IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

MCE Social Capital

Food Systems and Agriculture

Food Systems and Agriculture Gender Equality

Gender Equality Microfinance and Low-income Financial Services

Microfinance and Low-income Financial ServicesFirm Overview

MCE Social Capital is a nonprofit impact investing firm with a mission to unlock capital to empower families living in poverty to build a better future. Through a blended finance model, MCE disburses capital from two sources: - The MCE Empowering Sustainable Agriculture (MESA) Fund, a $41M impact-first fund - Our evergreen model, which leverages the credit of high-net-worth individuals and foundations (Guarantors) to borrow and lend. With these funding sources, MCE provides capital to two types of high-impact organizations: 1. Small and growing businesses (SGBs) in agriculture, water and sanitation, and clean energy that create jobs, raise smallholder income, and increase climate resilience. 2. Financial service providers (FSPs) that improve the economic security of their micro- and small business clients by offering financial products and services. MCE currently has $81.8M outstanding in loans to mission-aligned organizations, with the available capital and investment pipeline to cross the $100M threshold in 2025.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 50% – 99%

If MCE invests agile and suitable capital in enterprises committed to sustainable livelihoods, with a focus on local economies, women and climate resilience, these enterprises can scale and create opportunities for entrepreneurs, employees and smallholder farmers, generating inclusive economic growth.

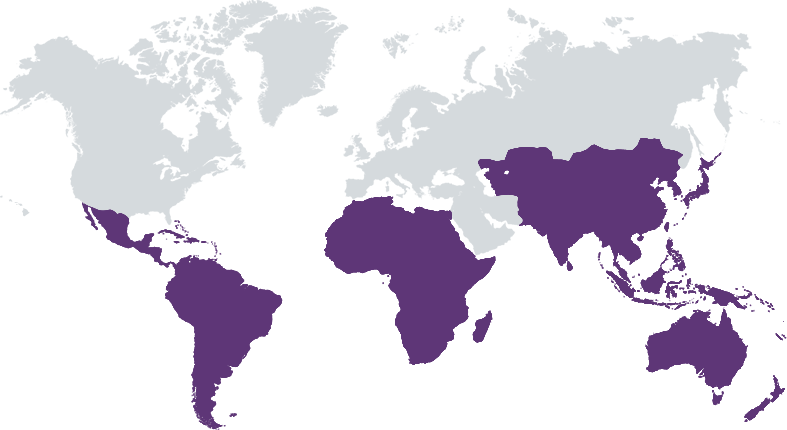

MCE brings together guarantors, lenders, donors and investors with a frontier market appetite to bridge the capital gap for enterprises building local economies. Investing in financial services and food & agriculture, MCE reaches entrepreneurs committed to generating sustainable livelihoods, with a focus on local economies, women and climate resilience. The ultimate goal is that these enterprises can scale and create opportunities for entrepreneurs, employees and smallholder farmers, generating inclusive economic growth. MCE prioritizes investing in: - Financial Service Providers (FSPs) committed to improving access to financial and essential products and services, enhancing borrowers’ business earnings and expansion, generating financial and climate resilience in the local communities, and integrating a gender lens. - Small and Growing Businesses (SGBs) committed to creating quality jobs and enhancing earnings for smallholder farmers, improving their resilience to climate change and adopting sustainable agriculture practices, as well as enhancing leadership, financing, employment and earning opportunities for women.

100% female senior leadership team. MCE is unique among our peers in the impacting investing and financial services industries with a five-person, all-female leadership team, each with 15-20+ years of experience. Commitment to reaching the missing middle. MCE’s initial loan sizes to small and growing businesses are as low as $300k, reaching a severely underserved market. Frontier market appetite. We have the experience and blended finance model to invest in markets where few other investors can (e.g., DRC, Haiti and Nicaragua). Innovative, flexible financing. MCE is recognized by its clients and peers for offering flexible financing structures that provide companies with appropriately-timed capital (e.g., revolving credit lines). Impact as our North Star. We prioritize positive impact for end-stakeholders through our portfolio companies, anchoring impact in our investment decision-making and ensuring accurate impact measurement and reporting through rigorous data collection and analysis led by our Impact Manager.

Investment Example

Azahar Coffee Company is a Colombian enterprise sourcing and exporting premium specialty coffee from 5,000 small-scale farmers in post-conflict areas, many of whom had lost their livelihoods due to displacement. Azahar developed its own Sustainable Coffee Buyers Guide, which helps buyers understand price-point to income ratios by region. Additionally, Azahar promotes climate mitigation techniques like natural pest prevention, soil enrichment and water efficiency amongst its farmers. The company’s purpose is to rebalance how value is distributed throughout the supply chain, making coffee farming a sustainable way to make a living. The price premiums Azahar farmers receive on their high-quality beans provide them with more stable and sustainable earnings within a fluctuating market. In 2023, MCE provided a $1M revolving credit facility to Azahar, becoming the company’s first international lender.

Leadership and Team

|

Camilla Nestor – Chief Executive Officer More Info

Camilla currently serves as CEO of MCE Social Capital. Over her two-decade career, she has focused on strategies that improve the economic lives of people around the world. Prior to joining MCE, she served as CEO of MIX, where she launched new strategic directions and worked to design and structure a merger with the Center for Financial Inclusion at Accion. Before that, in over a decade in leadership positions at Grameen Foundation, Camilla led global programs in financial inclusion, agriculture and health. She built the organization’s impact investing arm, placing debt, equity and guarantees that generated over $250 million for financial service providers. |

|

Elena Pons – Chief Investment Officer More Info

Elena has more than 20 years of experience in debt investments, including seven years with MCE from 2013-2020 managing impact portfolios in Latin America, Africa, and Asia. She started her career as a commercial banker in the U.S., and from there transitioned into independent consulting specialized in impact investing, microenterprises, and social entrepreneurship. In 2011, she joined boutique impact investing firm Sonen Capital where she assessed impact investment opportunities across all asset classes. |

|

Amy Bell – Chief Financial Officer More Info

Amy serves as the CFO of MCE Social Capital where she is responsible for stewarding the financial health of the organization to ensure it can provide enduring impact for the people it serves. She has spent the better part of her career demonstrating that capital markets can be designed to better communities. Amy’s work at the intersect of business and societal good started at JPMorgan Chase, where she grew the firm’s emerging impact investing business into a market leader, while managing a $100 million portfolio of investments in early-stage businesses benefiting underserved populations across the world. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Beyond the ESG and client protection assessments, MCE has developed in-house impact tools that enable assessing the potential deal’s alignment with MCE’s Theory of Change and impact goals. This ensures our investment decision making is aligned with our mission. The assessment scores indicators such as: -Women’s representation across the organization’s founders and owners, leadership, employment and consumers (2X Criteria) -The organization’s climate strategy and environmental risk management -The percentage of end beneficiaries who live in underserved rural regions For agricultural businesses, >the percentage of farmers who use regenerative practices >environmental certifications such as USDA/European Organic, Fairtrade, Rainforest UTZ or Smithsonian Bird Friendly >the percentage of end beneficiaries who receive organic inputs or technical assistance to support adaptation to climate change, improved crop yields, etc. For financial service providers, >adherence to the Client Protection Principles >additional financial and non-financial products provided including financial education classes, digital literacy classes, etc.

MCE integrates Impact, ESG and Client Protection analysis throughout the investment lifecycle. MCE ensures that potential borrowers treat their employees fairly and ethically by collecting and analyzing information on employee salaries, benefits, and turnover. We prioritize organizations with a track record of supporting female leadership in staff, management and board positions. For Financial Service Providers, we review each potential borrower’s compliance with the Client Protection Principles. MCE performs an ESG analysis of all investments to ensure we are not inadvertently supporting industries that harm local communities and environments. For Small and Growing Businesses, we ascertain that the policies and practices of borrowers do not adversely affect the health of staff, producers and beneficiaries, nor result in soil depletion, air pollution, or water contamination. Since 2020, we have been actively involved in the development of standardized impact metrics for SGBs with the Council on Smallholder Agricultural Finance.

Impact Tracking and Monitoring

Learn More

5758 Geary Blvd., #261, San Francisco, CA 94121 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.