IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

TLG Capital

Climate Change

Climate Change Entrepreneurship and Job Creation

Entrepreneurship and Job Creation Financial and Economic Inclusion

Financial and Economic InclusionFirm Overview

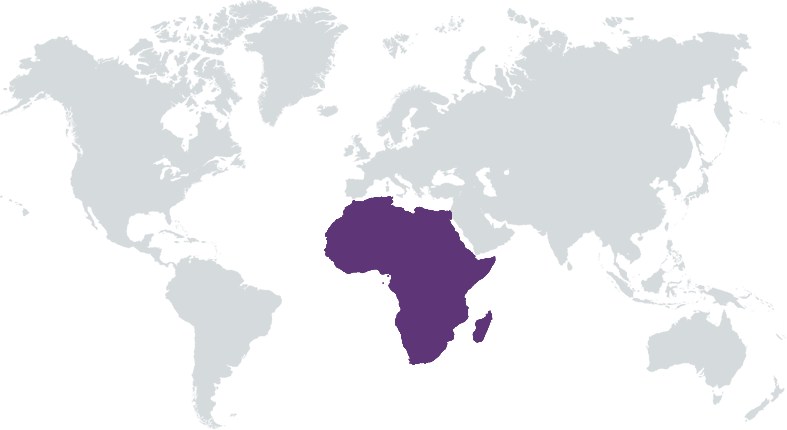

TLG Capital is a leading African impact private credit manager focused on Small-and-Medium-Enterprises ($100k-$15m revenue). We have invested $127m into 41 investments across 20 African countries with 24 exits (5%-35% USD IRRs) since 2012. We are a trusted partner to 80+ investors, such as Lombard Odier, Swedfund, and global family offices. Our new flagship fund, $200m Africa Growth Impact Fund II, is anchored by IFC ($20m board approved on 24 April 2024), alongside Swedfund, Norfund, BPI France, and others with first close by 18 December 2024. We manage additional funds, including: - Nigeria Private Debt Fund (10B Naira closed in October 2024) – the first-ever local currency private credit fund in Nigeria - Tunisia Empower Fund (50M Dinars closed in December 2023) – the first-ever local currency private credit fund in Tunisia - Africa Growth Impact Fund I (52M USD open-end and invested) – Our first dedicated USD private credit fund

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

We partner with African banks to structure bespoke credit facilities for each bank's sophisticated and special situation SME clients.

Today, the average African bank sees 23.0% of their loanbook in stress. The four-headed hydra of COVID, inflation, depreciation, and multi-sovereign-default has battered both bank and borrower alike. The resulting credit constriction has hindered recovery, toppled governments, reduced employment, killed domestic companies, and deepened reliance on foreign imports, all in context of countries that already subsist below $4,900 per year in GDP per capita (PPP). Against this harrowing backdrop, African SMEs and banks both need time and help. TLG’s $200m Africa Growth Impact Fund II works as a surgical partner to 94 African banks in 14 countries, providing long-tenor restructuring, growth capital, and hand-on value creation to viable but stressed African SMEs. 60% of capital will be invested in UN Least Developed Countries (<$1,310 GDP per Capita) and World Bank Conflict-affected Situations. We thematically focus on healthcare, climate business, local manufacturing, financial inclusion, and gender-equality.

In Africa, TLG is the first private credit fund to systematically work with local banks on their special situation SME borrowers. In return for helping the bank repair their borrowers, we require that the partner bank de-risk TLG’s involvement with a 100% guarantee on principal of our private credit investments. This approach has two key advantages: 1. Lower Risk – Local African banks know their local markets better than any fund manager. Requiring a guarantee from the bank allows us to screen great businesses that can perform if given the right structure. These guarantees yield more predictable outcomes for fund investors. 2. Scalable Impact – We have received more than $1.2 billion of deals that banks have offered to support with a guarantee. These SMEs often are great operators facing challenges in the current macro environment. Recovering these companies saves jobs, secures services that these businesses provide, and heals domestic banking systems.

Investment Example

In May 2024, TLG opened a $10m debt facility to the largest aluminium recycler in Nigeria. TLG’s investment paves the way for the business to recycle the equivalent of three Eiffel Tower’s worth of metal reducing carbon emissions by 477,000 metric tonnes over the next five years. Before TLG’s financing, the recycler faced a problem—they bought new machinery, but lacked financing to secure stable power generation. Their pen and paper financial systems also made it difficult to scale. TLG partnered with the local bank to inject additional capital alongside a hands-on value creation plan. In return, the bank secured TLG’s principal with a 100% guarantee. TLG financed generators and instituted a chartered accountant at the recycling plant, transforming their paper inventory/accounting system into a digital system, necessary to grow recycling capacity. TLG is presently working to bolster their backup generators with a solar mini-grid, further stabilizing their power access.

Leadership and Team

|

Zain Latif – Partner and CEO More Info

Mr. Zain Latif is the Founder and serves as Principal at TLG Capital. Prior to founding the company, he was an Executive Director at Goldman Sachs in the New Markets division focusing on Sub-Saharan Africa across all products. He joined Goldman Sachs from Merrill Lynch where he was involved in originating and executing transactions in Africa. Before joining Merrill, he was involved in spearheading the special situations African effort at HSBC which culminated in a widely reported inaugural debt/equity hybrid structure for a leading Nigerian financial institution. |

|

Isha Doshi – Partner and CFO More Info

|

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

75% – 99%

|

Yes. Impact has been our focus since inception and is the first deal screen we undertake. In 2018, TLG further adopted IFC performance standards, via which deals are screened for impacts on environment, community, workers, and governance. Today, we go beyond the IFC standards and include an enhanced DD process, integrating a gender lens. ESG due-diligence is used to assess risks, create an action plan for key issues, and terminate high-risk deals that don't meet our ESG standards. Every investment targets impact through a set of SDG indicators we ascribe to, across climate, health access, local manufacturing, financial sector deepening, gender equality, and improving standard of living in low-income and conflict-affected contexts--we are one of the only asset managers integrating a Least Developed Country and Conflict lens. This year, we have begun integrating the just transition, including energy transition and climate, in our screening and impact creation theory of change.

Yes, we systematically integrate social and environmental sustainability practices into our due diligence processes. We believe that the long-term viability of companies is intrinsically linked to their ability to manage these factors effectively. Our approach includes assessing companies work in areas such as environmental footprint management/reduction, responsible resource management, diversity and inclusion, and fair labor practices. During the due diligence phase, we conduct a thorough assessment of each company’s internal sustainability practices. We evaluate key metrics such as energy usage, waste management, employee welfare, and governance structures to ensure alignment with globally recognized ESG standards. This step also includes engaging directly with company leadership to understand their commitment to continuous improvement in these areas. Post-investment, we continue to monitor and encourage improvements in social and environmental practices through active engagement, ensuring that companies are not only complying with but also advancing toward more sustainable and equitable operations.

Impact Tracking and Monitoring

Learn More

34 Lombard Road, London SW11 3RF, United Kingdom

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.