IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Developing World Markets

Energy

Energy Gender Equality

Gender Equality Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

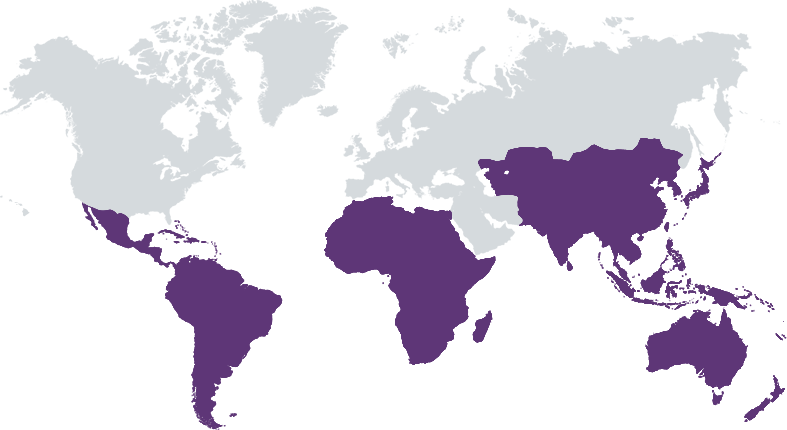

DWM is an emerging and frontier markets investment manager, dedicated to making impact investments that seek risk-appropriate returns for our investors and measurable environmental or social benefits for the developing world.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

We seek investments that meet critical development needs in emerging and frontier markets while generating market-rate returns.

We believe that for impact investing to be sustainable, it must offer risk-appropriate returns comparable to mainstream investments. This can be achieved by both identifying investments and strategies that will achieve returns comparable to mainstream investments or through blended finance structures. Taking this approach, DWM has channeled more than $2.9 billion in private debt and equity investments in over 250 companies in over 50 developing countries since 2006.

On the investor side, while our peer group has sourced the bulk of their funding from retail and concessional investors, DWM has successfully engaged institutional investments across U.S., Europe and Asia, including pension funds (e.g. faith-based, TIAA, several Dutch and Nordic), insurance companies and asset management groups; many of whom made their first impact investment with DWM. On the investment side, we are pioneers in both microfinance capital markets transactions (capital raises, CLOs) dating back to 1999, and institutional funds for investment into MFIs. We continue to innovate our products to enable expansion (our own and the wider industry's) into new sectors and impact themes, most recently with our all local currency SDGs Credit Fund that includes a 20% carveout for lending to EM & FM corporates, and our slated Climate x Gender blended finance Impact Note.

Investment Example

In 2024, DWM renewed a $1.5 million loan to Jardin Azuayo in Ecuador. Jardin Azuayo is a savings and credit cooperative dedicated to improving quality of life through financial inclusion and cooperative education. The company expands access to credit for women and low-income entrepreneurs, as well as small and medium-sized enterprises. It also has a small but growing portfolio of electric vehicle financing, contributing to climate change mitigation goals.

Leadership and Team

|

Peter Johnson – Managing Partner More Info

As co-founder & co-managing partner, Peter helped create the model for making sustained, institutional-quality, market-return impact investments in emerging and frontier markets starting with DWM’s first impact investment in 1999. In the more than two decades since, Peter’s innovations and drive for higher standards in investing and impact have been influential across the industry. At DWM today, Peter oversees fund management and key investor relationships, all within DWM’s investment focus of inclusive finance, agriculture and rural communities, off-grid solar and climate action, water and sanitation, education, housing and, a special focus of Peter’s, women’s economic opportunity. |

|

Odette Tolliver – Partner, CFO More Info

Odette joined DWM in 2010. As CFO she is in charge with the Holdings company financials and analysis of its business operations, budget, forecast and trends. She manages the back office operations for the DWM Funds in Luxembourg as well as the servicing of all foreign funds for which DWM Asset Management acts as Investment/Fund Manager. As a partner, Odette is involved in various strategic projects at the Holdings level. Prior to joining DWM Odette worked as director/manager of operations in the service industry. Previously she started and managed her own business, which became one of the largest Xerox dealerships in Romania for more than 10 years. |

|

Edward Marshall – Partner, General Counsel More Info

Edward joined DWM in 2009. He is responsible for all legal and regulatory matters pertaining to DWM, its investment vehicles and overseas investments. He serves as the Chief Compliance Officer for DWM’s registered investment adviser and is a member of the DWM Equity Investment Committee. Edward has over twelve years’ experience as an attorney in cross-border corporate and finance transactions. At DWM, he advises on all fund formation activities and capital markets transactions. He serves as transaction counsel for DWM’s equity and debt investments and provides legal support to equity portfolio companies. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

At the eligibility phase, all companies are screened for alignment with our three strategic impact goals, and a theory of change is developed for each investment. Then, during due diligence, impact data is gathered on more than 80 indicators, a subset of which inform an impact score used to assess alignment with the impact goals. Examples of indicators included in the scoring model to determine whether impact is integral to the product/service offered include: % clients who are poor and low-income, % MSMEs, % rural; % women, whether the institution tailors products/services to women's needs, non-financial services provided, the sector breakdown of clients (to determine whether financing is provided for basic needs and investment in livelihoods), and whether the company provides climate-related products/services.

Impact and ESG data gathered and assessed includes diversity within ownership, board and management, compensation equity, labor practices, and ESG policies and procedures in place. We have also improved related practices to ensure better compliance with the Operating Principles of Impact Management (our Disclosure Statement is available on our web site). We also assess environmental policies in place related to topics such as water and energy management, biodiversity protection, and GHG emissions reduction strategies. Our process also assesses whether training is provided to management, staff, and clients on these topics, and with what frequency. In 2021, in-line with becoming signatories of the Net Zero Asset Managers Initiative, we continued to focus on understanding and reducing emissions throughout our portfolio.

Impact Tracking and Monitoring

Learn More

100 First Stamford Place, Suite 402, Stamford, CT 06902, USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.