IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Satgana (GP) Sàrl

Climate Change

Climate Change Food Systems and Agriculture

Food Systems and Agriculture Water and Sanitation

Water and SanitationFirm Overview

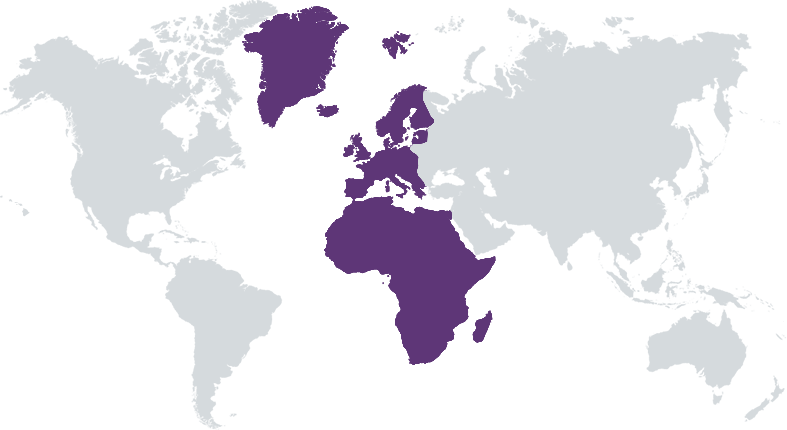

In Sanskrit, Satgana (सत् गण) means a good company. We are on a mission to harness Venture Capital as a catalyst for the next generation of purpose-driven entrepreneurs building technology solutions to heal our planet, generating positive impact at scale. Satgana’s Climate Tech VC Fund targets top decile financial returns investing in early-stage startups across Europe and Africa. As a SFDR Article 9 Fund, our investments actively contribute to the Climate Change Mitigation in alignment with the UN Sustainable Development Goals with a Diversity & Inclusion lens.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: 100%

-Vertical: Climate Tech & Sustainability -Stage: Pre-Seed & Seed -Geography: Europe (70%) & Africa (30%) -Portfolio management: hands-on support, knowledge & networks

Satgana bridges the Climate Tech early-stage financing gap, while mitigating early-stage risks by investing hands-on operational resources into the next generation Climate Tech Venture Capital firm investing in the Future of Earth. Tackling the climate & ecological crisis is the biggest challenge and the biggest business opportunity of our generation.

We invest earlier than most institutional capital, not being afraid of making big bets on yet-to-be-discovered mission-driven entrepreneurs shaking the status quo to make a real difference in the fight against climate change. We look for the outliers who build the world we want to live in tomorrow, today. Founders want us because of our value add & ethos. Post-investment, we give our founders an infinite amount of love (not an infinite amount of capital), in the form of strategic advice, deep networks, perks with partners, and operational support thanks to our managing partners, advisors and LPs.

Investment Example

Satgana Fund I SCSp has led the first round of Orbio Earth (€600k Pre-Seed), a methane intelligence startup helping energy operators to monitor and reduce methane leaks. Orbio then joined YC after our investment, quadrupled in revenue and raised a $3.5m Seed round with top tier Silicon Valley-based VCs. From a CO2eq perspective, fixing methane leaks from the energy sector would equate to remove all cars from our roads.

Leadership and Team

|

Romain Diaz – General Partner More Info

Former CEO & Co-Founder of Far Ventures, a pioneering Venture Studio in Africa (current MOIC x12 / IRR 50%) -Advisor at Launch Africa Ventures and Antler France -Former Venture Builder at Rocket Internet & Naspers Ventures -5 companies co-founded, 10 early-stage investments made -MSc from EM Lyon Business School |

|

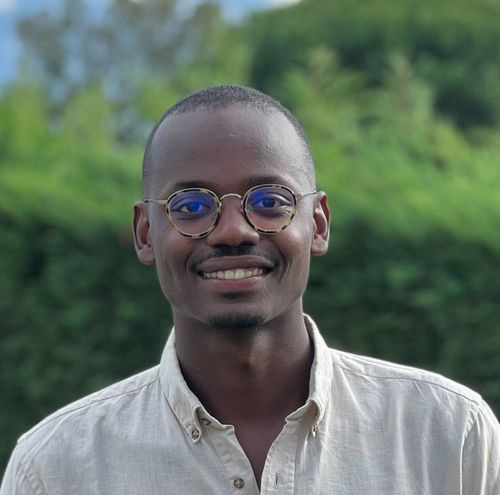

Anil Maguru – Partner More Info

-Former Impact Investor at Bold Rock Management, Family Office with €1Bn+ in AUM with a focus on Impact VC funds & direct investments -40 investments made -French & Rwandan citizen -MSc in Finance from EDHEC Business School & Imperial College London |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Upon application, we have a stringent due diligence process in place carried out by a diverse team of professionals to ensure the startup takes a triple bottom line approach. Our aim is to fund startups that demonstrate a high environmental performance. We're an Article 9 fund as defined by the EU taxonomy: we measure our Principle Adverse Impacts (PAI) and we Do Not Significant Harm (DNSH) as per the SFDR requirements. We have a quarterly review of our social and environmental performance with our Board of Directors. Our investments are into early stage startups that may not have the tools/knowledge to obtain their climate data. But as investors, we proactively assist with the process by providing strategic support on evaluating, quantifying and reporting on environmental issues. We prioritize metrics such as a startups carbon footprint, resource efficiency, biodiversity conservation, material use etc.

Diversity metrics, especially regarding gender, are looked at. When teams do not have gender-diverse teams, and when we lead investments, we include a clause in our term sheets for them to work towards increasing female representation and parity within their team

Impact Tracking and Monitoring

Learn More

18 rue Robert Stümper, L2577 Luxembourg, Grand Duchy of Luxembourg

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.