IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Spring Lane Capital

Climate Change

Climate Change Decarbonization and Carbon Drawdown

Decarbonization and Carbon Drawdown Water and Sanitation

Water and SanitationFirm Overview

Spring Lane Capital is a private equity firm founded in 2019 that specializes in providing hybrid project capital for small-scale sustainable infrastructure projects. We focus on sectors such as energy, food, water, waste, and transportation, supporting innovative business models that require flexible financing solutions. With over $450 million in assets under management, we partner with companies developing sustainable infrastructure solutions to address environmental challenges. Our investment approach combines project financing and growth capital to accelerate impactful, scalable projects.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 25% – 49%

Spring Lane Capital’s investment thesis is to provide flexible hybrid capital to small-scale sustainable infrastructure projects, helping innovative businesses scale solutions in energy, food, water, waste, and transportation, while generating both financial returns and environmental impact.

Spring Lane Capital’s investment thesis centers on providing hybrid project capital to small-scale sustainable infrastructure projects that are typically underserved by traditional financing. Our firm targets sectors like energy, food, water, waste, and transportation, where innovative business models often face financing gaps due to project size or risk profile. By combining project finance with growth equity, Spring Lane supports companies with capital structures that allow them to scale their operations and deploy sustainable technologies. This approach not only delivers strong financial returns but also generates measurable environmental and social impacts, addressing pressing global challenges in sustainability and infrastructure development.

Spring Lane Capital differentiates itself from peers through its hybrid capital model, which blends project finance with growth equity. This approach allows our firm to target small-scale sustainable infrastructure projects that are often overlooked by traditional investors. Unlike many private equity firms, Spring Lane provides flexible financing tailored to the unique needs of companies in sectors like energy, food, water, waste, and transportation. Additionally, our firm’s focus on early-stage infrastructure projects—where innovative business models intersect with sustainability—sets it apart by addressing niche markets with significant growth potential. This combination of flexible capital, focus on small-scale projects, and emphasis on sustainability-driven impact makes Spring Lane a distinct player in the infrastructure investment landscape.

Investment Example

An illustrative investment by Spring Lane Capital is its investment in and financing of a waste to value business developing and selling clean insulation. Our firm invested in a business that takes waste newspaper and turns it into green, low carbon insulation. Spring Lane led an equity round in the business, brought in strategic co-investors and provided structured capital to upgrade operations of a current facility. The company has strengthened its governance and management team and improved operations at the current facility. The plant is in an LMI community. The company has just received $20 million of federal grant money to build two new plants, one in Michigan and one in Oregon. Future projects will be able to access lower cost financing as a result of proving operating performance at increased levels at the first facility.

Leadership and Team

|

Rob Day – Co-Founder & Partner More Info

Rob Day has been a sustainable resources private equity investor since 2004, and acts or has served as a Director, Observer and advisory board member to multiple companies in the energy tech and related sectors. Rob also serves on the Board at the New England Clean Energy Council and the Investment Committee of the Clean Energy Trust. From 2005-2016 he authored the column Cleantech Investing, which appeared on GreentechMedia.com, and co-hosted several conferences with that group on the topic of new investment models for the sustainability sector. |

|

Christian Zabbal – Co-Founder & Managing Partner More Info

Christian Zabbal is a Managing Partner with Spring Lane Capital. Prior to this, he was Managing Partner of Black Coral Capital, a family office specializing in cleantech and renewables. He also serves as board member and co-founder on the CREO Syndicate, a group of large family offices that share a common interest and mission in investing capital in food, water, and energy companies and technologies. He is part of the investment committee of Sustainable Development Technology Canada, a Canadian Crown corporation focused on investing federal funds to promote the spread of new technologies and businesses in the sustainability space. |

|

Jason Scott – Partner & Entrepreneur in Residence More Info

Jason is Entrepreneur-in-Residence with Spring Lane and concurrently serves as a Senior Advisor at Renewable Resource Group, a Los Angeles–based asset manager focused on sustainable agriculture, water resources, renewables and other natural resources. He also co-chairs a network of family offices investing in Cleantech, Renewables and other Environmental Opportunities (called the CREO Syndicate). He has been active in climate and sustainable investing, and policy since the late 1990’s through roles with Acumen Fund, Generation Investment Management, Encourage Capital various advocacy groups. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Spring Lane evaluates the social and environmental impact of each of its investments in diligence including GHG mitigation goals and other metrics of social and environmental performance.

Spring Lane evaluates the social and environmental impact of each of its investments in diligence including GHG mitigation goals and other metrics of social and environmental performance.

Impact Tracking and Monitoring

Learn More

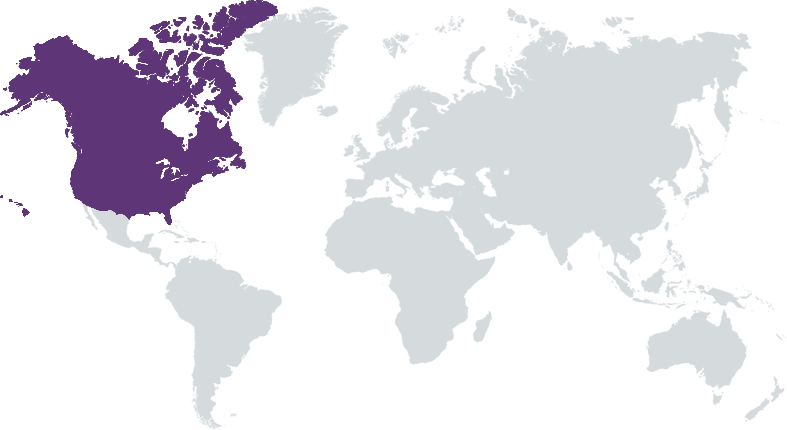

100 Cambridge Street, Suite 1802, Boston, MA 02114 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.