IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Amplify Capital

Climate Change

Climate Change Education

Education Health and Wellbeing

Health and WellbeingFirm Overview

Amplify Capital is a Toronto-based impact venture fund backing early-stage companies addressing global challenges in health, education, and climate. Founded in 2016, we focus on generating measurable impact alongside superior financial returns. Our investments support companies to achieve commercial success, attract traditional investors, and scale their impact. Amplify’s approach aligns with the UN Sustainable Development Goals and leverages best-in-class frameworks, including the 5 Dimensions of Impact. Our diverse team brings a range of perspectives, fostering an inclusive, high-performing culture that drives results. Our impact-first strategy consistently delivers top decile returns for investors while creating a more sustainable planet. Through comprehensive support across all business functions, we add value to our portfolio companies, validating our investment approach.

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 25% – 49%

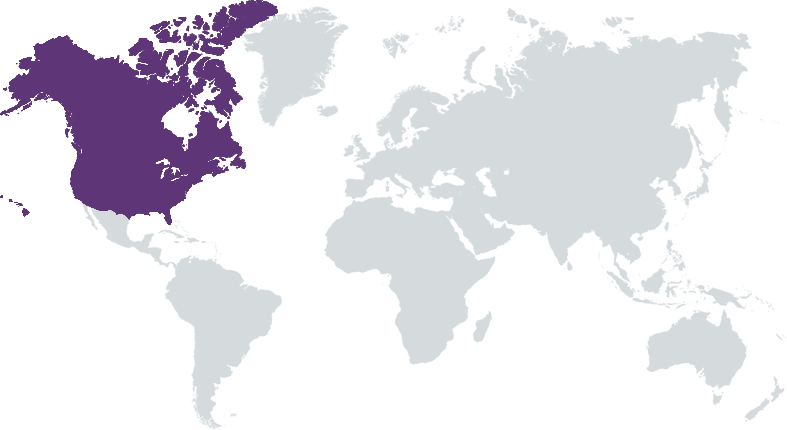

Amplify Capital is an early-stage impact fund investing in startups addressing urgent and necessary challenges in climate, health, and education across Canada and the U.S., at the Pre-Seed to Series A stages, delivering exceptional impact and superior returns.

Amplify Capital is an early-stage impact fund investing in relentless founders in pursuit of exceptional impact and superior returns. We invest in startups addressing urgent and necessary challenges in climate, health, and education across Canada and the U.S., at the Pre-Seed to Series A stages. Leading half our deals, our initial cheques are $1M, with 1:1 reserve for follow on investment. Our strategy targets scalable technologies meeting the urgent needs of underserved markets. By applying a rigorous quantitative impact lens aligned with the UN SDGs, the 5 Dimensions of Impact, and GIIN metrics, we uncover high-potential opportunities that traditional investors often miss. This approach consistently yields top-tier results. Our impact-first strategy consistently demonstrates that investing with impact results in superior financial returns, creating lasting value for stakeholders, society and the planet.

Amplify Capital's distinct impact-first approach integrates best practices like the SDGs, 5 Dimensions of Impact, and BCorp standards, guiding our process from screening to post-investment. This ensures founder alignment and a track record of superior impact and financial returns. Our proprietary deal flow and rigorous diligence provide access to top opportunities, allowing us to invest early and maintain active governance. Founders benefit from hands-on support, fundraising help, KPI reporting, and access to our network and portfolio hub. Our diverse team—spanning gender, age, ethnicity, and expertise—brings unique perspectives, driving differentiated deal flow and a high-performance culture. This comprehensive approach creates value, leading to exceptional positive environmental and social impact, and strong returns for our LPs.

Investment Example

Rally Reader (Palo Alto, CA) tackles the U.S. literacy crisis, where 68% of children—80% in underserved communities—cannot read proficiently by 3rd grade. The app acts as a personalized reading coach, improving literacy with real-time feedback and access to 50,000 eBooks. Proven to boost reading fluency, 71% of students read more after using the app. Founder Andrea Reisman Johnson established strategic partnerships and expanded into a robust pipeline of school districts across North America, positioning Rally Reader for large-scale growth. Long-term economic benefits from improved literacy could add $67 billion to the economy. Andrea chose Amplify Capital as an investor for our EdTech expertise and our shared vision of solving the literacy crisis.

Leadership and Team

|

Kathryn Wortsman – Managing Partner More Info

Kathryn Wortsman is the Founder and Managing Partner of Amplify Capital. Kathryn began her career in investment banking at RBC and has 25 years of experience in venture capital, private equity, capital markets, M&A and as an operator, working in both New York and Toronto. She served as a Principal at Constellation Ventures and Investment Director at MetLife in New York, and later joined CIBC Capital and BMO Capital Partners in Toronto. Passionate about social finance, Kathryn founded Social Venture Partners Toronto, growing it to 45 partners and providing $350,000 in grants to tackle homelessness. Today, she leads a team of six, managing two funds and 22 portfolio companies across North America. She sits on several boards, including Verto Health and Lucid Therapeutics. Kathryn holds a BA in Economics from the University of Western Ontario and an MBA from Columbia University. |

|

Daniel Armali – Partner More Info

Prior to joining Amplify Capital, Daniel worked for Canada's largest venture capital investor. He started his career working for Fortune 500 technology companies including Microsoft, OpenText and comScore, before moving to the Bank of Canada, where he spent time on asset management for the pension plan with the financial markets department responsible for the foreign reserves portfolio and domestic debt portfolio. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Amplify Capital systematically targets companies where impact is core to their business model. Our investment success is driven by supporting companies where social or environmental impact is embedded in their products or services. From deal sourcing to due diligence, our impact-first strategy ensures that we invest in startups positioned to make significant contributions to our fund’s goals: sequestering 100 megatonnes of CO2e, improving learning outcomes for 30 million learners, saving healthcare systems $1 billion, and improving health outcomes for 30 million patients. We rigorously assess whether each company’s mission, technology, and team align with delivering these impact outcomes. If they do not clearly align with our ambitious impact targets, we do not proceed. This disciplined approach allows us to focus our resources on companies committed to measurable, scalable impact, reinforcing our belief that we can generate superior financial returns and exceptional impact.

Amplify Capital systematically assesses companies' social and environmental sustainability practices during deal sourcing and due diligence. We consider governance structures, leadership diversity, future hiring practices, and integration of ESG principles into operations. Leveraging GIIRS, we also determine whether the company's product or service addresses a specific social or environmental issue and if target users are underserved. We encourage our companies to adopt strong governance, sustainable operations, and a culture of diversity and inclusion. Post-investment, we actively support our portfolio companies through the B Impact Assessment, helping them to pursue B Corp certification to maintain excellence in governance, social and environmental sustainability.

Impact Tracking and Monitoring

Learn More

33 Bloor Street East, 5th Floor, Toronto, Ontario M4W 3H1, Canada

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.