IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Working Capital for

Community Needs, Inc.

Financial and Economic Inclusion

Financial and Economic Inclusion Gender Equality

Gender Equality Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

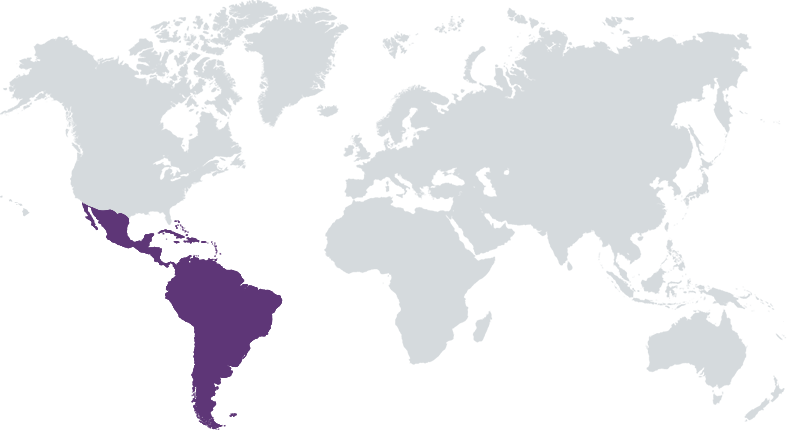

WCCN has been investing in low-income communities in Latin America through its microfinance loan fund since 1991, making it one of the first social impact funds in the world. WCCN works with its regional partners to seek out investments in women and people living in rural areas, two traditionally underserved populations in the region. The organization has returned 100% of the principal and interest owed to its investors in its 32-year history, and helps fund around 25,000 individual and family-owned businesses each year. WCCN's offers a fixed interest rate note to retail investors, with a $100 minimum, in 46 states in the US.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

WCCN provides investments that help improve income, family welfare and the empowerment of women, which result in improved lives and communities of the working poor in Latin America.

WCCN has a pooled loan fund that makes investments in partner microfinance organizations in Central and South America. WCCN's partners work with their impoverished end-borrowers to fund microbusinesses and may also provide them with health care, financial education and other benefits. With access to credit, the end borrowers can use their working capital to take advantage of economies of scale, purchase equipment and make other improvements to their businesses. When their businesses thrive, they can invest in education, healthcare and their communities.

WCCN is solely focused on microfinance in Latin America, and as such we are the only retail investment fund available on the market for that purpose. WCCN was founded in 1984 and had a variation of its loan fund since 1991. WCCN is often the first international lender to smaller microfinance organizations in Central and South America which many times opens the door to other international funders being willing to lend to such organizations.

Investment Example

WCCN recently invested $1,000,000 in Pro Mujer Nicaragua. Pro Mujer Nicaragua will use this investment for their microfinance portfolio, which has over 40,000 clients and an average loan size of $770.

Leadership and Team

|

Joshua Miguel Jongewaard – Director of Lending More Info

Miguel, born in Colombia and raised in Minnesota, brings 25 years of experience in financial services and investment management across North America, Europe, Latin America, and Asia. He has worked in private investment banking and social impact investing. Prior to working at WCCN, he worked for Symbiotics Group, MicroVest Capital Management, NDC (a CDFI), CarVal Investors, Cargill Inc., and US Bank Corporate Trust. His asset management experience includes micro-finance, SME finance (factoring/leasing), agricultural value chains, renewable energy, affordable housing, health services, education services, inclusive technology, private fund investments, loan portfolio acquisition (consumer, residential, commercial), and derivative trades (hedges, swaps, CDS). |

|

John Hecht – Chief Financial Officer More Info

John offers financial and management advisory services to businesses and community financial institutions, including practical strategies for growth and profitability. A licensed CPA, John’s financial background and award-winning CEO start-up bank experience provides proven ideas for success. Most recently, he was President/CEO of WPS Bank, a successful Wisconsin de novo community bank. In April 2015, the Bank was sold to Starion Financial and John was asked to take on the role of Madison Market President. In this new capacity, he successfully guided the integration of the two local teams and built the highest performing group in the Company. |

|

Will Harris – Executive Director More Info

Will previously served in the roles of Director of Operations and Board President. He has over 15 years of experience in economic development and international relations. Will is a Wisconsin native but has traveled and lived throughout Latin America. He studied Spanish and Latin American history at the University of Arizona and then later received his MBA from the same. He was a recipient of the Rotary World Peace Scholarship, which he used to pursue a master's degree in International Relations at the Universidad del Salvador in Buenos Aires, focusing his thesis on the topic of microfinance in Latin America. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

WCCN only lends to microfinance institutions whose mission is to provide credit to low-income entrepreneurs, who many times are unbanked. 90% of our partner organizations provide social services beyond credit including healthcare, financial education, and reforestation programs.

WCCN places a strong emphasis on how many women are employed by and in leadership roles in the organizations we lend to.

Impact Tracking and Monitoring

Learn More

211 S Paterson St, Suite 260, Madison, WI 53703 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.