IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Springbank

Diversity, Equity and Inclusion

Diversity, Equity and Inclusion Health and Wellbeing

Health and Wellbeing Workforce Development, Upskilling and Retraining

Workforce Development, Upskilling and RetrainingFirm Overview

Springbank is an early-stage venture fund investing in infrastructure that helps women and working families live healthier, happier, and more economically resilient lives. We can unlock greater workforce productivity, improved public health, and positive social outcomes by supporting this underserved demographic. We focus on a multi-trillion dollar opportunity. We partner with all founders across different ages, genders, and backgrounds, investing from pre-seed to Series A but supporting the company through their entire lifetime. When our community invests in you, we invest in your success and will be your strongest advocates, fiercest supporters, and most tireless collaborators. Our network forms a vast collective of operating executives, investors, and partners across entrepreneurship, corporate leadership, government, and public policy — we leverage its full force in supporting our founders. For the companies we work with, there is no problem beyond the purview of the Springbank community.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: Less than 25%

Springbank is an early-stage venture fund focused on investing in infrastructure that helps women and families live healthier, happier, and more economically resilient lives.

We believe that there’s a huge opportunity to create a new infrastructure that will not only undo generations of gender and social inequity but also unlock $12 trillion in GDP. That’s why we invest in the products, tools,and services that will create the new fabric of a more equitable society. These fall into three key areas: Care: Connected, innovative solutions for caregivers across children, elders, and themselves. Career: Reforming and reimagining work to enable fair, flexible, and dignified careers. Consumer: Leveraging technology to make sustainable improvements in daily life, making peoples’ lives easier, in and out of the home.

Beyond just the core fund, we created the Springbank Collective — a group of hand-picked members from across sectors and industries who invest alongside us and add value to portfolio companies. We couple that with our Leadership initiatives — influencing thought & policy towards our thesis — and Resources — bringing opportunities to founders within our network and the ecosystem as a whole. The Springbank network, in its totality, spans dozens of leaders across F500 companies, think tanks, NGOs, and government officials. We are officially partnered with the FamTech Founders Collective, New America, and Paid Leave to champion the future we all see so brightly. These diverse and valuable perspectives provide cross-sector insights and support to our portfolio companies and partners that not only position our portfolio companies to succeed at scale, but it also ensures that we are creating solutions that work for everyone.

Investment Example

We invested in Wellthy which is revolutionizing how families organize care for their loved ones. Through precision technology and expert care coordinators, Wellthy helps families manage and navigate care, specifically for families with aging, disabled, and chronically ill loved ones. 2M+ people have access to Wellthy today through some of the largest and best-known employers (Accenture, Google, Best Buy, Hilton) and health plans across the country. 40% of eligible caregiving employees engage with Wellthy throughout the year, which results in reduced absences and improved retention, especially for women and diverse employees.

Leadership and Team

|

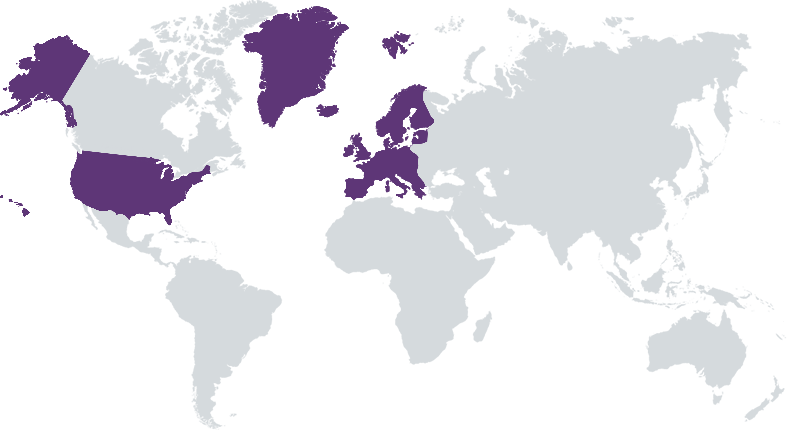

Courtney Leimkuhler – Managing Partner More Info

Courtney Leimkuhler is a co-founder and partner at Springbank. Before founding Springbank, Courtney spent her career in the financial services industry from large publicly-traded companies to fintech start-ups. She was the Chief Financial Officer of Marsh, the world’s leading corporate insurance broker with 35,000 employees in over 100 countries. Before that Courtney spent a decade at the New York Stock Exchange from pre-IPO through the sale of the public company in 2013 where she was the head of M&A and Corporate Strategy. Courtney began her career at Goldman Sachs. |

|

Elana Berkowitz – Managing Partner More Info

Elana Berkowitz is a founding partner of Springbank. A serial social entrepreneur and policy wonk, she’s a former Obama Administration technology policy official who has worked across the Obama-Biden Transition Team, the FCC and Secretary Clinton’s office at the State Department. She also served as innovator-in-residence for CARE, one of the world’s largest humanitarian organizations. She’s acted as an advisor on strategy, user insights, and impact partnerships consulting for companies and organizations, including Etsy, Kickstarter, Google, and Code for America. |

|

Jen Lee Koss – Founding Partner More Info

Jen Lee Koss is a founding partner of Springbank. She has spent the majority of her professional career focused on the consumer and retail sectors. In 2012, she founded an experiential retail agency, BRIKA (acquired in 2021 by SALTXC), that has collaborated with some of the best brands, property developers, and retailers across North America. Prior to BRIKA, she worked for over a decade in management consulting (The Parthenon Group and The Bridgespan Group), in investment banking, and as an investor — both across private equity and funds’ management at Ontario Teachers’ Pension Plan. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Our thesis is to invest in infrastructure that can close the gender gap - across women’s careers, their caregiving responsibilities, and the financial and physical health of families. In essence our work is about product-led impact. We invest in companies where the product or service being created IS the impact we want to see -- so the more they sell, the more money they make, the greater the impact. A good example is our portfolio company Parento which offers paid parental leave insurance to small employers. Parento data shows that when their clients’ employees take leave, the birthing parent returns to work over 95% of the time vs about 65% of the time when no paid leave is offered. This type of product-led impact focus drives complete alignment between us as market-rate return investors and the impact we are trying to achieve.

Impact Tracking and Monitoring

Learn More

25 N Moore St., New York, NY 10013 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.