IMPACTASSETS 50™

An Annual Showcase of Impact Investment Fund Managers

ImpactAssets 50

An Annual Showcase of Impact Investment Fund Managers

Connect Humanity

Demographic-based Impact

Demographic-based Impact Financial and Economic Inclusion

Financial and Economic Inclusion Place-based Impact

Place-based ImpactFirm Overview

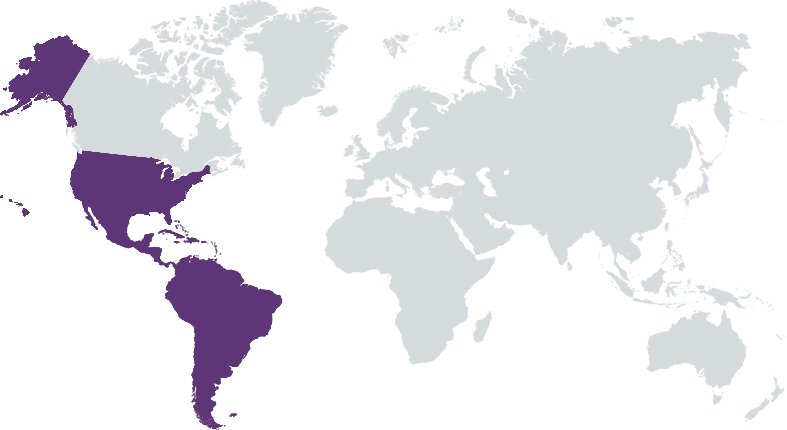

The digital divide is stark: 40M Americans have no internet while 120M don't have speeds good enough for Zoom. This disproportionately impacts historically marginalized communities and leads to widening generational disparities in health, education, workforce development, financial inclusion, etc. Connect Humanity structures financing for broadband projects that serve low-income, rural, and BIPOC communities to build affordable, high-speed internet. Broadband can be highly inaccessible, with jargon from both internet service providers and investors. We leverage our capital to swing more power towards communities, translating technical terms into plain English. We pioneered the use of "digital equity covenants" in our loan agreements to ensure that our capital does not inadvertently further digital redlining (discrimination by internet service providers in the provision of internet service, often on the basis of income, race, and/or ethnicity).

Years of Operation: Less than 3 years

% of Capital from Top 3 Investors: 100%

With ~3,000 registered internet service providers in the US, we believe the digital divide will be solved by community-oriented ISPs who grew up in the community to serve the community.

Local infrastructure requires local solutions. We believe the digital divide needs to be solved by community-oriented internet service providers (ISPs). Small and medium sized businesses, often minority or women-owned, that grew up in the community and hold local trust. Of ~3,000 registered ISPs in the US, 66% serve less than 500 census blocks, demonstrating how broadband is hyper-local. Over the last decade, 9 of the 10 fastest providers are community-oriented ISPs. The problem is that many ISPs don’t have sufficient access to capital markets. They’re too big for philanthropic grants, too small for private equity, and with business models unrecognizable to community finance. At Connect Humanity, we developed an underwriting approach and financing products that more appropriately balances the risk-return profile of broadband projects.

Most private capital in broadband is PE. Their check sizes, hurdle rates exclude low-income, rural communities. CDFIs either write small checks ($50-100k) or don't have the expertise to analyze network business models. Of impact investors, feedback has been deals take too long, they can't find deals, and/or they lose to PE. In our approach, we: 1. Do small-midsize deals because bridging the divide is a slow roll up, not mega deals; 2. Naturally work with and through minority- and women-owned businesses where others "can't find them" (our deals are 100% Opportunity Zones, 75% MWBEs); 3. Engage investees with transparency, sharing financial models and due diligence to support entrepreneurs in future fundraising; 4. Deploy credit, credit-like investments because we believe broadband should be owned by the community, not by investors (helping us win deals because we're non-dilutive); and 5. Provide growth TA (e.g., federal/state programs, pricing/marketing strategies, construction/network problem solving).

Investment Example

Macon County, Alabama is 82% Black; 28% of residents live under the Federal Poverty Line. Residents primarily had internet speeds developed 25 years ago. We provided a $500,000 loan to the Economic Development Authority as part of a $3,000,000 partnership with an ISP. We structured a blended finance stack that brought in capital from LISC, in-kind contributions from Utilities Board of Tuskegee, and federal/state grants. To ensure that historically Black communities, like Tuskegee, were served, we required the ISP agree to a community benefits agreement (CBA). The CBA obliged the ISP to report on progress, subscribers in low-income areas, and pricing transparency to a committee of stakeholders. The committee is comprised of the municipalities, local HBCUs, and other key community anchor institutions. Macon County tried to secure a partnership for 2 years prior to us becoming involved. We took 6 months to go from first meeting to close.

Leadership and Team

|

Jochai Ben-Avie – Chief Executive Officer More Info

Jochai Ben-Avie is the Co-Founder and CEO of Connect Humanity. He also serves as a Non-Resident Fellow at the Atlantic Council, a Truman National Security Fellow, a World Economic Forum Global Shaper, and a Board Member of Code for Science & Society where he chairs the Audit & Finance Committee. Jochai was previously Mozilla’s Head of International Public Policy and lead of the Firefox maker’s open source funding arm. During his time at Mozilla, he scaled the policy team from a solely US focus to a global presence active in shaping legislation across six continents to build a better internet. |

|

Brian Vo – Chief Investment Officer More Info

Brian Vo serves as Connect Humanity’s Chief Investment Officer in leading investment efforts to structure the right type of financing solution that meets the needs of organizations advancing digital equity. He collaborates with Connect Humanity’s partners, communities and social enterprises alike, to understand connectivity barriers, local context and needs, and the implications on the appropriate blend of impact finance. Brian has +17 years of investment and strategy experience, with +$7B of direction transactions, including private equity, and impact debt and equity. |

|

Erica Mesker – VP of Partnerships and Strategy More Info

Erica Mesker has over 10 years of fundraising, partnership development, and development operations expertise. As Vice President of Partnerships and Strategic Initiatives, she plays a critical role in shaping and managing Connect Humanity’s partnerships, impact storytelling, and development infrastructure. Previously, Erica was on the leadership team at the World Wide Web Foundation as Development Director. Prior to that, Erica was a core member of the development team at TechSoup, serving as the Director of Global Strategic Development. |

Financial Performance

Impact Performance

|

Percentage of Total Assets Under

Management that are Impact Investments: |

100%

|

We split IC into two analyses to minimize bias and impact washing in decision making. IC1 evaluates (a) mission alignment of demographics in the geography (income, rurality, proportion of BIPOC), (b) extent of community engagement with stakeholders to build trust and digital literacy programs, and (c) network design's inclusiveness of community anchors, like running fiber to schools and churches. IC2 evaluates business model and investment case. We don't penalize investees for not having traditional data room documents (pitch deck, business plan, excel model). For small businesses we engage (many BIPOC-owned), we find the same substance was considered and analyzed but sit in different formats. For those with less investor-investee experience, we meet them where they are at by walking through deep structured interviews to solicit the same content. This helps us build deeper relationships, foster trust and transparency throughout negotiations, and leads to greater deal flow referrals.

We evaluate companies' diversity in staff, management, and ownership, with an emphasis on observing relationships and power dynamics amongst individuals. We are specifically attuned to histories of serving historically marginalized communities and moments of disagreement to get a sense of how conflict is resolved. Knowing that our investees will be engaging directly with communities, we need to have confidence that they share Connect Humanity's values (i.e., building with and not for, transparency, mindful of positions of power). If they cannot demonstrate it amongst themselves, we would be concerned about how they might show up in communities.

Impact Tracking and Monitoring

Learn More

185 Santa Rita Avenue, Palo Alto, CA 94301 USA

Apply for the IA 50 2022

The application period to become an ImpactAssets 50 2022 Fund Manager will open in September 2021!

To stay informed on the application process, sign up here.