IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Rally Assets

Climate Change

Climate Change Financial and Economic Inclusion

Financial and Economic Inclusion Health and Wellbeing

Health and WellbeingFirm Overview

Rally Assets is an impact investment management firm. The firm helps investors generate positive social and environmental impact alongside a financial return. Rally creates impact funds and other portfolios to enable foundations, other institutional investors, family offices and individual accredited investors to invest in alignment with their values. Through Realize Capital Partners, Rally is a fund-of-funds manager for the Government of Canada’s Social Finance Fund. Rally is a Portfolio Manager and Exempt Market Dealer registered in Alberta, British Columbia, Ontario and Quebec with the respective provincial securities commissions. Rally is a certified B Corporation. Certified B Corporations meet the highest standards of verified social and environmental performance, public transparency and legal accountability to balance profit and purpose.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 100%

We invest in opportunities that are contributing to and profiting from creating positive environmental and social systems change.

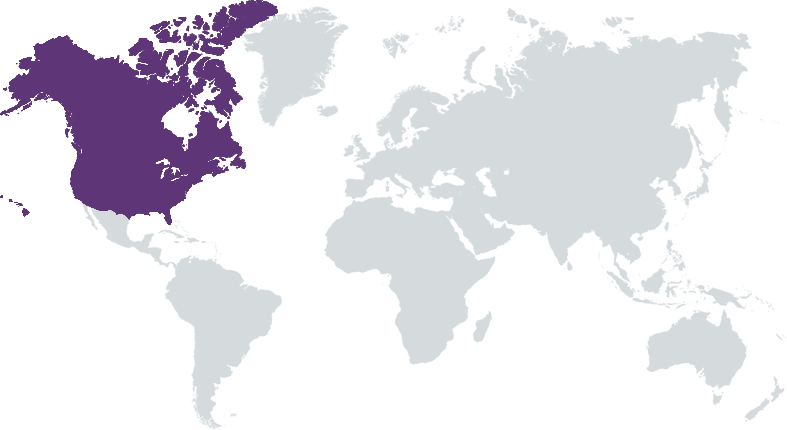

- Impact Continuously Evaluated: We evaluate impact throughout our investment process starting with identifying our universe of potential securities to portfolio inclusion for each mandate. - Market Rate: Impact investing can achieve market rates of return or better over the long term. - Actively Managed: Active management can enhance impact, reduce risk and drive higher returns. - Quantamental: Rigorous fundamental analysis, combined with a quantitative, data-informed approached is needed to uncover the best investments and to avoid greenwashing, leading to a concentrated, high conviction portfolio. - Forward Looking: Developing a forward-looking investment thesis as to how we expect impact to evolve and grow over time is key to identifying impact alpha. - Diversified: A global strategy that targets fundamentally strong companies diversified across asset classes, themes, sectors and regions, with an eye to long-term impact and value creation, can help to optimize a portfolio’s impact while achieving a targeted risk-adjusted return.

As a pureplay impact investing firm that invests across all asset classes, sectors and SDGs, we are differentiated through: - Our investment process, which incorporates impact measurement and management at all stages, from pipeline generation to screening, diligence, investment decisions, monitoring and exiting - Our history of over 10 years as one of Canada’s first impact investing building knowledge and capacity among institutional investors through market research, education and strategy work - Our scope of investment knowledge and capabilities which spans all asset classes (e.g. public equities, fixed income, PE/VC, private debt, real assets), all impactful sectors and many forms (from fund-of-funds to direct co-investments) - Our range of service offerings, which is inclusive of open-end, liquid funds with low-minimums allowing smaller investors to participate, customized separately managed accounts for larger investors with focused missions, and a closed-end funds that blends de-risked government capital to incentivize larger institutions to participate

Investment Example

Within our multi-asset class open-end fund, Rally Total Impact Fund, we were an early investor in Cross Border Impact Ventures (CBIV) Women’s and Children’s Health Technology Fund. The fund is a women-led growth-stage venture fund investing in tech companies focused on maternal, reproductive and newborn health. The fund is improving the health outcomes of women, children and adolescents in low- and middle-income countries. Asset Class: Venture Capital System Role: Equalizes health and medical technologies that are affordable, high-quality, and accessible for different population groups. Primary SDG: SDG Target 5.1: End all forms of discrimination against all women and girls everywhere Metric: Number of women, children or adolescents who have their lives improved by the innovation in low- and middle-income countries. Outcome: Reduced health disparities. Impact: Due to greater social equity, people are able to fully contribute to and benefit from economic and social progress

Leadership and Team

|

Upkar Arora, FCPA, FCA, ICD.D – CEO More Info

As CEO, Upkar is responsible for setting the overall direction, strategy and vision of Rally, and nurturing the right culture, environment and values to enable our people to flourish and deliver impact in alignment with our mission. Upkar brings sophisticated expertise in business, capital markets and finance from working with companies of all sizes, at different stages, sectors and geographies. Over the past 35 years, he has been active in investing, financing, operating and advising companies, using innovative investment structures (debt, equity and hybrid) in the public and private markets. |

|

Kelly Gauthier, MBA – President More Info

As President, Kelly is responsible for leading the team and managing the business to enable Rally to grow. Kelly anchors Rally’s impact thought leadership both internally and externally. For two decades she has helped clients create impactful portfolios. She has worked with a range of asset owners to design and implement their approach to responsible and impact investing, strategically aligning their investment and portfolio strategies with positive outcomes for people and the planet. |

|

Marc Foran, CFA, MBA – CIO More Info

Marc is responsible for Rally’s investment management services. He leads Rally’s multi-asset portfolio strategies and investments and is portfolio manager of the Rally Funds. He ensures our investment process is structured to deliver strong impact and financial performance. With two decades of experience in the financial services industry, Marc has a diverse background in managing global funds and portfolios consisting of direct and fund investments in public equities, bonds, alternative investment strategies and assets, and private equity investments. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Our impact methodology enables an extensive examination of impact intention during due diligence. Research and analysis of qualitative and quantitative data points enable evaluation of the investment product’s current and expected future impact, focusing on the significance of the issues addressed, impact performance and risks; the additionality of the fund manager’s and our investment’s contributions; the materiality of impact-focused activity; and the commitment to sustainable and inclusive practices. Embedded in our due diligence and portfolio construction is an extensive gender and social equity lens approach, that ensures both are considered in all facets of every investment. We collect demographic data at the staff, senior management, and Board level at due diligence. This helps us understand how diverse the organization is and at what level, at time of investment and change year-over-year post-investment.

For private products, we use in-house assessment tools to collect, analyze and monitor practices. We examine each private product issuer’s operations (reported across dozens of data points) across five key aspects: Impact Measurement Strategies; Diversity; Positive Employment Environment and Equality Practices; Environmental and Social Considerations; Indigenous Reconciliation Practices. For public equities, we use the materiality map from the Sustainability Accounting Standards Board (SASB) and Bloomberg’s ESG scores to supplement research. SASB’s materiality map identifies likely material sustainability issues on an industry-by-industry basis. Bloomberg provides a rating for ESG practices of publicly listed companies using its proprietary framework. Bloomberg picks the most critical aspects under each pillar to score companies, and classifies companies as ‘leading or ‘lagging’ compared to peers (for E and S the peer is sector specific, for G it is country specific). We aim for a portfolio that is leading its peers.

Impact Tracking and Monitoring

Learn More

317 Adelaide St W, Suite 1005, Toronto, ON M5V 1P9 Canada

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.