk assessment is core to Quona’s due diligence process and, after investment, in the lifecycle of the companies. Companies must have a clear financial inclusion thesis in Quona’s target investing markets to be considered for investment, which eliminates significant negative impact risk from the Quona portfolio. Assessing impact risk relates to specific business models (e.g. in lending, avoiding over-indebtedness) and stakeholders (e.g. investors that may be short term returns-focused). Quona manages risks where possible as a minority investor and actively identifies mitigants.

Impact Tracking and Monitoring

Learn More

1101 15th St NW, Suite 401, Washington, DC 20001 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.