IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Winnipeg Ventures LLC

Diversity, Equity and Inclusion

Diversity, Equity and Inclusion Education

Education Workforce Development, Upskilling and Retraining

Workforce Development, Upskilling and RetrainingFirm Overview

Winnipeg Ventures, a Delaware-based company, is the manager of the Seedstars Winnipeg Edtech Fund (SWEF), the first EdTech and Future of Work fund in Latin America. The general partners, Ana Maria Aristizabal and Jose Garcia Herz have invested in more than 20 edtech and future of work companies. Their proof of concept fund has a MOIC of 2.6x and includes notable startups such as BeeReaders, EdMachina and Talently. SWEF is supported by venture partners and advisors specialized in education, investing and technology, including: Andre Bennin (Partner at Rethink Education), Brian Greenberg (Founder of the Silicon Schools Fund), Dina Buchbinder (Founder of Education for Share), Marcelo Burbano (Founder of edtech company Arukay), Beatriz Salazar (Co-Founder of Teach for Peru), Ivan Pasco (pioneer of the internet industry in Peru).

Years of Operation: 5 – 9 years

% of Capital from Top 3 Investors: 50% – 99%

SWEF will fund the technological innovations that will shape the future of education and work in LATAM, uplift the workforce and prepare current and future generations for the jobs and challenges of the 21st century. SWEF acts as lead seed investor and supports its best companies until their series A.

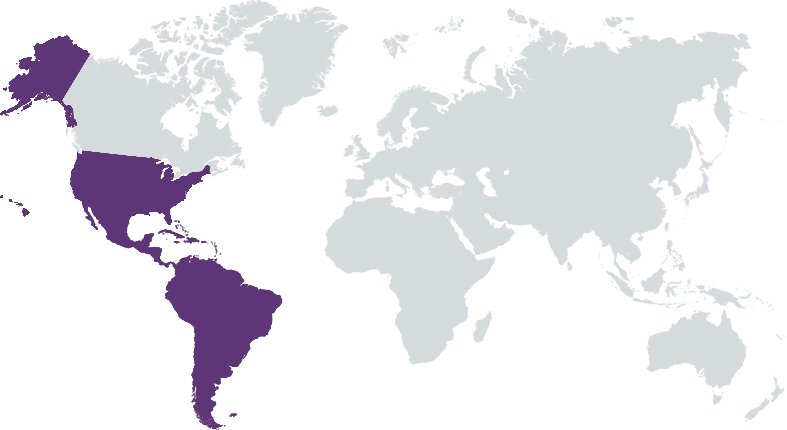

SWEF will invest in Edtech and Future of Work companies whose products and services improve the lives of Latino/a learners and workers. We will invest in and lead primarily seed rounds and will reserve capital for follow-on investments until Series A. We plan to invest in 35-40 companies with initial tickets ranging between $200,000 to $800,000 and follow-on investments up to $3.5 million. While our primary focus of impact is Spanish-speaking Latin America, we will carefully consider startups serving the Latino/a market in the US, as well as Brazilian startups with the potential to serve the rest of the region.

SWEF has a first-mover advantage as the pioneering edtech and future of work fund in LATAM, offering investors unparalleled access to pipeline and sector expertise. Global edtech funds lack boots on the ground and invest in later stages, while regional funds lack sector-specific knowledge and a network to support early-stage edtech companies. We are able to lead rounds and support companies’ growth. Few regional funds can lead early-stage rounds in the sector, and international investors typically follow local players. The GPs have 50+ years of experience as investors, educators, and operators. They have invested in and supported 22 early-stage edtech and future of work startups and will be supported by a team of venture partners, advisors, and IC members specialized in education, operations, and technology. We have built a robust strategic partner network, starting with Seedstars and their entrepreneur support expertise, followed by renowned universities and corporate foundations.

Investment Example

Through its proof of concept fund, Winnipeg invested in Beereaders, a digital platform dedicated to increasing reading comprehension among latino K-12 students. At that time, they operated in Peru and Chile, worked with 80 schools and engaged 20,000 students on their platform. Since our investment in 2020 they have extended their reach to Mexico and the United States. Their partnership network has grown to include more than 400 schools and their user base has skyrocketed to 250,000 students. A recent study demonstrated 11% increases in reading comprehension, driven by their commitment to improving literacy skills among young latino learners throughout the Americas. Today, Beereaders boasts annual recurring revenues exceeding $1.5M, representing a remarkable 14.4x increase (since our investment). Moreover, it is currently valued 4x the value at which we initially invested, demonstrating the dual return approach of our investments.

Leadership and Team

|

Ana Maria Aristizabal – General Partner More Info

Ana is a seasoned impact investor education operator. She has invested in and scaled startups since 2011. She is a Professor of impact investing at Columbia University and serves on the board of Village Capital. Previously, she was a Venture Partner at JFF Ventures, led the growth of KIPP schools in California, led equity investments in LATAM for Bamboo Capital Partners and executed $3B in investment banking transactions at Citi and ABN AMRO in Colombia. |

|

Jose García – General Partner More Info

Jose has a rich background in education, private equity, and venture capital. He teaches entrepreneurship in prestigious Peruvian universities. He raised and managed four PE funds with a total AUM of $130M and launched Winnipeg's inaugural VC fund, resulting in 26 investments. Serving as Chairman of PECAP, he drives the advancement of the Peruvian VC ecosystem. Jose's financial expertise is evidenced by over $1 billion in transactions at KPMG, Flemings, and NBK Bank. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

SWEF will invest in companies where social impact on learners, workers and/or their supportive ecosystem, is integral to their product or service. To be considered for an investment from SWEF, startups must have a product or service that can or has the potential to increase access to quality education (SDG 4) and/or increase people’s access to better job opportunities and economic mobility (SDG 8). Through this exercise, SWEF will also assess the startup’s ability to reduce inequality (SDG 10) and promote gender equality (SDG 5). After a startup has been selected for the portfolio, the SWEF team will work closely with the founders to help them define their key performance indicators (KPIs) and impact metrics based on the IRIS+ standards.

As part of its investment approach, Winnipeg Ventures rigorously assesses the company's social practices during due diligence.This evaluation includes an examination of their adherence to industry standards (IRIS+), diversity, equity, and inclusion (DEI) practices, corporate governance, and social responsibility initiatives. We proactively advocate for the adoption of good governance principles, endorse diversity, equity, and inclusive hiring practices, implement robust parental leave policies, and actively address pay gaps. Furthermore, we closely monitor diversity metrics with the goal of achieving gender-balanced representation. Our firm is committed to transparency and accountability, exemplified by our annual ESG report, which offers insight into our portfolio companies and internal ESG metrics and assessments. This commitment reflects our dedication to these values and determination to make a positive impact on sustainability and social responsibility.

Impact Tracking and Monitoring

Learn More

Harrison Street, Hoboken, NJ 07030 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.