IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Capria Ventures LLC

Financial and Economic Inclusion

Financial and Economic Inclusion Food Systems and Agriculture

Food Systems and Agriculture Workforce Development, Upskilling and Retraining

Workforce Development, Upskilling and RetrainingFirm Overview

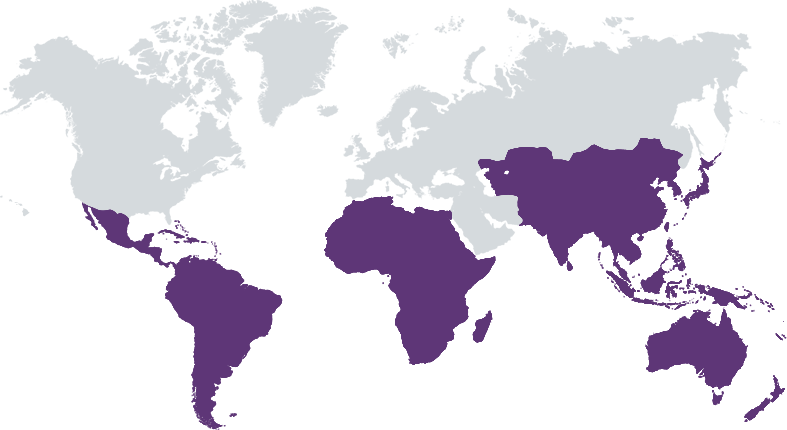

Capria Ventures is a Global South specialist venture capital firm investing in applied Generative AI, connecting founders into a uniquely collaborative network. Capria activates strong relationships between hundreds of founders and leading local VC firms in the tech hubs of the Global South – from Sao Paulo to Lagos to Bangalore to Jakarta. Capria brings state-of-the-art venture capital innovation combined with global best practices of sustainable ESG management to select and manage its portfolio of startups serving the fastest-growing economies of the world. Capria manages funds with assets exceeding USD 180M. Capria has offices in Seattle, Bangalore, Nairobi, Buenos Aires, Jakarta and Washington DC

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

Capria Ventures invests in early-stage and early-growth tech startups in high-impact sectors across the Global South, applying Generative AI to deliver local solutions at scale to meet the essential needs of the aspiring middle class.

With a population of more than 5 billion, the GDP of the Global South region (India, Latin America, SE Asia, and Africa) will grow 60% faster than the Advanced Economies over the next 5 years, driven by the rising middle class. Applications of Generative AI will be a talent and language equalizer, reduce costs, open up vast new markets, and amplify the demographic advantages of these regions. Most of the best and most scalable solutions will be built in the Global South and optimized for local needs and local market dynamics. Capria invests in early-stage and early-growth asset-light, technology-enabled service businesses with compelling unit economics in fast-growing sectors, including fintech, agri/foodtech, job/HRtech, edtech, and climate. Our investments will support startups in essential-needs sectors to build and scale GenAI-enhanced businesses with superior positive social and environmental impact where the benefits of GenAI will disproportionately benefit the lower- and middle-income populations.

Capria is a Global South investing specialist with 12 years of experience investing in more than 60 startups, having evaluated 10,000+. Capria is one of the first investors in startups serving the unserved low-income and rising middle-class populations in India and, for the past 8 years, has built an investment portfolio of more than 350 companies across 12 emerging Global South tech hubs. Our partnerships with 19 local VC investment partners enable us to have a superior pipeline with their existing portfolios, relationships, experience, and networks. Capria’s team is located across the Global South with region-specific expertise combined with a global value creation team supporting founders. Capria is on the front edge of the GenAI revolution with 4 GenAI developers on staff and active GenAI acceleration engagement with more than 100 founders. Capria is a pioneer in delivering comprehensive annual impact reports starting in 2013.

Investment Example

Founded in 2015, BetterPlace is the largest blue-collar enterprise SaaS provider in India and SE Asia, addressing all hiring, management, and engagement needs of 10’s of millions of low-income blue-collar (“frontline”) workers. Capria was a seed-stage investor when the company had almost zero revenue. We have extensively supported the company in all manners, including business model development, Generative AI strategy, strategic PR & marketing, hiring and retaining key talent, strategy and support for five acquisitions, and fundraising. Today, managing a workforce of over 2.2 million blue-collar workers, Betterplace has enabled higher incomes and provided additional income opportunities through gig work, flexible hours, and benefits like earned wage access (EWA). With ~$150m ARR and healthy growth, Capria participated in the company’s $24m Pre-Series D round in 2023, to support BetterPlace’s next phase of India and international growth.

Leadership and Team

|

Dave Richards – Co-Founder & Managing Partner More Info

Dave Richards is co-Founder and Managing Partner whose responsibilities include portfolio management, member of investment committees, fundraising and investor relations, marketing, and oversight of finance, business operations, and administration. He brings deep experience as an entrepreneur, executive, and global early-stage investor. |

|

Will Poole – Co-Founder & Managing Partner More Info

Will Poole is a serial entrepreneur and venture investor, focused on improving ecosystems that bring opportunity to low-income populations. In 2012, he co-founded Unitus Seed Fund. Will's career started by founding two startups at the dawn of the PC era, working in the early days at Sun Microsystems, and pioneering e-commerce at eShop which was acquired by Microsoft in 1996. At Microsoft, he ran the $13B global Windows business and started their product focus on emerging markets. |

|

Susana Garcia-Robles – Managing Partner More Info

Susana Garcia-Robles is a Senior Partner at Capria Ventures and Senior Advisor to the Association for Private Capital Investment in Latin America (LAVCA). She left the Inter-American Development Bank in February 2020, where she was Chief Investment Officer and Gender Initiatives Coordinator at the IDB Lab. In 2012 she co-founded WeXchange, the first LAC pitch competition and platform of encounter between LAC women entrepreneurs, mentors, and investors. In 2019 she co-founded WeInvest Latam, a network of women investors. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Yes, Capria targets and invests in tech startups and funds that align with our impact thesis to profitably and sustainably improve the lives of middle and low-income families across the Global South. Capria aims to achieve a balanced risk/return profile across its portfolio from both an impact and financial returns perspective. Capria utilizes its proprietary impact screening system to take into consideration local market characteristics, investment size, strategy and stage, and target population size. This allows us to diversify, select companies that have the potential for the highest returns, and allows us to achieve both breadth and depth of impact on a portfolio level.

As part of Capria’s initial investment screening process, we require that each company have a clear and significant impact potential that is integrated into its core business model (not as a CSR program or a sidebar). This ensures that as a business scales, so does its impact. We formalize impact & ESG in our investment legal documents addressing a company’s commitment to deliver and report performance across impact metrics (examples highlighted later in this section), implement impact & ESG risk management practices, and develop actionable plans to address these risks should they materialize. In our investment decision process, we focus on validating our thesis and its alignment with our impact goals alongside ensuring the company has started the process of thinking about ESG risks and mitigation plans.

Impact Tracking and Monitoring

Learn More

1200 Westlake Ave N, Suite 510, Seattle, WA 98104 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.