IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

North Sky Capital

Energy

Energy Entrepreneurship and Job Creation

Entrepreneurship and Job Creation Water and Sanitation

Water and SanitationFirm Overview

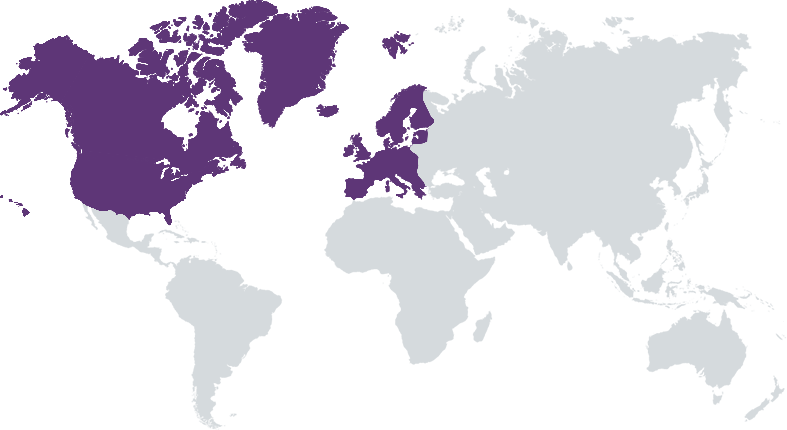

North Sky Capital is a pioneer in impact investing in the United States. Now in its 24th year, North Sky has deployed $1.4 billion across more than 190 impact investments on behalf of its various impact funds. The Firm has two flagship investment strategies: impact secondaries (private equity) and sustainable infrastructure. Both strategies support positive environmental and social impact while targeting market rate investment returns. North Sky has been an active impact investor since the beginning of the modern era of private markets impact investing in 2005.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

We leverage more than 20 years of investment experience and expertise to seek impact investment opportunities across the private markets spectrum that have strong financial return potential as well as ability to contribute positively to environmental and social improvements.

We believe impact investing should achieve both competitive financial returns and positive environmental and social impact. Drawing upon our 20+ years of experience, we develop and execute attractive impact strategies across the private equity and sustainable infrastructure sectors that align with UN SDGs and their underlying Target Indicators. Our private equity strategy invests via secondary structures to create diversification across four key themes – cleantech / climatech, healthy living & aging, waste & water and sustainable food / agriculture. We prefer growth equity opportunities to avoid technology risk. This strategy aligns well with market opportunities that leverage our industry experience to achieve attractive returns. Our sustainable infrastructure strategy focuses on environmental infrastructure, clean power generation and grid efficiency & enhancement. We target lower to mid-market sized projects located in North America, working closely with project developers to successfully construct these direct investments. Several of these projects are in Opportunity Zones.

1. Impact Thought Leader. North Sky has played an innovative, leadership role in impact since we began investing in the sector in 2005. This longstanding vantagepoint into the growing impact ecosystem fosters deep sector knowledge and investment experience to draw upon when evaluating companies, managers and infrastructure projects with the greatest opportunity to generate strong returns and intentional impact. 2. Cohesive Team. In aggregate our Senior Investment Team has more than 125 years of capital markets experience and together placed more than $1.4 billion into impact investments across our 10 impact funds. Additionally, the investment team possesses first-hand, transaction-related expertise from their M&A, IPO, private placements and infrastructure development experience prior to joining North Sky. 3. Independence. North Sky is independent, 100% employee controlled, with no affiliations to an investment bank, commercial bank or wealth management platform. This independence ensures that our limited partners’ interests are always our singular focus.

Investment Example

Through our sustainable infrastructure strategy, North Sky committed to a joint venture with Orenda Power. This commitment will finance the continued development and deployment of Orenda’s project portfolio, contributing to the availability of large-scale energy storage systems to charge from and discharge into the New York power grid. The joint venture currently owns over 40 battery project sites with over 200 megawatts of power, equivalent to 334 MTCO2e emissions avoided. This supports New York’s goal of a zero-emission grid by 2040. The joint venture aligns with UN Sustainable Development Goal 7 (Ensure access to affordable, reliable, sustainable and modern energy for all) through Target Indicator 7.2 (Increase global percentage of renewable energy). Additionally, the investment facilitates the developer's relocation to an Opportunity Zone in Brooklyn, thereby bringing a growing small business and well-paying green jobs to a Low-Income Community.

Leadership and Team

|

Scott Barrington – Co-CEO More Info

As Co-CEO & Managing Director, Scott Barrington is responsible for the overall management of the firm and its investment activities. Scott actively participates in all aspects of sourcing, analysis and execution of investment decisions. From 2000 to 2010, North Sky was the private equity team within Piper Jaffray & Co (now Piper Sandler). While there, Scott led the team and also served on Piper Jaffray’s Merchant Banking Investment Committee. Previously, Scott practiced law at Dorsey & Whitney LLP and was a member of the emerging companies group where he advised start-up companies and private equity firms regarding LBO and VC transactions, M&A, IPOs and other corporate finance matters. |

|

Danny Zouber – Co-CEO More Info

As a Co-CEO at North Sky Capital, Danny oversees the management and strategic direction of the firm and its investment activities. He participates in all aspects of sourcing, analysis and execution of investment decisions as a member of the firm’s Investment Committees. He is also co-head of the impact secondaries investment team. He co-manages the firm with Scott Barrington. |

|

Gretchen Postula – Managing Director, Chief Compliance Officer, Head of Investor Relations More Info

Gretchen is Managing Director and Head of Investor Relations at North Sky Capital and also serves as the firm’s Chief Compliance Officer. She is part of North Sky’s senior management team and is actively involved in strategic planning, fund development and staffing decisions. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

75% – 99%

|

UN SDG alignment is integral to every investment decision. North Sky Capital’s impact investing criteria is deeply-rooted into our investment due diligence process to ensure that investments in our portfolios meet or exceed comprehensive expectations. Parallel with traditional fiduciary considerations, we incorporate impact factors into the initial due diligence phase to identify all intentional impact objectives before proceeding with further analysis. For each investment, North Sky Capital includes analysis on an investment’s impact and alignment with firm-wide and strategy-specific ESG factors.

North Sky’s ESG investing criteria are inherent in the investment due diligence process. We take ESG factors into consideration as a part of initial due diligence, guided by the UN SDGs. We evaluate an investment’s impact, both in terms of positive impact (the SDG Mapping) and negative risks (ESG Risk Scan), and its alignment with firm-wide and strategy-specific ESG factors (ESG Check). In our ESG Risk Scan, we categorize each risk into high, medium or low. For risks categorized high or medium, we assess whether the project or company has taken measures to mitigate or manage these risks appropriately and to what effect these risks may affect the investment outcome and overall risk profile. In our ESG Check, we establish a baseline for a project, developer, manager or company's ESG policies and practices.

Impact Tracking and Monitoring

Learn More

701 Lake Street East, Suite 350, Wayzata, MN 55391, USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.