IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Adenia Partners

Decarbonization and Carbon Drawdown

Decarbonization and Carbon Drawdown Diversity, Equity and Inclusion

Diversity, Equity and Inclusion Gender Equality

Gender EqualityFirm Overview

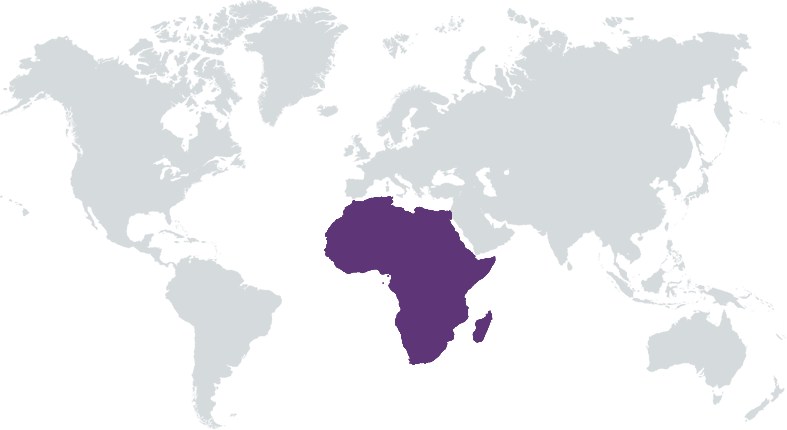

Adenia Partners is a private markets investment firm with over $800M assets under management, committed to responsible investing and a sustainable Africa. Founded in 2002, Adenia has a proven track record with 35 platform investments executed and 20 realized exits. Based on-the-ground across Africa, Adenia has one of the most highly qualified African private markets investment teams in terms of educational pedigree, longstanding experience as entrepreneurs and investors, and local in-depth knowledge. By creating stronger companies with quality jobs, fostering economic improvement, and elevating companies to meet ESG standards, Adenia is increasing the enterprise value for investors, whilst benefiting workers, communities, and companies in Africa. As a firm, Adenia has set ambitious goals with regards to promoting gender lens investing and minimizing the environmental impact of its investment program.

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

To take controlling positions in under-managed medium-sized companies in Africa and transform them into local and/or regional champions. We do this by taking a hands-on approach and by instilling an ESG culture and creating financial and social value through the implementation of operational, ESG, and impact action plans.

Adenia is disciplined in its approach to majority ownership. 32 of the 35 investments made in the last two decades have been control transactions. Maintaining control allows Adenia to set the agenda throughout an investment’s life in terms of financial and extra-financial value creation, preservation, and realization. Prior to investment, among other analyses, ESG and Impact due diligence is conducted. Post-investment, Adenia and its co-shareholders define ambitious strategic plans to transform each investee into a local champion that is performing in line with international best governance and operational practices. Significant HR and financial resources are mobilized to achieve such plans, catalyzed by Adenia’s controlling shareholder position. Core among Adenia’s role within an investee, is the building and motivation of management teams, who lead the companies day-to-day to achieve their targets. Finally, with Adenia’s control stake, exits are triggered with a timing and nature most optimal for Adenia’s LPs.

Adenia stands apart from its peers in the following ways: 1. Hands-on approach with operational involvement in mid-sized companies. Through strong and proactive support to management teams, Adenia enables top-line, bottom-line, and ESG improvement . 2. Control investment focus. This enables Adenia to drive radical change and maximizes liquidity with the possibility to dispose businesses to strategic players ready to pay premium valuations. 3. Local presence. Through our offices on the ground across Africa, Adenia is active in the local business community and very close to its portfolio companies. 4. Experience. Adenia can demonstrate an established and positive track record through its acquisitions of 35 founder-led / family owned businesses and 20 successful exits, translating into strong returns for investors. We have won the ESG Performance Award from BII, GPCA award for Best Generalist Fund Manager, AVCA award for 20 years of outstanding achievement and several Environmental Finance awards.

Investment Example

In 2018, Adenia merged two small retailers to create Quickmart and subsequently grew it into the second-largest supermarket chain in Kenya. This investment has yielded impressive financial results, but also substantial economic, social, and environmental impacts across the region. • Economic Growth & Job Creation. By expanding the store network (from 9 stores in 2018 to 60 in September 2024) Quickmart has created over 3,000 direct employment opportunities with an additional 17,000 jobs supported through its supply chain, and 100,000 induced jobs created through economic multipliers. The broad-scale employment impact is further underlined by Quickmart’s contribution to Kenya’s GDP, representing a total economic effect of KShs 163 billion in 2023. • Promoting Gender Inclusivity: Adenia’s commitment to driving gender equality within its portfolio is evident in Quickmart’s workforce transformation where female employment increased by 80%. • Financial performance: +30% CAGR of revenue and EBITDA, resulting in >3x valuation boost (in USD terms)

Leadership and Team

|

Antoine Delaporte – Founder Managing Partner More Info

Antoine Delaporte founded Adenia Partners in 2002 based on the principles of responsible investment and majority ownership with hands-on support. Adenia’s principles, values and investment strategy has remained consistent while the group has grown to become one of the leading pan-African private equity investment firms. Before founding Adenia, Antoine had built a reputation as one of the most experienced and successful entrepreneurs in Madagascar, developing three companies with an employee base of more than 2,500. |

|

Alexis Caude – Managing Partner More Info

Alexis Caude is a Managing Partner at Adenia. Based in Mauritius, he oversees numerous investments made in the Indian Ocean, East Africa and South Africa. Alexis is a a serial entrepreneur, finding particular success in creating and growing digital businesses. He founded and chaired the Executive Board of NEWSWEB, a leading online publisher that went public on the Paris Stock Exchange (Euronext) in 2006 and was subsequently acquired by the LAGARDERE Group. He has also founded and co-founded two other digital businesses that he grew and eventually sold to two strategic players, achieving superior returns to investors. |

|

Stephane Bacquaert – Managing Partner More Info

Stéphane Bacquaert is a Managing Partner at Adenia, primarily focused on leading Adenia’s private equity activities in North and West Africa. He has 25 years’ experience as a private equity, venture capital and consulting professional. Stéphane joined Adenia in 2019 from Wendel where he was Managing Director and CEO of Wendel Africa for 15 years. At Wendel, Stéphane led the IPO of Bureau Veritas (Euronext: BVI) where he has been a Board member for over a decade. He led the investment strategy of Wendel in Africa where the group invested over $1 billion in equity since 2013. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

For each investment, Adenia performs an extensive ESG due diligence including against the IFC Performance Standards, applicable ESG regulations and international sanctions databases. This enables to identify both ESG risks and opportunities. Each company is rated against the BII E&S risk rating (low, medium, medium-high, high) and against the FMO criteria for good corporate governance. We also measure In addition, we define a Theory of Change that identifies the main opportunities to contribute to the advancement of SDG 5, 8, 9 and 13 and other relevant, sector-specific SDGs.

Impact Tracking and Monitoring

Learn More

1st Floor Office 12, The Strand 1, Beau Plan Business Park, Beau Plan, 21001, Mauritius

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.