IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

INOKS Capital

Climate Change

Climate Change Food Systems and Agriculture

Food Systems and Agriculture Gender Equality

Gender EqualityFirm Overview

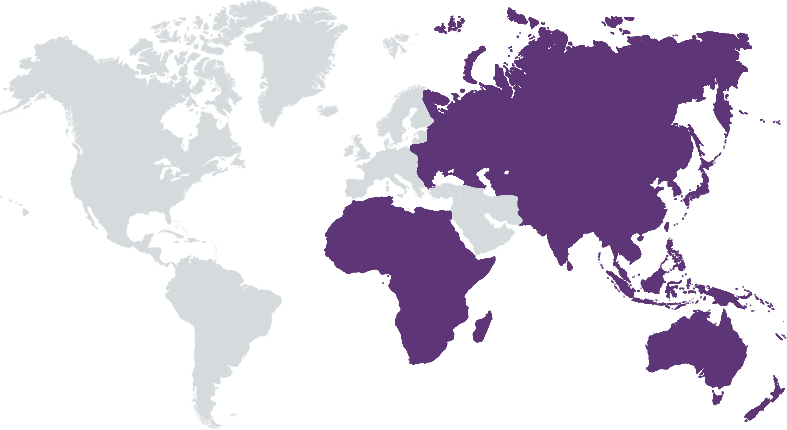

INOKS Capital is a Swiss asset manager prudentially regulated by Finma providing customized financing solutions via investment funds or mandates to companies active non-speculatively in mainly the Agriculture/Food sector incl. Agtech/Fintech and renewables. The funded companies may i.e. produce or transform basic food intakes like cereals (wheat, rice) or vegetable proteins (i.e. sunflower oil) that provide resilience as they are covering basic nutritious needs. INOKS Capital aims to be the market leader in capital access for added value resilient activities in the real economy by applying its proprietary ESG/Impact framework.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

INOKS Capital is a Swiss regulated asset manager providing through its investment funds companies customized financing solutions that support positive impact in at least one of the 4 impact themes (Food security, poverty reduction, woman empowerment and environmental quality.

The managed funds by INOKS Capital support growth by providing short term to mid- term capital solutions to SMEs in the Agri/Food Sector including Agtech/Fintech and renewables. The Fund intervenes at different stages of the Agri/Food value chain to support the working capital requirements of real economy participants and provides technical assistance in cooperation with external companies. The Fund is non-directional and seeks to mitigate non-market risks through hands-on pre-investment due diligence and post-investment transaction monitoring. Its unique approach targets consistent, resilient returns and low volatility. Through its low correlations to other traditional and alternative forms of investment, it is an attractive tool for enhanced portfolio diversification.

-proprietary ESG/IMPACT framework embedded in the entire investment process from sourcing, due diligence, structuring and investment/Monitoring. This framework has been in place since its inception of 2006 and has been refined also with the help of external consultants since then. -INOKS Capital is among the first 75 signatories of the Operating Principles of Impact Management -long standing relationship with its investees (often revolving structure over several years) -non speculative funding, all done inhouse, only real economic activities will be funded and supported -external technical assistance programme -highest level of prudential regulation in place in Switzerland as an asset managers -detailed risk mitigation package applied to safeguard the investors capital -positive performance for the last +15 years in the investment funds with little correlations and volatility for its investors

Investment Example

INOKS supports a local Ivorian rice processor aiming at improving food security through increased local rice availability and more stable market prices. The company’s goal is to develop and improve local milling facilities and strengthen agricultural productivity & efficiencies of local farmers’ cooperative, this is key even more so in times of global conflicts affecting food supply chains. Financing is to assist the funding of activities pertinent to local purchase and processing of paddy rice and distribution of white rice. Available over a 12-month period for a revolving amount of EUR 7.5M. The fund will support: Purchase of paddy rice from local farmers and/or co-operatives in Ivory Coast. Storage of raw material at the factory. Process and/or condition the raw material by hulling, drying, sorting, polishing, bagging into white rice Sale and/or distribution of retail goods to local buyers

Leadership and Team

|

Nabil Marc Abdul Massih – CEO More Info

Nabil has over 25 years of experience managing commodity investments as a trader, collateral manager and portfolio manager. He joined INOKS in 2006 to seed and launch the Ancile Fund. He is CEO, principal of INOKS and a member of the Board. |

|

Ivan Agabekov – CFO More Info

Ivan has been with INOKS for more than 10 years. As CFO and member of the board, he oversees both the company’s investments and its finances. Since 2009, he has helped modernize and institutionalize the company. He holds a LLM, EMBA and several finance certificates. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

INOKS' ESG/Impact framework is integrated in the entire investment process from sourcing, due diligence, structuring and investment or de-investment. Funded companies need to provide detailed disclosure about their practices and processes, in case of two equal investment the one with the greater impact potential/outcome is selected. If necessary an ESAP is formulated with the company to mitigate deficiencies.

INOKS' ESG/Impact framework is integrated in the entire investment process from sourcing, due diligence, structuring and investment or de-investment. Funded companies need to provide detailed disclosure about their practices and processes. If necessary an ESAP is formulated with the company to mitigate deficiencies.

Impact Tracking and Monitoring

Learn More

Rue de l'Athénée 32, 1206 Geneva, Switzerland

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.