IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Shared Interest

Climate Change

Climate Change Energy

Energy Entrepreneurship and Job Creation

Entrepreneurship and Job CreationFirm Overview

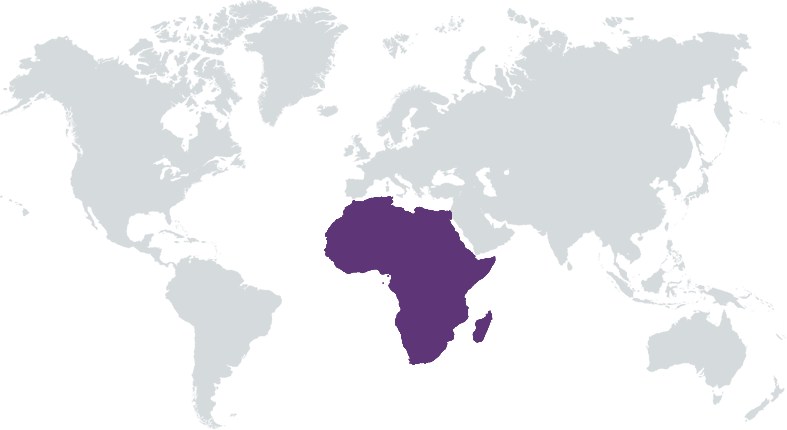

Established in 1994, Shared Interest is a US-based non-profit investment fund that provides access to local capital and technical support for small and growing businesses, small-holder farmers and cooperatives in Southern Africa. Shared Interest helps move Southern African commercial lenders to extend credit to clients they would otherwise consider “unbankable” – and to make them their “ordinary business.” Shared Interest works through local partners to supply local technical assistance for clients (including how to build relationships with local lenders). We further provide support services to the financial institutions themselves so that they will adapt their products and practices to the needs of their new markets

Years of Operation: 10 years or more

% of Capital from Top 3 Investors: Less than 25%

Shared Interest utilizes loan guarantees to provide the necessary collateral to unlock capital of Southern African financial institutions that provide loans to small & growing businesses and agricultural enterprises & co-ops.

Shared Interest mobilizes the financial resources of Southern Africa's own commercial lenders - facilitating their loans to black women entrepreneurs and other small and growing businesses by partially guaranteeing them. The goal is to catalyze mainstream commercial loans to the majority market - unlocking the equivalent of millions of dollars (more than $131M to date) in loans to entrepreneurs. The guarantee fees paid by the lenders and beneficiaries help to cover the costs of the technical assistance Shared Interest's partners provide to beneficiaries and banks. The guarantees themselves take the form of letters of credit (L/Cs) issued by commercial banks. Investors' loans to Shared Interest are in turn invested in high-quality securities that serve as the collateral that backs the L/Cs. Investors' returns consist of a portion of the interest these securities earn while they are unlocking commercial credit for some of Southern Africa's lowest income people.

Given our size relative to our guarantor competitors (typically parastatal organizations), we are able to work on smaller transactions and complete our due diligence and approval processes quickly. Additionally, the collateral we offer takes the form of a standby letter of credit which is easily and efficiently drawn upon by a lender if required.

Investment Example

The demand for formal, affordable low-income housing in South Africa’s urban centers far outstrips supply. Nearly 12.5 percent of South Africa’s approximately 60 million people, particularly in the urban areas, live in under-developed backyard dwellings that are often disconnected from water, waste, and energy services, creating public health risks and unsafe living conditions. The commercial banking sector provides little to no access to capital for township homeowners or property developers. To address the affordable housing crisis in South Africa, Shared Interest provided a partial credit guarantee to its lending partner Lead Investment Capital to support the Inclusive Housing Fund (IHF) project in South Africa. Through IHF, approximately 31 low-cost apartment buildings with about 470 rental units will be built—creating 500 jobs and benefitting 1,500 individuals with housing, primarily benefitting women and youth.

Leadership and Team

|

Ann McMikel – Executive Director More Info

Ann McMikel is a global development leader with more than two decades of experience in the non-profit sector. She joined Shared Interest from the Black Women's Health Imperative, where she served as the Chief Development Officer/Executive Director of SIS Circles. Previously, she served as the Executive Director of Step Up in Atlanta, GA, executing the organization's mission to support teen girls from under resourced communities. Earlier in her career, she spent 16 years at the American Cancer Society, ultimately in the role of VP, Global Partnership and Planning, where she helped establish global programs focusing on women's cancer, pain control, and tobacco control, helping to make cancer a worldwide health and development priority. |

|

Amye Jameson – Senior Director of Operations More Info

Amye Jameson previously served 14 years with the Office of Fiscal Accountability and Compliance (OFAC) for the State of New Jersey, Department of Education, as a Team Lead and Special Investigator overseeing the compliance review process and compliance audits. Amye has extensive experience in banking, serving as Assistant Vice President at First Third Bank, Columbus, OH. Revitalizing her own prior experience as the owner of AA and Associates, a small business consulting firm, Amye has most recently been an independent contracting consultant for non-profits and small business in NJ, FL and WA, including working with a non-profit whose programs promote comprehensive wellness in girls by cultivating their mind, body and spirit through our holistic based initiatives. |

|

Dorcas Onyango – Global Programs Senior Advisor

Ms. Onyango oversees the programming strategy and the implementation of latest business model for Shared Interest in Southern Africa. Ms. Onyango previously served as the Coca-Cola Africa Sustainability Director. Ms. Onyango is an innovative and accomplished communications and sustainability professional with extensive experience leading marketing, innovative women’s economic development programming and stakeholder engagement strategies in Africa's private sector. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

75% – 99%

|

When first looking at potential investments, we prioritize organizations owned and managed by people of color and predominantly women. We then look at the impact of the products and services ensuring the business will create and sustain jobs, address gender equity issues through these jobs and services offered in the community, employ adaptation, mitigation, and resilience strategies to combat climate change, and empower rural livelihoods through smallholder farmers to promote food security.

We look at racial and gender diversity within the ownership, management, and employees of the prospective investee. We also take into account the business' environmental impact, e.g., whether the business helps create increased climate resilience or, conversely, if it is accelerating climate change, extracting local resources, or otherwise operating unsustainably.

Impact Tracking and Monitoring

Learn More

1412 Broadway 21st Floor, Suite MA126, New York, NY 10018

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.