IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Echo River Capital LLC

Climate Change

Climate Change Natural Resources and Conservation

Natural Resources and Conservation Water and Sanitation

Water and SanitationFirm Overview

Echo River Capital is an early stage venture capital firm investing globally in cutting-edge water technologies. The firm was established in 2021 by our General Partner, Peter Yolles. Our investment thesis centers around the “Three D’s of Watertech” and aims to Digitize, Decarbonize, and Decentralize the water cycle. Water systems are undergoing significant transformations driven by the depletion of natural resources, the adverse environmental impacts of climate change, and inefficient water management, negatively impacting our well-being and the health of our planet. ERC champions innovations with the highest potential to tackle these challenges, revolutionizing how we utilize water. In line with our vision to create lasting environmental benefits, we integrate impact metrics to measure progress in our portfolio. We work with portfolio companies to develop impact commitments, enhancing accountability and fostering a culture of purpose-driven innovation. Our ultimate goal is building a future of living in freshwater harmony with nature.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: 50% – 99%

Echo River Capital invests in early-stage water technology companies worldwide, aiming to Digitalize, Decarbonize, and Decentralize the water cycle, fostering a future of climate resilience and freshwater harmony with nature facilitated by scalable, capital-efficient business models, and cutting-edge technological advancements.

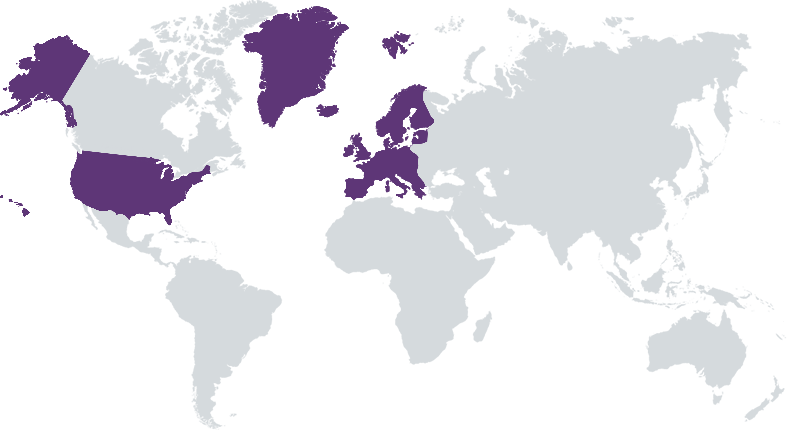

Our “Three D’s of Watertech” investment thesis addresses the challenges faced by water systems through investments in emerging water technologies that Digitize, Decarbonize and Decentralize the water cycle. Fund I commits $25K-$100K to 35 companies across various geographies, technology types and end-market verticals. We maintain average post-money valuation under $10M, supporting early-stage ventures while preserving 10x+ exit potential at each round. Impact is central to our investment thesis and we prioritize investments based on their impact potential. The fund tracks companies’ impact progress and reports annually on the cumulative impact across the portfolio. Our impact goals focus on Water Efficiency, Clean Water and GHG reduction, aligning with ESGs and UN SDGs. In alignment with our dedication to impact, diversity metrics constitute a pivotal aspect of our investment philosophy. 50% of our portfolio consists of founders from under-represented communities. We proactively support women and minority entrepreneurs to propel their ventures.

Echo River Capital distinguishes itself through its exclusive specialization in water technology. Leveraging GP Peter Yolles’ 30-year water industry expertise— from leading WaterSmart from founding to exit, providing water reduction data analytics to 15 million people, to restoring rivers and founding California’s first water trust— we offer unparalleled operational insights. ERC provides deep industry-specific coaching to accelerate scaling and traction, and access to a global network of water industry veterans as independent board members and advisors, positioning Peter as a strategic partner and investor. ERC’s deep commitment to measurable impact sets us apart within the investment landscape. We track impact across the portfolio, aspiring to establish a reporting framework for other investors. We encourage portfolio companies to monitor diversity metrics, fostering a culture of inclusivity at organizational level. We nurture a community of diverse founders and like-minded LPs who work together and share our vision for a sustainable water future.

Investment Example

Gybe, a US-based company founded in 2019, uses satellite imagery to monitor water quality at a never before seen scale. Water pollution is a major threat to public health and economic growth, further exacerbated by the time-consuming and expensive nature of current measurement methods. Gybe’s in-water sensors replace manual water sampling and measure key parameters like Turbidity, Phycocyanin, Dissolved Organic Matter, and Chlorophyll. Their algorithms analyze and combine data with satellite imagery, producing water quality maps and time-series. Gybe’s quantified insights and real-time feedback across entire water bodies support effective management decisions for municipalities, agencies, NGOs and beverage companies in North and South America. The company currently has 85 customers, with 92% retention rate. Gybe participated in Techstars and Imagine H2O, and received investment from ERC in 2022. Their impact metrics contribute to the fund’s Clean Water commitment through reporting on water quality improvements, ultimately reducing human and environmental risk.

Leadership and Team

|

Peter Yolles – Founder and General Partner More Info

Peter Yolles is a groundbreaking water industry innovator and a seasoned entrepreneur in private and public companies. As Founder and CEO of WaterSmart Software, he demonstrated exceptional leadership by developing a Software-as-a-Service data analytics and customer engagement platform, adopted by 200 water utilities in the US, UK and Canada. Under his guidance, WaterSmart raised $18M in funding and grew revenue to $7M ARR with 120% cash retention and an industry-leading Net Promoter Score. Peter began his investing career at the GE Capital Structured Finance Group after his Yale MBA and Water Science, Management, and Policy Masters. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Echo River Capital invests only in companies that generate significant water-related benefits to the environment, human health and/or climate resilience, and relate to SDG6 or other benchmarks. In our deal sourcing and due diligence, we systematically target companies where impact in the water domain is integral to their product or service and invest solely in companies that align with our impact-focused criteria. To manage impact, ERC has developed a proprietary impact metric framework for early stage investing that tracks inputs, outputs, outcomes and impacts. Echo River executes an impact side letter with each company to report annually on up to three custom quantitative metrics that validate their impact progress, and one qualitative aspirational metric. Companies also agree to track and report on diversity, equity and inclusion efforts. ERC produces a cumulative impact report annually to communicate progress across the portfolio to Limited Partners and to the public.

Echo River prefers to invest in companies that are Benefit Corporations or B-certified. In cases where companies are not, we look at the diversity of the founding team with a goal of investing at least half the portfolio in companies with founders from under-represented communities. WaterSmart, the company Peter co-founded, initially earned B-Corp certification and later became a public benefit corporation. Echo River Capital is a Delaware Benefit LLC and is in the process of becoming a certified B-Corp. We encourage our portfolio companies to pursue similar practices and certifications. Moreover, through our tracking and reporting on diversity, equity and inclusion efforts of our investment companies we actively encourage social sustainability practices across the portfolio.

Impact Tracking and Monitoring

Learn More

1 Lagoon Road, Belvedere, CA 94920 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.