IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Bamboo Capital Partners

Climate Change

Climate Change Food Systems and Agriculture

Food Systems and Agriculture Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

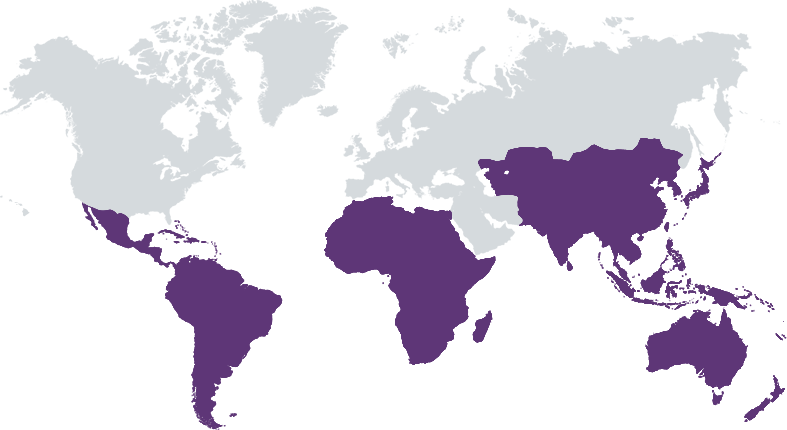

Bamboo Capital Partners is a pioneering impact asset manager which provides innovative financing solutions to catalyse lasting impact in emerging and frontier markets. Founded in 2007, Bamboo invests in businesses that address critical needs of low-income populations, primarily in the financial inclusion, energy access, food security and healthcare sectors. Bamboo bridges the gap between seed and growth stage funding through a full suite of finance options – from debt to equity – activated unilaterally or through strategic partnerships. Bamboo's funds have been recognized as Best for the World Fund by B Lab. Bamboo has a team of 30 professionals across Europe, Latin America, Africa and Asia. Since inception, Bamboo's investee companies have positively impacted nearly 244 million lives through their products and services, supported nearly 58,400 jobs including 20,600 jobs for women, and avoided 17.4 million metric tons of CO2 emissions.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

Our mission is to deliver both impact and financial returns to our investors by financing companies that provide access to essential goods and services for low- to middle-income communities in emerging and frontier markets.

Bamboo invests in businesses that have the potential to generate lasting impact and improve the lives of low-income communities while delivering strong financial returns. We fund companies using market-based approaches that can fill gaps where philanthropy and government may not be equipped to serve fully or effectively and where profitability can be a driving force. We bridge the gap between seed and growth stage funding through a full suite of finance options – from debt to equity – activated unilaterally or through strategic partnerships. Deploying private equity instruments allows us to engage deeply in the development of businesses as shareholders and board, and our time horizon allows us to take a long-term view on growing value in the company as partners.

Since its inception, Bamboo has been a pioneering force in the impact investing industry. Bamboo invests to improve the lives of the world’s most marginalized communities. Our investments align with 14 of the 17 UN Sustainable Development Goals. We innovate in the way we structure our products, from plain vanilla private equity funds to structured fixed income and venture capital funds. For some of our new funds, we adopt a blended finance approach which brings many benefits to our work. For instance, we have been selected by the World Bank, the International Fund for Agriculture Development (IFAD) and the United Nations Capital Development Fund (UNCDF) to manage impact funds focused on solar energy in Haiti and Madagascar, smallholder finance in Africa and SME financing in the Least Developed Countries respectively. We also partner with the international NGO CARE and the International Trade Center (ITC) on a gender-focused fund.

Investment Example

Access to electricity is a major challenge in Haiti. Of the nearly 10 million people without access to electricity in Latin America and the Caribbean, over 60% are in Haiti. Alina Enèji, a Haitian company established in 2021, seeks to tackle this challenge by providing reliable and affordable electricity to rural households through innovative mesh-grid solar energy systems. With mesh grids, households produce electricity from panels installed on their roof and use it to power their home, while being linked to a mini grid allowing generation and use to be shared among nearby households, offering the back-up which would have been provided by a grid. Alina’s pay-as-you-go payment scheme also removes the discouraging barrier of larger upfront payments. Alina is supported by the Off-Grid Electricity Fund (OGEF) managed by Bamboo Capital Partners.

Leadership and Team

|

David Grimaud – CEO More Info

David is passionate about impact investing and its power to deliver sustainable, positive impact for underserved communities around the world. David was born in France, raised in Togo, and educated in Europe, West Africa, and the United States. In many ways David is the embodiment of a bridge between cultures – both in business and more broadly. David has over 15 years’ experience structuring global investment strategies for institutional clients, striving to push impact investing and sustainable finance across emerging and frontier markets. David wants to use his first-class experience as a senior investment professional and global citizen to bring different ways of doing business. |

|

Christian Schattenmann – Head of Energy Access More Info

Christian Schattenmann is Head of Energy Access at Bamboo Capital Partners and is in charge of energy investments. He structured and negotiated multiple equity transactions and is board member in several off-grid energy companies. Before joining Bamboo Capital Partners, Christian worked as CFO at PACT, a German based Semiconductor Company. Prior to that, he was Investment Manager at the Venture Capital Group PariCapital. Over more than 20 years he was directly involved – both on the buy and sell side – in structuring and implementing a wide range of financing instruments. Previously Christian has also worked for an international law firm with assignments in Munich, London and Buenos Aires. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Our impact criteria, applied to 100% of our investments, is as follows: - The company provides essential goods and/or services affordably to low- to middle-income communities unreached (or underserved) by existing businesses. - Usage of the product/service results in improvements in quality of life and or, efficiencies that translate into increased income or reduced expenses. - The company generates employment/income among a low- to middle-income population or a population with limited opportunities. To help capture our impact, we use a logical framework approach and monitor impact for each company. Among other, we monitor the total number of beneficiaries reached and their socioeconomic profile (income level, gender, location…), jobs created, including female jobs, contribution to avoid CO2 emissions, etc. This helps us assess the company’s impact before investing, then monitor the company’s performance on a quarterly and/or annual basis.

In the deal sourcing, we check companies against our Exclusion List (aligned with IFC). During the due diligence phase, we conduct an ESG (Environmental, Social, Governance) due diligence to check the company’s policies and practices in terms of human resources, client protection, environmental management, governance, and its social/environmental management system when available. We also conduct further analyses on the potential impact of the investment. Analyses about both potential positive impact and ESG risks are included in the investment memorandum submitted to the Investment Committee, to inform the investment decision.

Impact Tracking and Monitoring

Learn More

SPACES - Quai de l'Ile 13, Geneva 1204 Switzerland

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.