IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Planet A GmbH

Climate Change

Climate Change Food Systems and Agriculture

Food Systems and Agriculture Natural Resources and Conservation

Natural Resources and ConservationFirm Overview

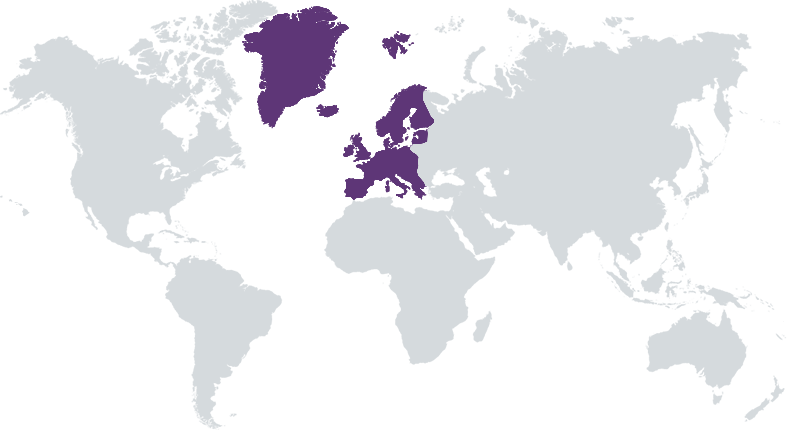

Planet A is a VC fund partnering with European green tech startups that have a significant positive impact on the planet while building scalable businesses globally. Our mission is to contribute to an economy within the planetary boundaries. We support innovation in four key areas: climate mitigation, waste reduction, resource savings, and biodiversity protection. We invest in early-stage (pre-seed, seed, Series A) software as well as hardware solutions. Planet A is the first European VC to offer scientific impact assessments to support our investment decisions and empower founders to manage and improve their impact.

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: 25% – 49%

Planet A is a venture fund investing in early-stage green tech start-ups that have a significant positive impact on the planet while building scalable businesses.

Planet A invests in early-stage climate tech and nature tech startups in Europe, investing in software as well as hardware, (pre)Seed to Series A. We have invested in 19 companies so far, sector agnostic, ranging from biobased materials to alternative proteins and geothermal energy. By applying scientific in-house expertise we are able to identify the winners of the massive economic transformation to a net-zero world.

We’re the first European VC with an in-house science team that assesses the impact of innovative climate and nature tech solutions and calculates life cycle assessments. Unlike ESG funds that aim to limit negative impacts and financial risks, we only invest if a company can demonstrate a positive, quantifiable impact in at least one of four key areas: climate mitigation, resource savings, biodiversity protection and/or reduction in waste. Our unique science-based approach allows us to identify the winners of tomorrow while empowering founders to tackle the world’s largest environmental problems and scale their businesses fast.

Investment Example

INERATEC, a spin-off company from Karlsruhe Institute of Technology, develops, builds, and delivers chemical plants equipped with innovative chemical reactor technology for Gas-to-Liquid, Power-to-Liquid, and Power-to-Gas applications. INERATE’s technology and know-how are based on compact and microstructured chemical reactors for decentralized and demanding applications, such as Fischer-Tropsch synthesis, Methanol synthesis, methanation, and synthesis gas generation via catalytic partial oxidation and reverse water gas shift. INERATEC is currently building an industrial pioneer plant in Frankfurt, that will produce Up to 3,500 tons or 4.6 million liters of e-Fuels annually from biogenic CO2 and renewable electricity. INERATEC`s innovation will help decarbonize the hard-to-abate transport sector, for example in aviation and long-distance shipping. Our LCA shows that INERATEC PtL can save 63% CO2e on average compared to a fossil reference product.

Leadership and Team

|

Nick de la Forge – Cofounding Partner More Info

Nick is the deep-tech expert at Planet A, leading the fundraising efforts and is responsible for expanding our network within the European investment space. |

|

Lena Thiede – Cofounding Partner More Info

Lena is an environmental and climate policy expert. At Planet A, her focus is on environmental impact assessments and policy advocacy. |

|

Fridtjof Detzner – Cofounding Partner More Info

Fridtjof co-founded the DIY website builder Jimdo before he shifted his focus to supporting and investing into founders that contribute to an economy within the planetary boundaries. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

Planet A looks for startups that tackle the world’s biggest environmental problems. We only invest in startups that can demonstrate a quantifiable, significant positive impact in at least one of these key areas: climate mitigation, resource savings, biodiversity protection, or reduction in (plastic) waste. We anchored impact in every step of our investment process: At first we screen the significance of the impact; gather company data and scientific literature. During the Due Diligence, we calculate a full-fledged Life Cycle Assessment: We assess the environmental impacts associated with all stages of a product’s life — from raw material extraction through materials processing, manufacture, distribution, use phase to end-of-life. Our approach allows us to not only evaluate greenhouse gas emissions, but also to determine plastic, water, and land-use footprints. The consequential Life Cycle Assessments we conduct comply with ISO 14040 and 14044 standards and are publicly available on our website https://planet-a.com/lcas/

During the Due Diligence we assess relevant ESG criteria via a questionnaire which includes: 1. ESG risk assessment, 2. ESG status assessment and 3. ESG development opportunities. The questionnaire includes an assessment of principle adverse impact indicators as required by the Sustainable Finance Disclosure Regulation (SFDR). Furthermore. we integrate sustainability clauses in term sheets and shareholder agreements and ask the founders to commit to the following: - to be Paris aligned and take steps towards becoming climate neutral. This includes inter alia adopting a climate policy within 12 months of Planet A`s investment and setting targets to reduce carbon emissions. - Establish an ESG Policy and commit to an annual ESG review - Develop a D&I Policy within 12 months after closing of the investment. - Provide Planet A with data pursuant to the SFDR concerning principle adverse sustainability indicators. See database here https://sifted.eu/articles/esg-term-sheet-vc

Impact Tracking and Monitoring

Learn More

Münzstrasse 18, 10178 Berlin, Germany

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.