IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

XSML Capital

Entrepreneurship and Job Creation

Entrepreneurship and Job Creation Gender Equality

Gender EqualityFirm Overview

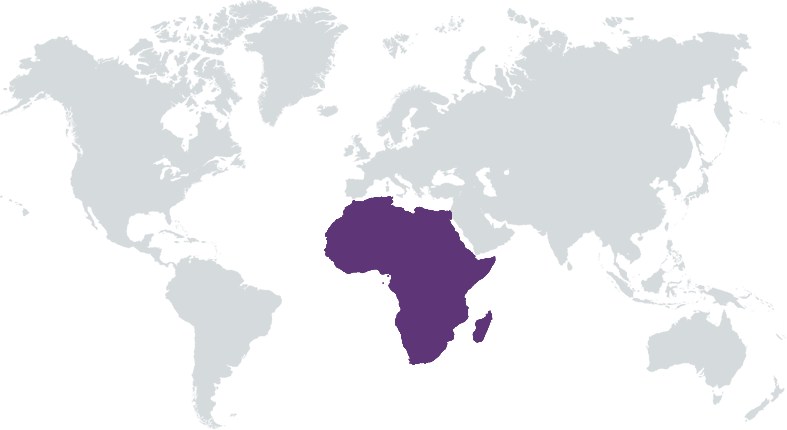

XSML Capital (Extra, Small, Medium and Large), founded in 2008, are partners in growth for entrepreneurs in frontier markets in Africa. We provide expertise, network, and bespoke financing, geared to nurture local talent and bring durable and fair prosperity in underserved markets. Since 2010, XSML has been investing in SMEs in challenging markets: Angola, Congo DRC, Uganda. In some markets, we are the only investor providing growth capital (debt, equity, mezzanine) ranging from US$ 300k to US$ 10m. So far, our local teams have helped to scale more than 70 SMEs. Staying close to our clients and understanding the African context helps us to offer tailored business support and technical assistance. We support investees to continuously improve their business standards and sustainability. We are approaching the first close of our fourth fund. As our clients grow, we follow them into new markets like Zambia and Kenya.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

XSML invests debt & equity in small and medium-sized enterprises (SMEs) in sub-Sahara Africa that are led by strong entrepreneurs, who with our support can scale their business, providing access to essential goods and creating jobs in underdeveloped markets.

SMEs are the main driver of social-economic development. Especially in Africa, they unlock access to essential goods and services, and advance livelihoods by creating jobs. But African entrepreneurs struggle to get affordable growth capital to scale their business. XSML Capital bridges the SME finance gap in Angola, Congo DRC, Uganda, Zambia, Kenya. In some markets we are the only investor serving SMEs needing investments ranging from US$ 300k to US$ 10m. We provide debt, equity and mezzanine as well as business know-how and technical assistance. This allows our local investment teams to tailor our support to the SME’s needs.We invest across sectors as the economies where we are active are still small. We partner with the best entrepreneurs in their industry who welcome also our support to raise ESG standards and overall sustainability, and with whom we can forge long-term relationships. This generates attractive returns for our investors.

We have a 14-year track record successfully investing in SMEs in African frontier markets. We are the only investor with extensive local investment teams on the ground in our markets. We have helped to scale over 75 SMEs across different sectors. Due to our in-depth local market knowledge and network, we scout the best entrepreneurs. We maintain close long-term relations with our clients, which is part of our success as evidenced by an expected MOIC of 1.5 or more for our 2nd and 3rd fund. We're often the only investor providing growth capital ranging from USD 300k to USD 10m. Thanks to our knowledge of our clients and their markets, we can tailor the financing, business support/technical assistance to clients' needs - mixing debt, equity, mezzanine. We offer more flexible terms and can grow our financing as SMEs expand. This provides more flexibility and early liquidity versus an equity-only approach.

Investment Example

Engineering company Geek in Kinshasa installs optical fibre cables for Liquid Telecom, Africa’s largest fibre and cloud operator. Geek is well positioned to win many of the upcoming multimillion dollar tenders in the DRC. In 2022, Geek was almost forced to end its Liquid Telecom contract because it had to prefinance the optical fibre installation. This jeopardised the company’s business lines in installing solar energy, providing IT services and construction. Local banks could only offer short-term loans that were not big enough to cover Geek’s financing needs. XSML stepped in to finance the company’s future growth. Thus far, XSML has invested US$ 1.5 million in two four-year loans. We expect a 14% IIR. Since its start in 2016, the company, led by a strong local founder, has grown to 39 staff and created almost 1,700 temporary jobs in some of the country’s most remote corners.

Leadership and Team

|

Marcel Posthuma – Managing Partner More Info

|

|

Jarl Heijstee – Managing Partner More Info

Jarl Heijstee is co-founder and Managing Partner of XSML. Jarl has over 12 years of experience in selecting, setting up, and managing investments funds in emerging markets. He was an investment officer with FMO, the Dutch Development Bank, and gained expertise in structuring private equity and mezzanine transactions with a particular focus on SME and microfinance sectors in Africa and Latin America. Prior to FMO, Jarl was a consultant with Arcadis, managing private sector investment projects in Eastern Europe. |

|

Barthout van Slingelandt – Managing Partner More Info

|

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

We invest in promising SMEs that offer essential goods and sectors in underserved countries in Africa. We are agnostic in terms of sectors but an important part of our investments go into healthcare companies, pharmacies or other companies that improve the offer of affordable, essential goods and services for the general population. We perform Environmental and Social Due Diligence on each prospective investee company leading to an improvement plan post investment that aims to - at the bare minimum - put in place a social and environmental management system at the company, in line with the IFC performance standards, and often zooms in on improving practices within the company. We collect baseline (pre-investment) job and gender data to track improvement. Going forward we will start tracking energy and water consumption. Regularly there is a need for ISO certification which we also support / execute with the use of external consultants.

We implemented applying a gender lens throughout our investment process to promote gender equality at our portfolio companies and increase investments in women-led SMEs. We have a gender action plan and, track gender equality at our investees and have started to pilot gender action plans with a subset of our investees. XSML and its portfolio is 2x compliant (before new criteria).

Impact Tracking and Monitoring

Learn More

SANNE House, Bank Street, Twenty Eight, 1 Cybercity, Eben, Mauritius

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.