IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

ArcTern Ventures

Climate Change

Climate Change Decarbonization and Carbon Drawdown

Decarbonization and Carbon Drawdown Energy

EnergyFirm Overview

ArcTern Ventures is a venture capital firm obsessed with helping solve the climate crisis and rethinking sustainability. ArcTern, based in Toronto with offices in Oslo and San Francisco, invests globally in breakthrough technology companies solving climate change and sustainability - we call it Earthtech. The fund was founded on the premise that accelerating the transition to a carbon-neutral economy will disrupt all industries and present an unprecedented opportunity for outsized financial returns. Within the Earthtech space, ArcTern invests across five high-impact subsectors: Electricity and Energy, Industry, Transportation / Mobility, Food Systems, and Nature.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: 25% – 49%

ArcTern‘s primary investment focus is to seek attractive financial returns through a portfolio of privately negotiated equity, equity-related or equity-like investments in Earthtech startup companies primarily focussed on developing breakthrough solutions for solving climate change and sustainability.

ArcTern aims to make initial investments at the Series A stage and targets initial Series A check sizes in the $4M range (typical Series A total round sizes range from $10-20M). Fund III (US$340M) will allocate approximately $110M to 20-25 initial investments. Approximately $230M will be reserved for ~10 follow-on investments in top-performing companies, representing a follow-on allocation of ~$20M per company. The maximum allocation to any one top-performing company will be in the $20-25M range (including initial Series A investments, as well as follow-on Series B and C investments). Series B investments are expected to be $6-8M ($20-60M+ round sizes) and Series C investments will be $10-12M ($50M+ round sizes), with variations expected. ArcTern Fund III will have a 10-year fund life, with a 5-year investment period and 5-year harvesting period and will aim to exit investments in a 5-year time frame.

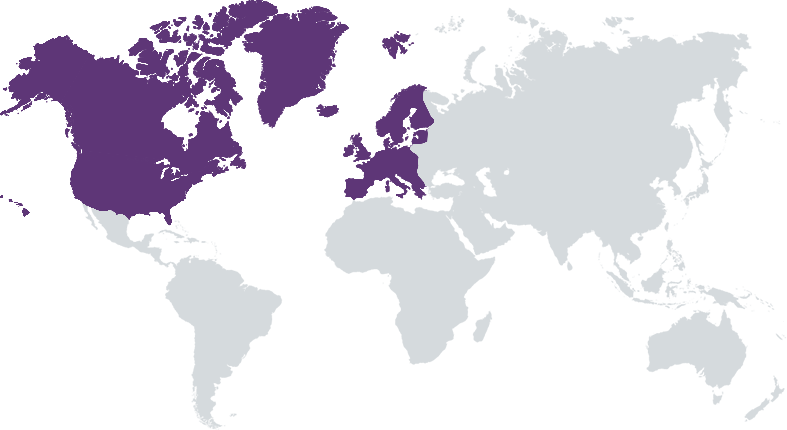

Climate Credibility: We’ve been investing in the Climatetech sector for over a decade and have deep sector knowledge. We win or get invited to join the top deals because of our added expertise and brand value. We’re ex-Founders: ArcTern’s Managing Partners have all founded, scaled, and exited venture-backed startups. We connect with entrepreneurs, which enables us to win deals and build strong CEO relationships. Global Network: We’ve built an extensive global network (800+ active relationships) for deal flow and assisting portfolio companies with fundraising efforts. Focus on Winners, not Geography: ArcTern identifies best-in-class companies in emerging Climatetech subsectors regardless of geography (NA or EU), which allows it to see 2x the number of potential outliers. Deal Selection Ability: Proven ability to process a high volume of deal flow and select winners, underpinned by: (a) screening criteria, (b) pattern recognition (experience), and (c) deep fundamental diligence by a world-class investment team

Investment Example

In September 2024, ArcTern invested in King Energy, a company that turns unused commercial rooftops into clean energy assets. King Energy simplifies solar adoption by managing the entire process, from financing and installation to maintenance, while solving the "split-incentive" problem with its innovative billing solution. Property owners benefit from increased rental income and property value, while tenants gain access to clean energy at lower rates. King Energy has the potential to reduce emissions by approximately 230M tCO2eq/year in the US by unlocking the solar potential of multi-tenant properties. ArcTern’s partnership goes beyond funding; Partner Mira Inbar will join King Energy’s board, bringing valuable expertise to help guide the company’s growth. Together, we are driving meaningful environmental impact and advancing renewable energy adoption.

Leadership and Team

|

Murray McCaig – Co-founder & Managing Partner More Info

Murray is an experienced company builder with a passion for generating positive environmental impact. He has founded and led the growth of multiple technology startups: Spotnik Mobile—a wireless technology company sold to TELUS, a mobile carrier; EnviroTower—an energy efficiency solution for commercial buildings; and Fluence Corporation—a global municipal and industrial water treatment business. Earlier in his career, Murray was a principal with the McKenna Group, a Silicon Valley-based strategy consulting firm, where he worked with global tech companies and early-stage ventures to launch new innovations. |

|

Marc Faucher – Managing Partner More Info

Marc has spent his 25-year career at the intersection of tech and emerging markets, as both a venture capital investor and a company builder. Before ArcTern, Marc was COO and co-founder at Unata, an enterprise software platform for grocery retailers across North America. It was successfully sold to Instacart in 2018. Prior to that, Marc was an investment partner with the BlackBerry Partners Fund and Summerhill Venture Partners, two technology-focused VC funds. He has lived and breathed every stage of the investment lifecycle. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

The first aspect of ArcTern’s investment screening criteria is environmental impact. ArcTern targets investments with an annual environmental TAM of 200+ megatonnes of GHG emissions per year (the potential to reduce GHG emissions by 200+ megatonnes/year if the company achieved 100% market share). At the company level, the firm has adopted a consistent and straightforward GHG emission reduction calculation methodology based on identifying the GHG reduction factor per unit of production or service, which is derived from a combination of peer-reviewed academic research and company input. Within the Earthtech space, the Fund will principally focus its investment activities in the following sectors that reduce GHG emissions or have other positive environmental benefits (e.g., reduction of waste, pollution, and toxins; protection of ecosystems and biodiversity): Electricity and Energy (Production, Use, Transport), Clean Industry, Transportation and Mobility, Food Systems, and Nature (other environmental or climate resiliency benefits).

In addition to screening for environmental impact potential prior to investment and post-investment, ArcTern monitors and reports ESG metrics in an annual Impact Report. At a product-level, ArcTern’s latest fund, Fund III, has been voluntarily classified as an Article 9 fund under the SFDR where the fund has sustainable investment as its core investment objective. As a result, the Principal Adverse Impact (PAI) Indicators are utilized during the due diligence processes. Where possible, ArcTern will request information from the target company on the PAI indicators and consider them when making investment decisions. ArcTern will also annually request an update from the portfolio companies on PAI Indicators as part of post-investment monitoring & support and disclose the results annually an Impact Report. ArcTern also assesses sustainability by incorporating recommendations from the TCFD, UN PRI and, when possible, the EU Taxonomy alignment, to assess the sustainability risk of a potential investment.

Impact Tracking and Monitoring

Learn More

2 Bloor Street West, Suite 504, Toronto, Ontario M4W504 Canada

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.